Are You Actually Paying A Lot More Income Tax If You Go For The 8% EPF Cut?

Decisions, decisions...

PM Najib Razak announced a revised Budget 2016 with 11 recalibrated measures on 28 January, one of which dictated that employees' EPF contribution will be reduced from 11% to 8% of their monthly salaries from March 2016

According to Najib, who is also Finance Minister, the reduced contributions will add an estimated total of RM8 billion worth of spending income. Employers, however, are still required to pay the same rate in contributions - 12% for those earning above RM5,000 and 13% for those earning RM5,000 and below.

This is not the first time Putrajaya has initiated such a move. During Budget 2009, employees' EPF contribution was also lowered by 3% for 2 years to stimulate the economy and ensure domestic growth to avoid recession in times of global economic slowdown.

With the rising costs of living, this is good news especially for the lower and middle-income groups, as they would be bringing more cash home every month.

However, a viral post suggesting that one could end up paying more tax with the 8% cut seems to have caused many taxpayers to consider sticking to the original 11%, as they are given the choice to do so

Now, the real question is... are you really paying more tax if you agree to the EPF cut?

This is where we'll need to understand the difference between Monthly Tax Deductions (MTD) and income tax:

The MTD refers to a certain amount that has been automatically deducted from your salary every month by your employer to pay tax on your behalf, aside from the EPF and SOCSO monthly deductions. However, the deductions do not take into account your additional tax rebates and reliefs, so your employer could very likely be overpaying for you. This is where filing your income tax comes in.

When calculating your income tax, your annual income (stated in either the EA Form for private sectors or EC form for government sectors) will be the basis from which it is calculated. Do take note that you might also have other incomes that fall under the "taxable income" category such as dividends, collected rent, businesses etc.

Your tax payable can be calculated based on the following equations:

Chargeable Income = Taxable income – Tax exemptions – Tax Reliefs

Calculated Tax = Chargeable Income x Applicable Tax Rate

Tax Payable = Calculated Tax – Tax Rebates

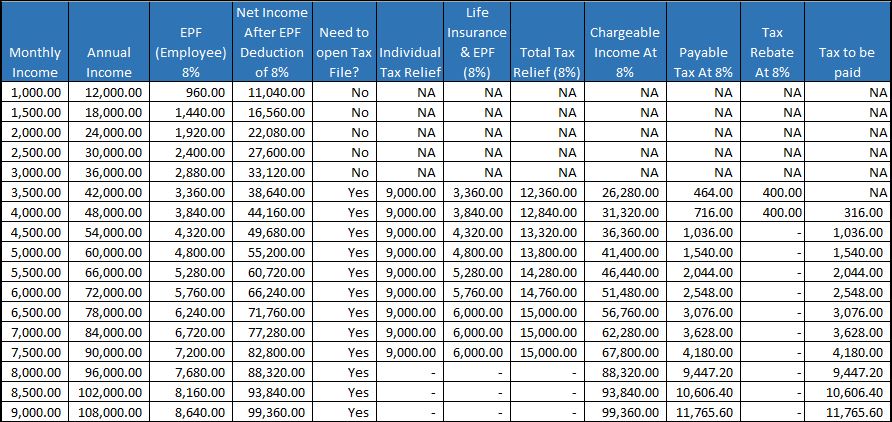

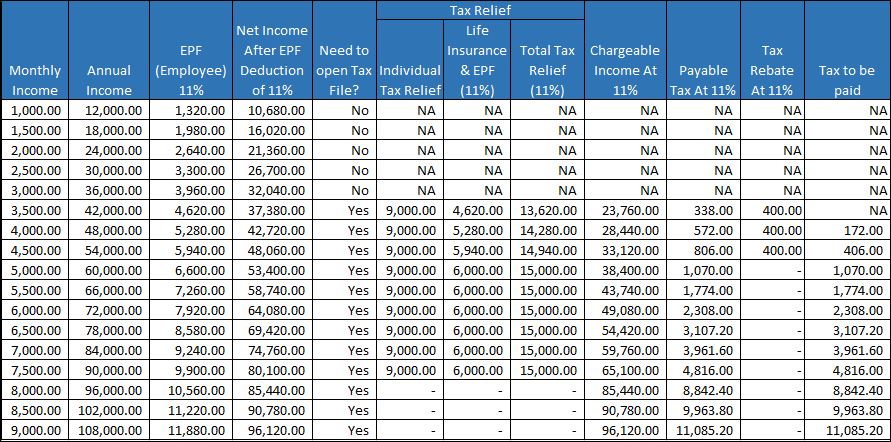

With all that info in hand, blogger Shan Lee Liew drew up the following scenarios based on several monthly incomes to illustrate the differences in payable taxes for both 8% and 11% EPF cuts:

Assuming that one did not utilise any other tax reliefs besides the individual and EPF tax relief (claimable up to RM6,000), those earning between RM4,000 to RM9,000 will be required to pay between RM316.00 to RM11,765.60 if they opted for the 8% cut compared to RM172 to RM11,805 if they opted for 11%. Those earning RM3,500 and below are pretty much exempt from tax liability thanks to the tax rebate.

