[INFOGRAPHIC] Is Tertiary Education Only for the Rich?

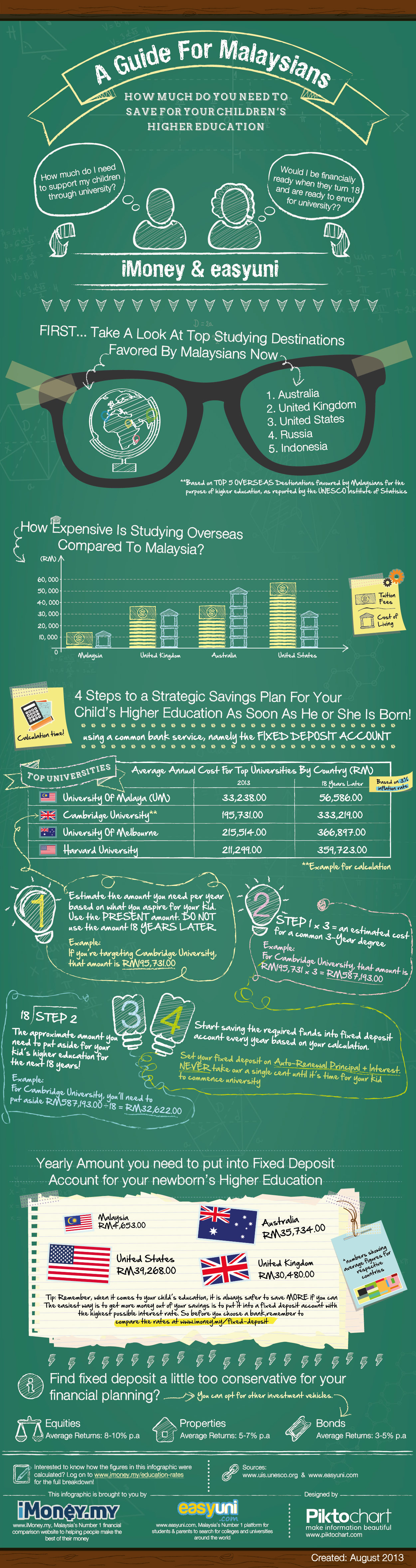

Has tertiary education become an exclusive privilege only for the rich? According to iMoney.my, Malaysians need to put an average of RM4,652 into a fixed deposit account every year for 18 years if they want to finance a single child through a local university. For overseas destinations, the number could be up to six times the amount!

[INFOGRAPHIC]: How long do you have to save to send one child to university and how much would it cost you? (click for full infographic)

According to Malaysia’s financial comparison website www.iMoney.my, Malaysians need to put an average of RM4, 652 into a fixed deposit account every year for 18 years if they want to finance a single child through a local university. For overseas destinations, the number could be up to six times the amount!

