A Breakdown To Help You Understand Super Confusing GST Receipts

Telecoms, restaurants and even the humble mamak are causing confusion among Malaysians as they charge GST without needing to.

With the new GST tax implemented, many are still confused over the calculations of their bills

There were glitches and hiccups on the first day as the Goods and Services Tax (GST) structure kicked off. Consumers expecting the tax to be assessed separately after the itemised bill was totalled were surprised to find that the GST element had been included in the net selling price of every item.

thestar.com.myReloading mobile phone prepaid credit from Maybank2u was subject to the 6% tax although it not supposed to be taxed. There were also uploads of receipts which showed GST was charged for newspapers and Touch ‘n Go reloads which were part of the list of GST-free products.

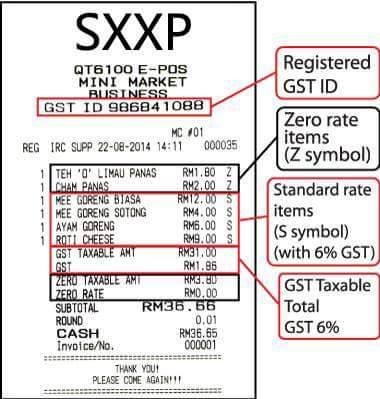

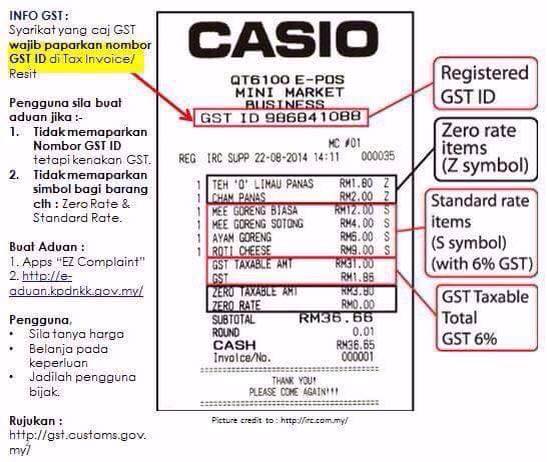

1. This will help you understand the different components of the receipt:

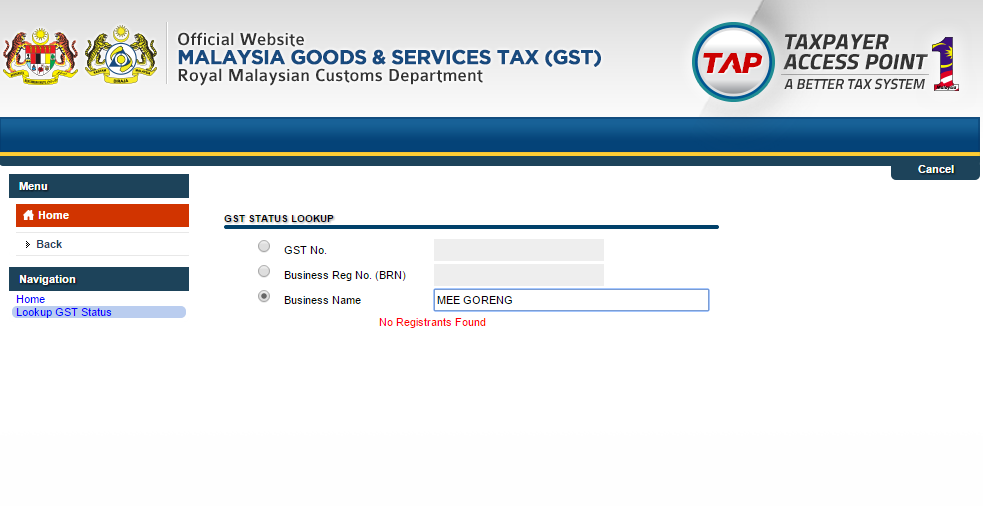

If the retailer is registered, great. The 6% tax is applicable and you are not being cheated. However, if the retailer is not found in the registry, the next measure should be to lodge a report with the Ministry of Domestic Trade, Co-opperatives and Consumerism.

