How Your Personality Affects The Way You Manage Your Money

It might explain why we all think about money so differently.

Even though most of us think we are in control of our actions, a lot of our decisions are actually guided by our personality or our mood

By becoming more aware of how your personality affects your spending, you can gain insights that can be incredibly helpful when you are trying to learn new financial habits.

A good start in this process is taking a Myers-Briggs (MBTI) test

This personality test is a widely accepted and recognized personality test that will categorize you in one of 16 personality types.

Each personality type will be a combination of 4 letters, which will each stand for a trait that you have.

You can do the MBTI test here to find out your score.

Each letter is picked from a pair of traits. The four pairs are:

- Introversion (I) or Extraversion (E)

- Intuition (N) or Sensing (S)

- Thinking (T) or Feeling (F)

- Judging (J) or Perceiving (P)

Here's how each pair of traits differs in terms of spending:

Extroversion versus introversion

The difference between extroversion and introversion describes how each of us sources our energy. If you are generally more extroverted, you will become energized the more you interact with people. If you find social activities uplifting and refreshing, you are likely to be more extroverted than introverted. Conversely, introverts actually gain energy from being by themselves. Introverts regularly need to spend time by themselves to ponder and reflect, recharging themselves in the process.

In terms of spending habits, your tendency to be extroverted or introverted might lead you to spend more or less. Extroverts enjoy social situations more and will spend their money more freely. Introverts might be hesitant to assert themselves and therefore get taking advantage of more easily.

Sensing versus intuition

This trait describes how you take in information, and how you arrive at decisions or conclusions. If you follow your heart more than your brain, you could fall on the Sensing end of the axis and tend to seek information that is detailed, specific and sequential. People who are more intuitive, tend to display a preference for the ‘big picture’, so they can intuit for themselves what it all means.

In terms of spending habits, this could mean that if you are more sensing you would have a preference for purchases that have an immediate effect, as opposed to more intuitive people who prefer long term purchases.

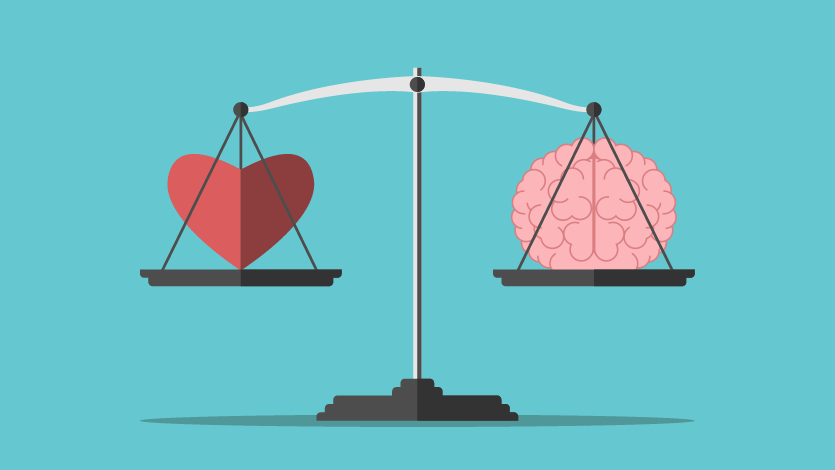

Thinking versus feeling

This trait describes how you evaluate the information you receive. People who are thinkers tend to think about the task at hand. The decisions they come up with are often objective and logical. Feelers are more aware of how their decisions and actions affect the people around them. As such, they tend to weigh their choices against the possible consequences on others.

In terms of spending habits, a thinker will be more likely to make rational and logical financial decisions, while the feeler might make decisions that are more considerate of others.

Judging versus perceiving

This trait describes how we organise the world. Simply put, people tend to fall into two camps: those who seek tidy conclusions, and those who prefer having things more open-ended. People who are judging like closure. They like making decisions, and would happily tick things off as they go through their To-Do list.

Those who are perceivers prefer not to rush into decisions. They are more comfortable with leaving things open-ended and tend to take a more spontaneous approach to life.