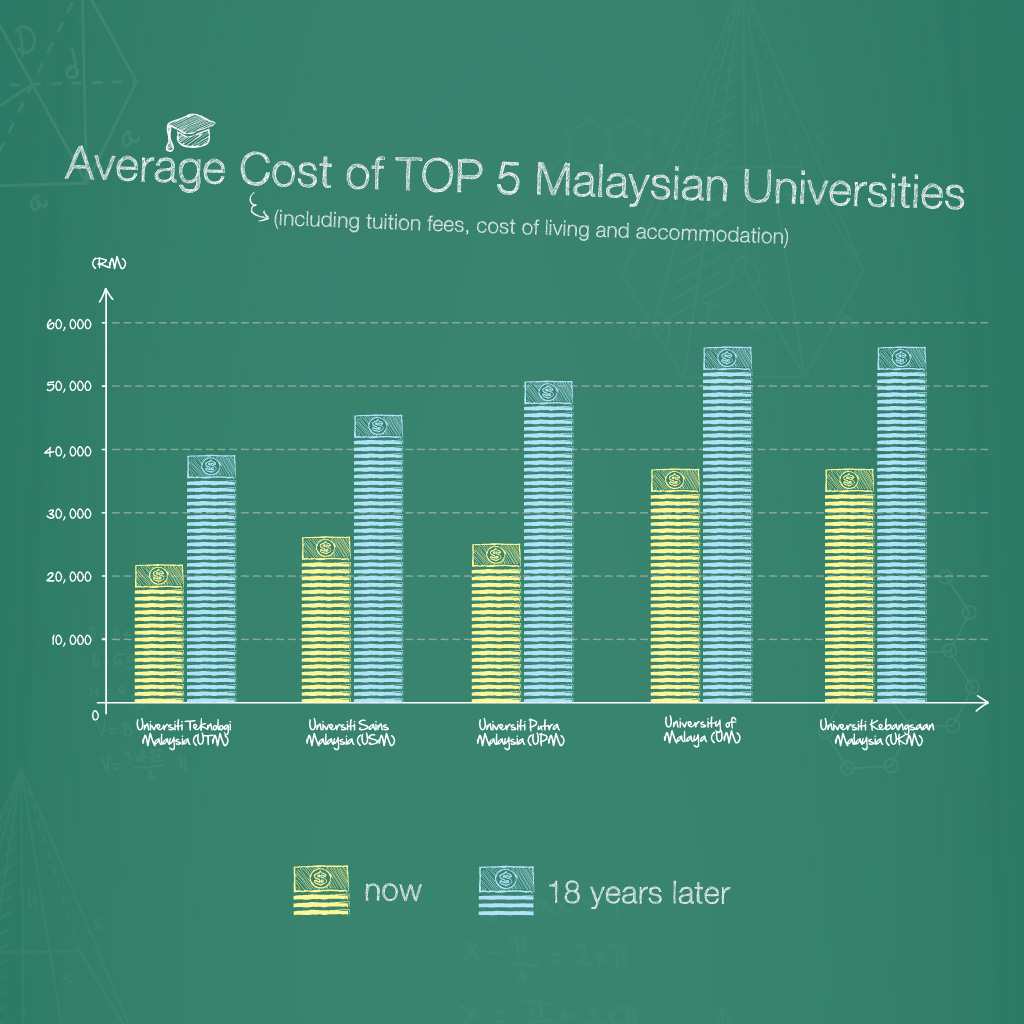

Image via amazonaws.comMALAYSIAN UNIVERSITIES: local university fees could prove to be a headache, with the average annual cost of studying at the University of Malaya now a hefty RM33,238.

In Malaysia, university fees could prove to be a headache even for the locals, with the average annual cost of studying at the University of Malaya now a hefty RM33,238. The other four top-ranked universities in Malaysia aren’t far behind, with Universiti Teknologi Malaysia being the lowest at RM22,928. - Credit imoney.my, easyuni.com, piktochart.com