2. The GST ID code is to know if a retailer is officially GST registered with the Customs Department

3. 'S' and 'Z' are the acronyms of what they stand for, standard-rated supply and zero-rated supply

'S' are standard rated supplies that are taxable goods and services. 'Z' stands for zero-rated supplies which are goods and services that are not taxed upon consumers. The GST is not charged on consumers because companies pay for it beforehand and claim it from the government as Input Tax Credit.

Input Tax is the GST charged on the purchase of goods and services used in the business stage. The input tax means it is claimable by businesses registered under the GST registry.

4. Places like restaurants and hotels apply service charges to the bill. In the case of an eatery, besides the 6% GST taxed on food, another 6% will also be taxed on the service charge.

The difference is caused by the 6% GST on service charge. For example, using the first item on the left receipt that costs RM19.50:

Old way of taxing

The 10% Sales and Services Tax and 6% Government Tax are each calculated separately on the RM19.50.

Sales and Service Tax 10% of RM19.50 = RM1.95

Government Tax 6% of RM19.50 = RM1.17

Total Tax = 1.95 + 1.17 = RM3.12

Hence, your grand total will be RM19.50 + RM3.12 = RM22.62

New way of taxing

The same is applied for the new way and with the addition of applying the GST on the service charge as well.

Service Charge 10% of RM19.50 = RM1.95

GST 6% of RM19.50 = RM1.17

GST 6% on top of Service Charge = RM0.117 (roundup RM0.12)

Total Tax = 1.95 + 1.17 + 0.12 = RM3.24

Hence, your grand total will be RM19.50 + RM3.24 = RM22.74

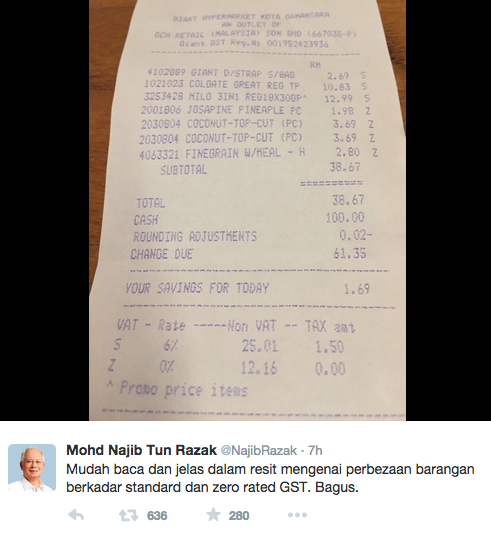

5. Another example of a GST receipt would be Najib's grocery shopping from Giant hypermarket

Below the receipt, VAT stands for Value-Added Tax, which is another name for GST*.

Items 'S' (standard-rated supply) and 'Z' (zero-rated supply)* are separated to their respective categories. Item S is calculated with the 6% GST and the total amount of RM1.50 is the tax for the groceries.

