4 Ways To Take Advantage Of The Weak Ringgit

There are opportunities in every crisis!

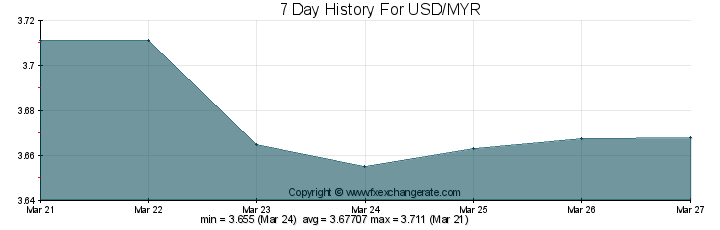

So you've heard the ringgit is weak. It's bad. But just how bad is it?

Let's compare the ringgit with the most popular currency in the world - the US Dollar.

Four months ago, your RM100 = USD30

Last month, your RM100 = USD28

Today, RM100 = USD27

Now imagine if you had RM100,000 in your bank account four months ago. That amount of money you had is now only worth RM90,000 in a short span of four months. Yup, 10% of the value gone just like that.

Some analysts are even predicting we could see RM100 = USD25 by end of 2015. In other words, the ringgit you hold now is depreciating every day at a very fast rate. It's quite scary to say the least. Malaysians are already getting the pinch of purchasing imported products (hint: look at the latest revised price-list of Apple products).

Why is this happening?

"The ringgit has the highest correlation to crude oil price movements. Correlation statistics also show that crude oil price is currently the most important driver of ringgit price movements, among others (for example, the US Dollar Index, the FBM KLCI, palm oil prices and ringgit-US yield differentials).

The overhang of foreign positioning in local market debt, particularly in short-term BNM bills and government T-bills, further adds to the ringgit’s vulnerability." – The Edge Weekly, December 6, 2014.

The depreciation of Ringgit is caused by several combination of factors mainly due to the massive fall of oil prices which impacted Malaysia's economy and US economy strengthening from the effect of Quantitative Easing.

How about 1MDB scandal? Yup, some analysts believe that could be a factor too but it's too far fetched to say it's a major contributing reason.

Does it mean our government isn't managing our economy properly?

Partly, although what is happening is due to a series of uncontrollable external factors. Having said that, it is convenient to point fingers and blame our government, blame our employers or blame the neighbour's black cat for setbacks in your life.

That's the lazy way out. We need to stop the victim mentality. Perhaps, we should consider shouldering our own destiny instead of letting others dictate it.

Remember folks, there's always opportunity in every crisis. Things are less bleak if you're willing to change perspectives.

Below, I'm listing down four strategies that you can take to fortify yourself against a depreciating ringgit:

Strategy #1: Start buying other stable currencies such as USD, Yen, Pound, and SGD

The rule is simple. If we can't beat them, we join them! Start converting your Ringgit to other currencies before Ringgit fall even further.

Idea A: Opening up FCA (Foreign Currency Account) at Maybank, CIMB, RHB, etc.

Idea B: Go to the most competitive currency exchange shop (such as in MidValley) and convert them to USD and keep the money as savings.

Strategy #2: Invest in stocks, gold, or even oil

The principle of investing is to use your ringgit and invest and hedge on to a 'value'.

For example, if the value of the ringgit keeps dropping while the value of gold goes up, the money you would have invested in gold is safeguarded from depreciation. Sure, investing could be risky because the opposite could happen but it could also be very rewarding.

Idea A: Use internationally recognised online broker investment platforms such as Plus500, OSK188, FXPro for trading.

Idea B: Buy and keep gold from banks or gold and jewellery shops.

Strategy #3: Shorting Bursa KLCI and the ringgit

What is shorting? Basically, pull off a George Soros but with way less money. In a nutshell, when you short the stock market, you profit when Bursa index drops. Likewise, if you short the ringgit, you profit when the ringgit drops.

Idea A: Buy Put-Warrants in Bursa such as FBMKLCI-HI, FBMKLCI-HK or FBMKLCI-HN.

Idea B: Open future trading accounts with local banks such as HLeFutures or CIMB's iTrade Future Trading.

Strategy #4: Do freelance work online

With the rise of the Internet, it is now much easier than ever to work from home anywhere in the world, like this ex-Petronas engineer who creates web games from his home.

This is an opportunity for you earn an income in USD! Imagine, every dollar you earn will be multiplied by 3.5x-3.8x!

Idea A: Learn skills that will help you to get freelance projects from all around the world, like web design, programming, copywriting, or language translations. Find suitable work on popular sites like as freelancer.com, elance.com and odesk.com.

This story is the personal opinion of the writer. Submit a story as a SAYS reader too by emailing us at [email protected].