In terms of spending habits, the judging types are more likely to pay their bills in time and will get uncomfortable with outstanding debt, while perceivers take more of a long-term perspective, without experience emotional stress due to outstanding debt.

Depending on which personality you exhibit, your spending pattern could be very different from other people

By becoming aware of this phenomenon, you can anticipate your weak moments and proactively train healthy financial habits.

For example, if your MBTI test pointed out that you are an emotional spender, you would be wise not to go wandering around shopping malls while you’re in a sad mood!

Similarly, if you are categorised as a Pleasuremonger, it might be wise to assess how much money you spend on leisurely activities, the results might surprise you.

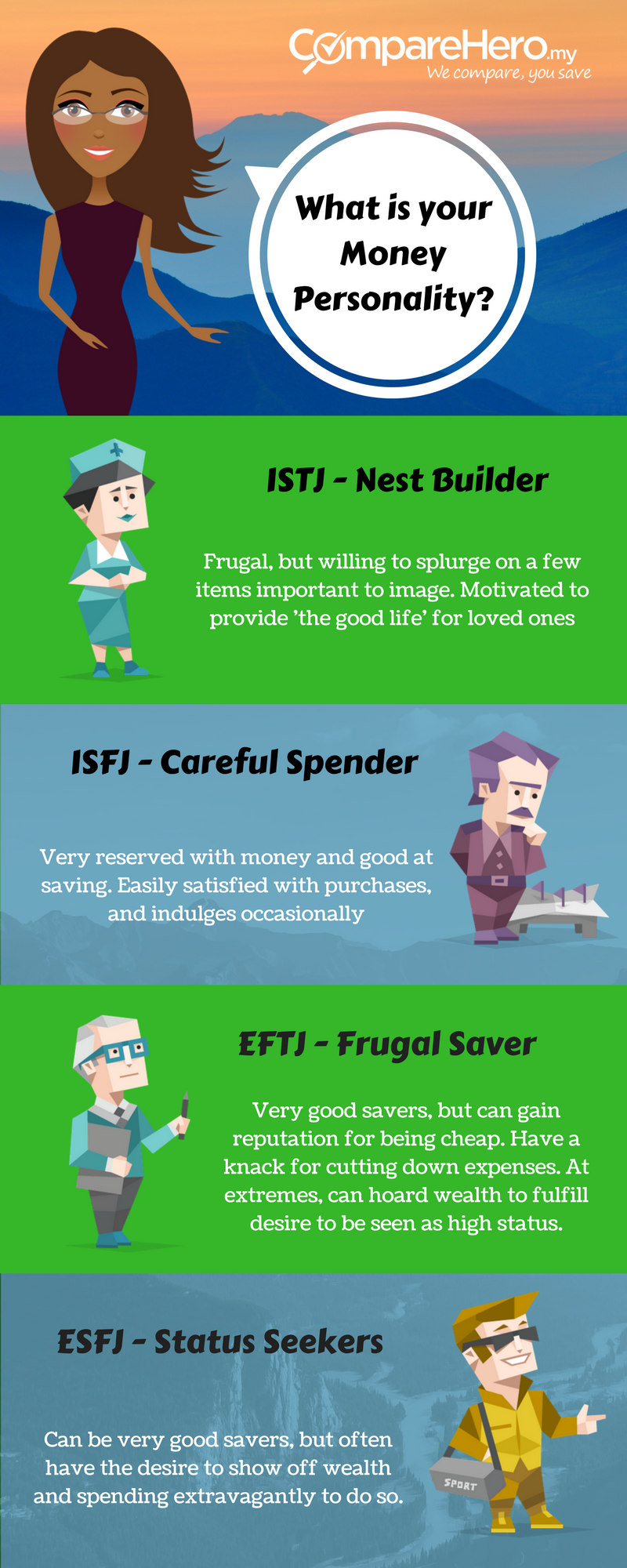

Know your personality type already? Find out how the 16 personality types spend money differently:

Regardless of which money personality type you have, everyone can benefit from more awareness to their financial behaviour.

Make more informed financial decisions!