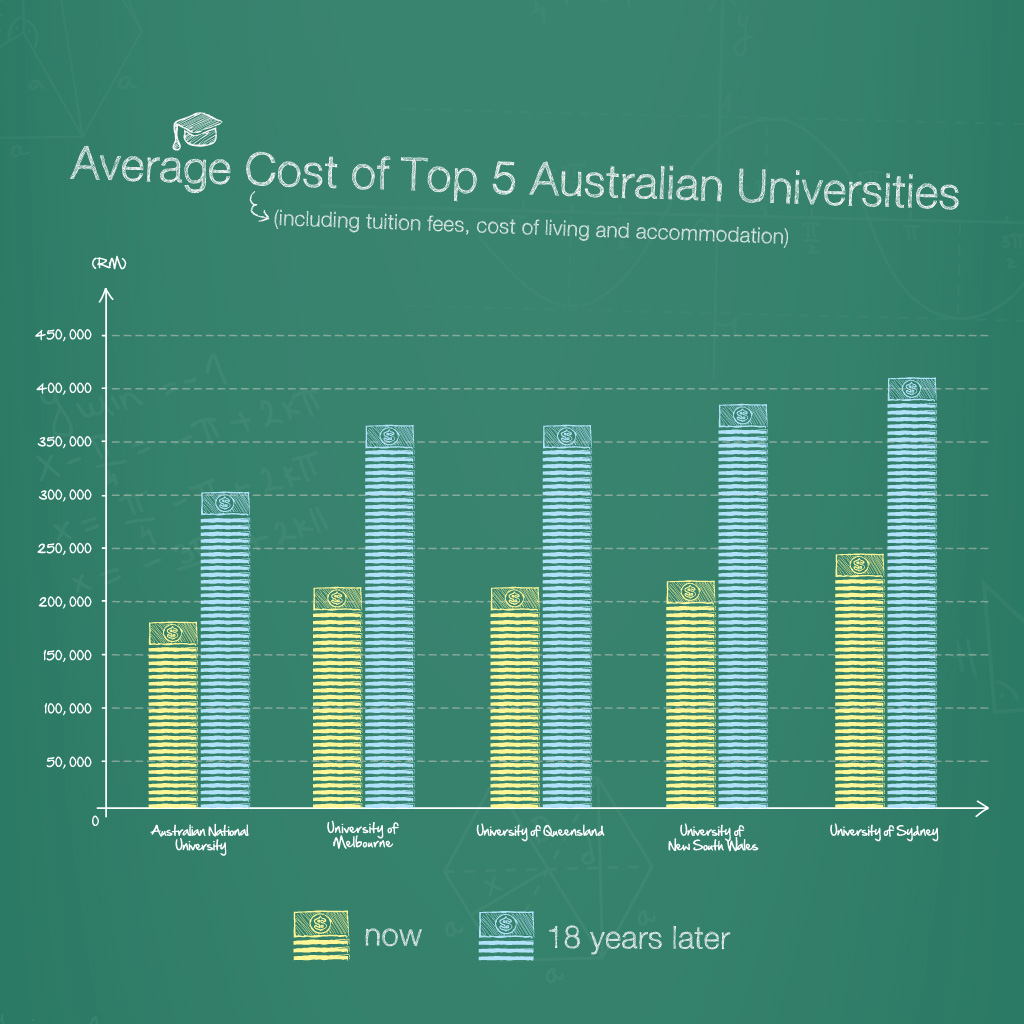

Image via amazonaws.comAUSTRALIAN UNIVERSITIES: Malaysia’s most favoured overseas studying destination – could now cost as high as RM215, 514 per year at the top-ranked University of Melbourne.

Meantime, studying in Australia – Malaysia’s most favoured overseas studying destination – could now cost as high as RM215, 514 per year at the top-ranked University of Melbourne. Two Top 5 universities that are even costlier are the University of Sydney and the University of New South Wales. - Credit imoney.my, easyuni.com, piktochart.com

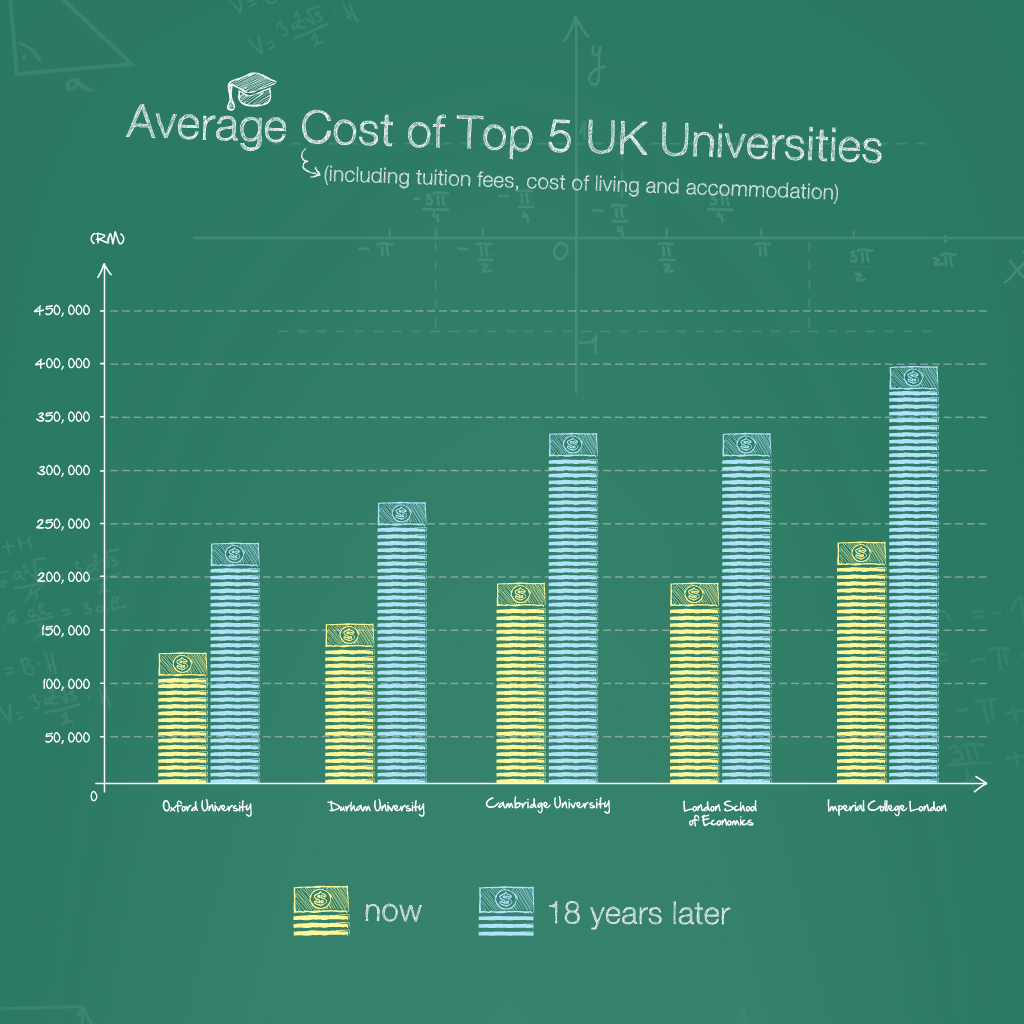

Image via amazonaws.comUK UNIVERSITIES: Malaysia’s second favourite overseas studying destination – due to inflation, a year at the esteemed Cambridge University could skyrocket to RM333,219 when a current new born hits 18 years of age.

