Even Malaysians Have To Pay Tourism Tax From 1 August Onwards

We're all tourists now.

Government’s new tourism tax to kick-off on 1 July

Tourism and Culture Minister Nazri Aziz said that the Tourism tax will be coming into effect on 1 July and not 1 August, as previously indicated by the Customs Department.

In a circular published on Tuesday, 6 June, the Customs Department announced that business operators are required to register their accommodation premises to be added into the government's database on 1 July. With Nazri's recent statement, this means that these premises will start collecting Tourism tax from as early as 1 July.

Nazri further mentioned that Tourism tax is estimated to generate RM654.62 million if 60% of all 11 million rooms in the country were occupied following typical night stays.

Nazri also said that the bill, which has yet to be gazetted, will be implemented regardless of whether or not the Yang di-Pertuan Agong signs it

“Parliament is the supreme body in the formation of a law. So, once the bill has been passed by Parliament, it will be automatically gazetted after 30 days. If the Agong doesn’t sign it, it will be automatically gazetted. I know. I’m the minister,” said Nazri.

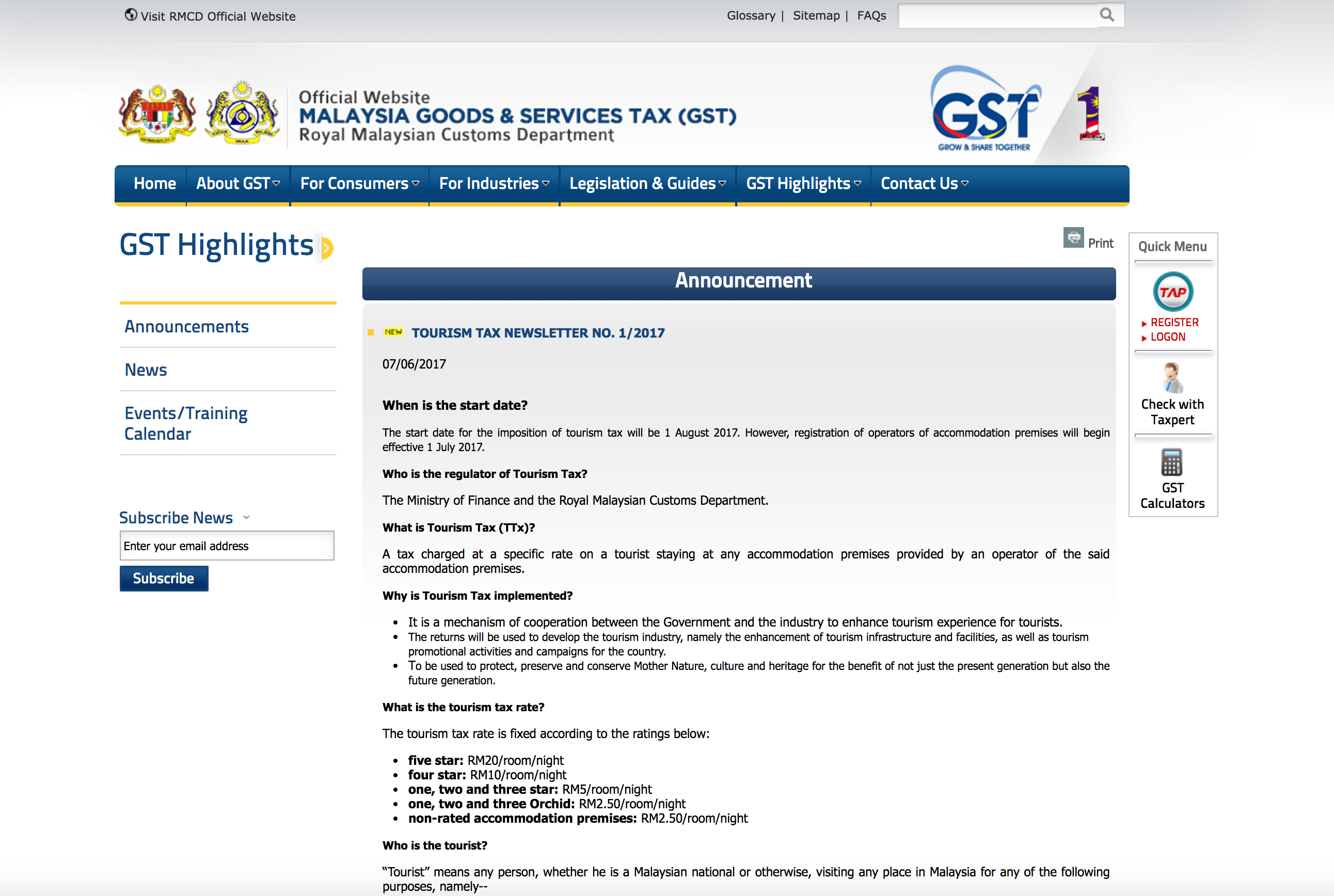

7 JUNE: From 1 August 2017, tourists visiting Malaysia will be required to pay a tourism tax if they're staying in a hotel, resort, or any sort of accommodation

The tourism tax is to be paid in addition to the existing 10% service charge and 6% GST. The tax rate will depend on the rating of the accommodation premises you are staying at:

1. Five-star: RM20 per night/room

2. Four-star: RM10 per night/room

3. One to three-star: RM5 per night/room

4. One to three Orchid (more environmentally-focused rating system): RM2.50 per night/room

5. Non-rated accommodation premises: RM2.50 per night/room

In this case, Malaysians are also included in the tourist category

In the defence of the Royal Malaysian Customs Department, the word "tourist" refers to person who travel for any reasons ranging from leisure, recreation or holiday, culture to religion, visiting friends or relatives, sports, business meetings, conferences, seminars or conventions, studies or research, any other purpose which is not related to having an occupation that pays you for visiting that place.

Not all places that provide accommodation will be required to impose the tourism tax on you

On the bright side, not every place providing accommodation is required to impose tourism tax. For example, Airbnb.

You are not required to pay the tourism tax if you are staying at such places:

1. Homestay or kampungstay registered with the Ministry Of Tourism and Culture (MOTAC).

2. Religious institutions that aren't commercially viable.

3. Places with less than 10 rooms.

4. Premises operated by the Federal Government, State Government or statutory body for training, educational or accommodation that aren't for commercial purposes.

However, all places registered by the Commissioner under subsection 31C(1) Tourism Industry Act 1992 will have to include the tax. In other words, you can forget about hotels and better known establishments.

What will the tax money be used for?

According to the Royal Malaysian Customs Department, the returns will be funnelled back to boosting the local tourism industry such as building infrastructure, facilities and coming up with promotional activities and campaigns necessary for the industry to flourish.

And on behalf of future generations, the tax money will also be used for conservation and preservation efforts for the environment as well as Malaysian culture.

For more information, visit the Royal Malaysian Customs Department website.