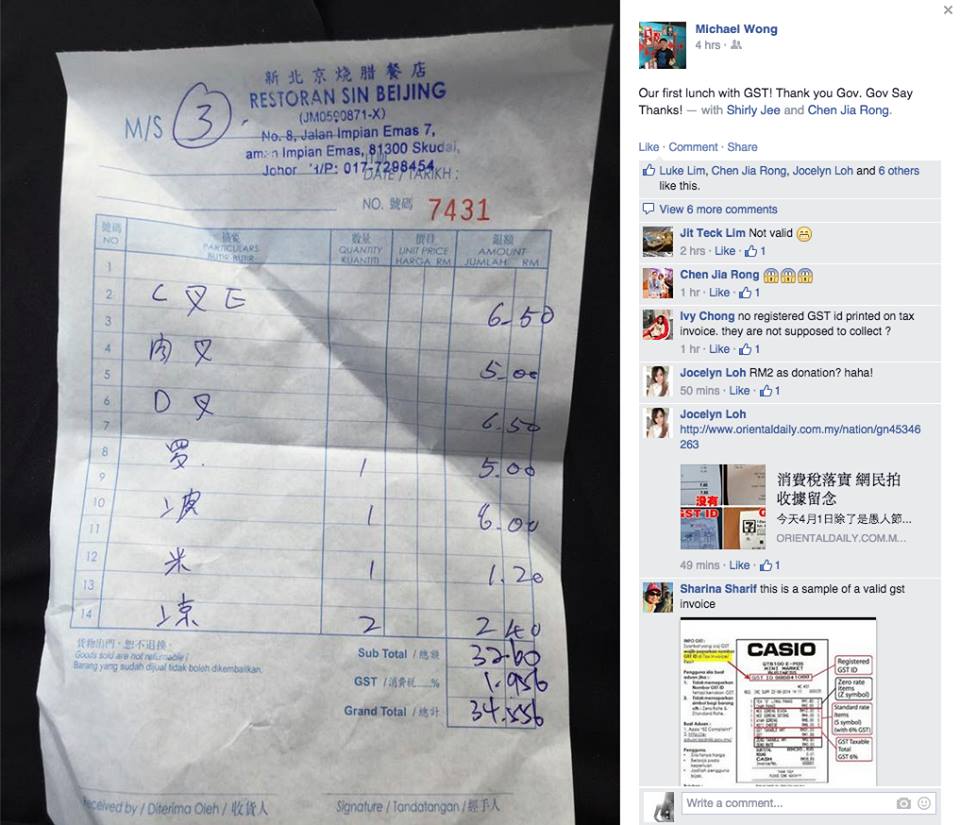

With all the confusion, some retailers are taking advantage of the situation. Here are 4 tips to avoid being a victim of GST fraud:

I) Always check for the GST ID code on the receipt as only registered retailers are allowed to implement the 6% tax

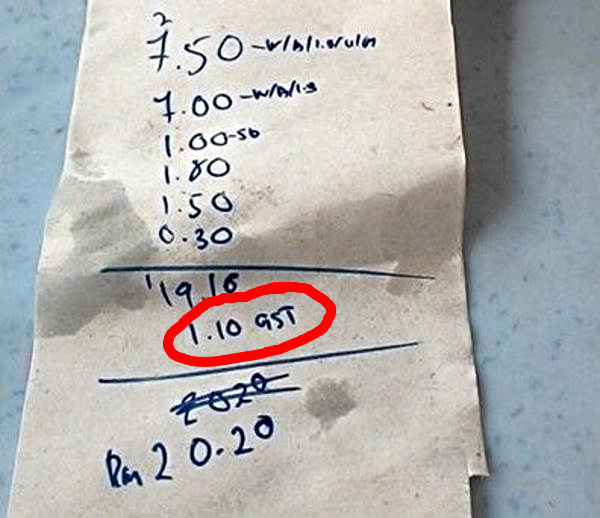

II) Check if the receipt is printed. Calculating GST requires a computerised audit system, handwritten receipts are not allowed.

III) Roughly estimate the annual income of the retail

According to GST.com, retailers have to earn a minimum of RM500,000 per annum before they are GST-taxable. This is to ensure that small businesses can survive by being GST-free and are not required to bear the costs of registration. However, retailers that have not reached the minimum amount can also voluntarily apply to be GST registered.

IV) You can check the legitimacy of a GST ID code at the Customs Department website, by entering:

i. Business name

ii. Business registration number

iii. GST registration number

If you feel like you have been a victim of GST fraud you can lodge a report here:

At Ministry of Domestic Trade, Co-operatives and Consumerism or use the MyKira GST app is also available to make a report.