Note that the payable taxes indicated in these tables are significantly less than the number highlighted in the viral post above.

In addition, both scenarios do not take into account the additional RM2,000 personal tax relief for those earning RM8,000 and below.

Financial comparison website iMoney pointed out that taxpayers will not only be taxed on a higher chargeable income, the EPF contribution tax relief will be significantly less with the 3% reduction

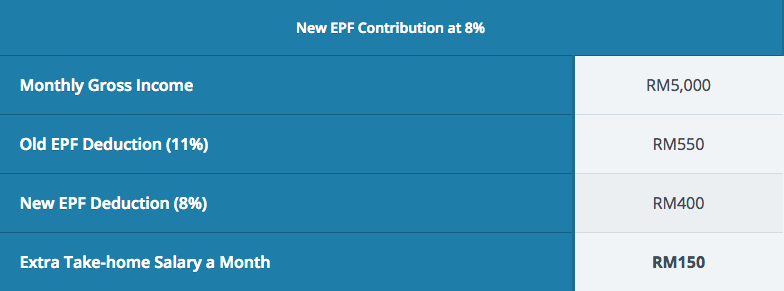

Take, for example, the following scenario. An employee who makes RM5,000 per month will be taking home an extra RM150 every payday if they opted for the 8% EPF cut instead of 11%, as illustrated in the table below:

That’s an additional RM150 every month, coming up to RM3,300 over 22 months (March 2016 to December 2017). However, that would also mean a lower EPF tax relief of RM5,100 for Year of Assessment 2016 (tax filed in 2017), and RM4,800 for Year of Assessment 2017 (tax filed in 2018) while the previous 11% deduction would have maxed out your tax relief to RM6,000.

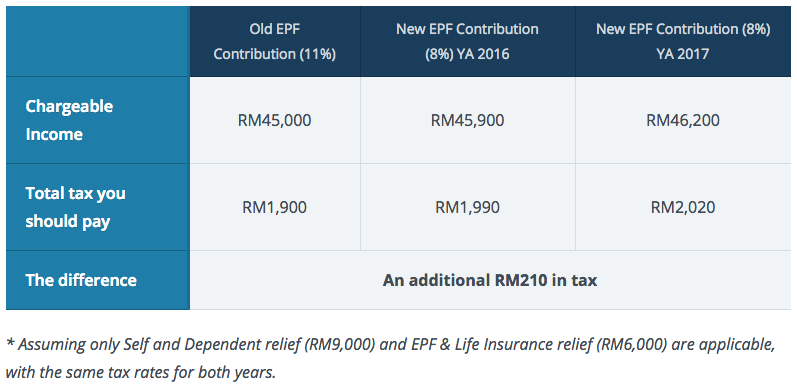

When the time comes to file for your income tax in 2017, here is the difference you will see:

imoney.my

imoney.my

An additional RM210 a year is not a lot, but if you add up the opportunity cost you lose when you opt out of saving the additional 3% in your EPF, here’s exactly how much you stand to lose:

imoney.my

imoney.my

Based on the calculation above, you would have missed out on an additional RM22,461.18 by the time you retire if you decided to choose the new 8% EPF contribution rate. Adding this amount with the additional tax amount of RM120, that will come up to a whopping RM22,671.18!

imoney.my

imoney.my

So, should you go for the 8% EPF cut or stick to 11%? If you ask Malaysian employers, their advice would be the latter as taking a reduced EPF cut will affect your retirement savings down the road unless you really need the extra money.

Speaking to The Star, Cuepacs secretary-general Datuk Lok Yim Pheng said employees should weigh their options carefully.

“If they can afford to survive without the extra money, they should opt not to reduce their EPF contribution. They should only do it if they really need the money to offset the higher cost of living,” she said, adding that the extra money could be useful for children’s education or for getting housing or car loans.

Alternatively, experts suggest making full use of the extra money such as paying off high-interest debts, building up a solid contingency fund, or investing in instruments that will generate higher returns such as mutual funds and stocks

Having extra money will likely see an increase in consumer spending, especially among the low and middle-income groups who make up about 60% of the working population. This is good news for the country's economic state, as spending - not saving - spurs domestic economic growth.

On a micro scale, consumers will likely spend the extra money on fulfilling instant gratification such as buying new gadgets instead of putting it aside for a rainy day.