In the UK – Malaysia’s second favourite overseas studying destination – a year at the esteemed Cambridge University now costs an average of RM195, 731. Due to inflation, that cost could skyrocket to RM333, 219 when a current new born hits 18 years of age. - Credit imoney.my, easyuni.com, piktochart.com

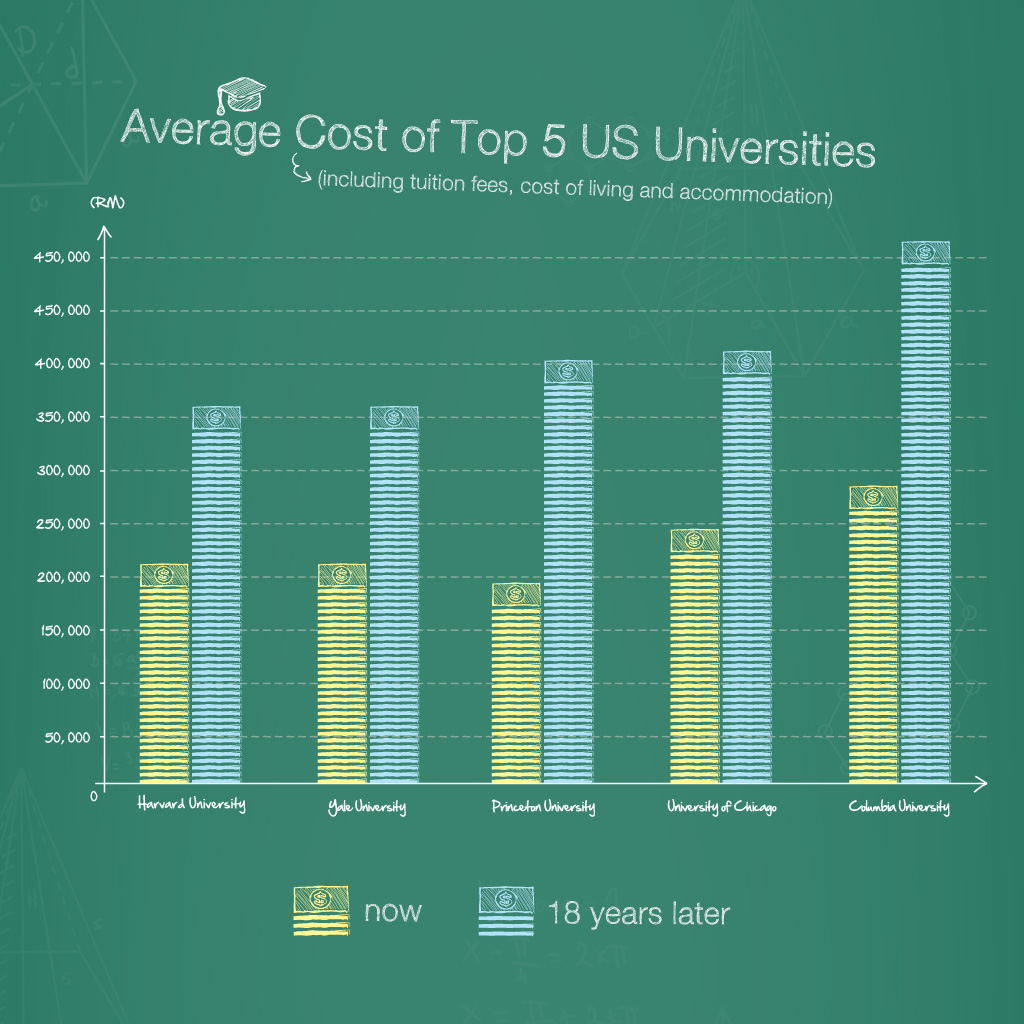

Image via amazonaws.comUS UNIVERSITIES: most expensive for Malaysians - Princeton University and top-ranked Harvard University cost an average of RM235,414 and RM211,299 per year respectively.

In the U.S.A., the cost of completing tertiary education is generally still the highest for Malaysians, with the prestigious Princeton University and the top-ranked Harvard University costing an average of RM235,414 and RM211,299 per year respectively. Columbia University is even costlier, at a staggering RM274,758 per year. - Credit imoney.my, easyuni.com, piktochart.com

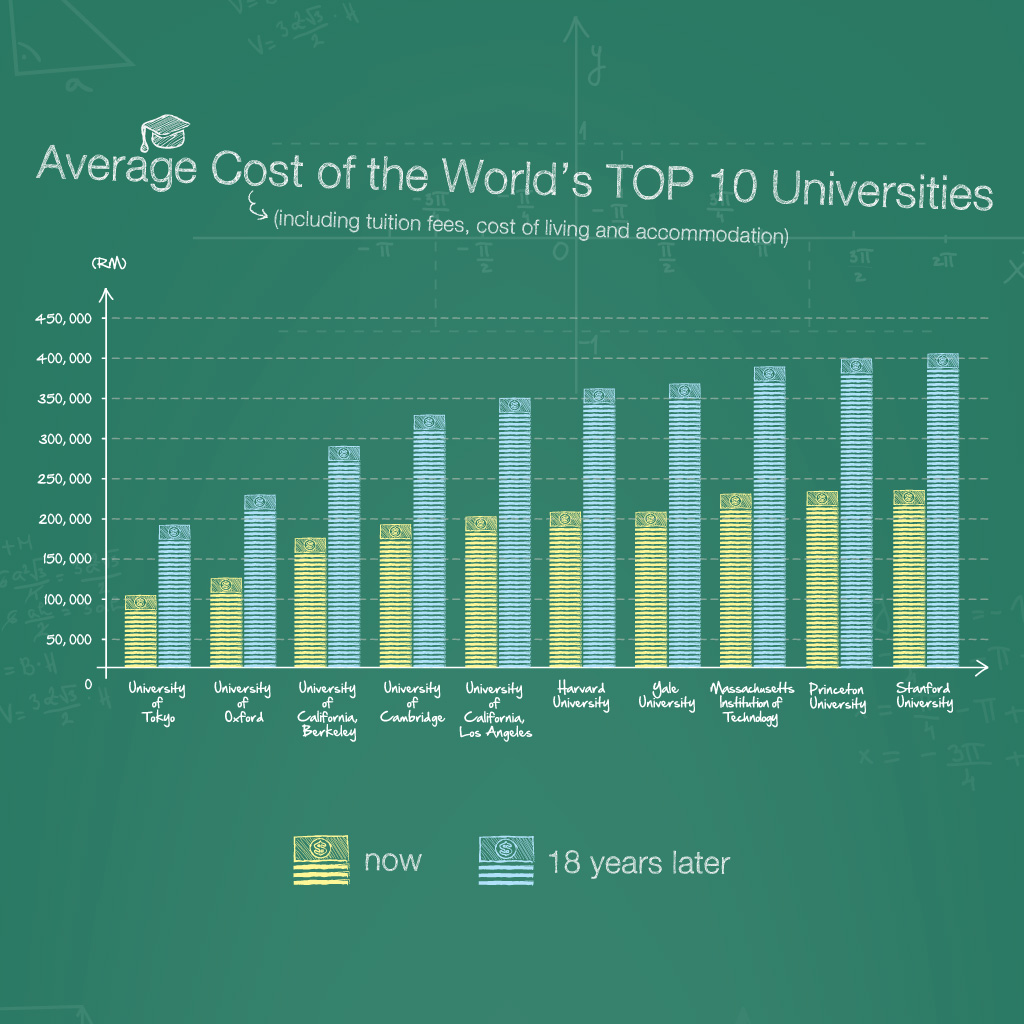

Image via amazonaws.comWORLD'S TOP 10 UNIVERSITIES: How much would it cost a Malaysian parent to send their child to one of these top 10 universities? (click for full infographic)

Harvard University – currently the top-ranked university of the world – now commands an average studying cost of RM211, 299 per year. That number could climb drastically to RM359, 723 in 18 years’ time, due to inflation. Remarkably, the average studying cost for Massachusetts Institution of Technology, Stanford University and two other universities from the Top 10 Universities of the World all exceed that of Harvard University! - Credit imoney.my, easyuni.com, piktochart.com

Image via amazonaws.comWant your child to be in the world's top 10? iMoney says you'll need to put between RM18,500 to RM39,500 in a fixed deposit account, every year for 18 years

iMoney.my reckons that Malaysians would need to put in anything from RM18.5k to RM39.5k into a fixed deposit account every year over 18 years, just to finance a single child through the world’s current Top 10 Universities.

imoney.my

imoney.my