It's Official: GST Will Be Implemented, This Is Why It's Not So Bad:

The Ministry of Finance is expected to introduce a Goods and Services Tax (GST) during the Budget 2014 announcement on 25 October 2013. Talks and analysis about the GST can be confusing. We strip away the big jargons and answer 13 burning questions to help you understand the GST without the headache.

1. What is Goods and Services Tax (GST)?

A goods and services tax (GST) is a tax on consumption or in other words, spending.

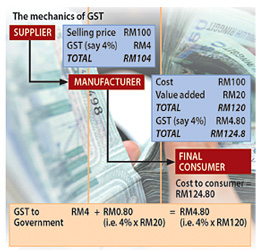

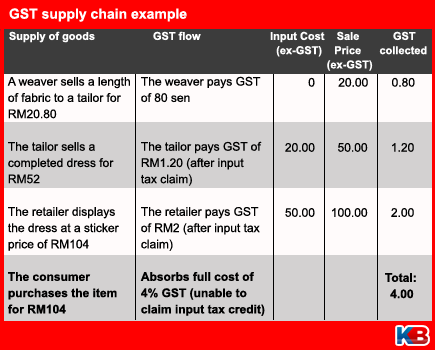

GST is a consumption tax based on the value-added concept. GST is imposed on goods and services at every production and distribution stage in the supply chain including importation of goods and services.

2. How does the GST work?

GST is charged and collected on all taxable goods and services produced in the country including imports. Only businesses registered under GST can charge and collect GST.

Unlike the existing sales tax and service tax, GST is generally charged on the consumption of goods and services at every stage of the supply chain, with the tax burden ultimately borne by the end consumer.

3. How will I, as a consumer, be affected?

So long as a person participates in the economy as a consumer – practically everyone does – they will be nett GST payers once the tax is implemented.

Unlike income taxes, individuals will not need to fill in any forms or file returns; GST is collected on their behalf by businesses. As such, GST is considered an indirect tax.

4. Are there any goods and services that are exempted from GST?

In principle, GST is imposed on all goods and services produced in the country including imports. However, certain basic foodstuff and essential services are not subject to GST. Such exemption is to ensure that the lower income group is not burdened by GST.

Unless exempted by law, all goods and services (technical term: supply) in the course of furtherance of business in Malaysia are taxable. In international trade, imports are taxable whereas exports are exempt.

Items to be exempted from GST - rice, sugar, salt, flour, cooking oil, dhal, chilli, herbs, salted fish, cincalok, budu, belacan, piped water, electricity (for first 200 for domestic use), government services, public transport (bus, LRT, ferry, toll) sales and purchase of property or rental of property.

5. Why does the government want to implement the GST in Budget 2014?

Its purpose is to replace the sales and service tax which has been used in the country for several decades. The government is seeking additional revenue to offset its budget deficit.

The government is spending more than it earns leading to a 2012 fiscal deficit, which in 2012 was 4.5% of GDP. Introducing a GST could help the government raise additional revenue, as consumption increases, to narrow the fiscal deficit.

6. How is the GST different from the current Sales Tax and Service Tax (SST)?

How is the GST different from the current sales tax and service tax (SST)<br/><br/>

Image via kinibiz.comThe sales tax is imposed only at the manufacturing stage that is at the time when the goods are manufactured or when the goods are imported. On the other hand, service tax is imposed on specific services at the time when the services are provided to the consumer

Compared to the sales and service taxes, GST is considerably more efficient. Critically, GST has a broader tax base and does not have a cascading or compounding tax problem.

7. When will the GST be implemented? 1 April 2015

The Government has not determined the implementation date of GST in Malaysia. Presently, the Government is actively involved in providing awareness and knowledge on the concept and rules regarding GST implementation.

Once an announcement on the GST is made, actual implementation of the tax will be subject to a 14-month long implementation period for businesses to familiarise themselves with the new accounting standards.

8. What will happen to the existing Sales and Services Tax?

Sales tax is currently levied at a rate of 10% and has been in force since the 1970s. Service tax, meanwhile, is levied at a 6% rate.

Sales and service tax will be abolished once the GST is eventually implemented.

9. Why do we need the GST?

The GST unit of the Royal Malaysian Customs Department considers GST as a ‘method of collecting taxes which works better than others’ to explain the need for GST.

Economists, meanwhile, believe the government has very rightly approached the GST as a new source of income with a broad tax base as a means to begin to diversify tax revenue sources.

10. Why are people against the GST?

Another question worth asking is if GST equates to double taxation of income. Technically this is true according to tax experts. Disposable income spent on goods and services that attract GST is income that has already been subject to income tax.

“GST is regressive. Evidence has shown that the higher you earn, the less you pay. The people from the middle-income group will have to pay more compared to the higher income group,” Nurul Izzah.

11. Will GST cause inflation?

Yes and no. Studies allowing for a GST rate of 4% predict some goods and services will increase in price while others may see a decrease. The overall impact is expected to be neutral.

According to the GST unit of the Royal Malaysian Customs Department, any inflation will be one off, because the increase in prices would occur as single event. Following the spike inflation will return to the normal cycle.

Because the GST is a replacement for the current sales and services tax (SST), goods that now carry a heavy SST tax burden will likely fall in price.

12. How will the government control the prices of goods?

To protect small businesses there is a threshold of RM500,000 in annual turnover. Businesses below that threshold do not need to register nor collect GST.

The government will take stern measures to ensure that the businesses do not take advantage of the GST implementation to increase prices of goods to make excessive profits.

Measures to be taken by the government include introducing the Anti Profiteering Act, intensifying enforcement action through the National Pricing Council, distribution of Shoppers’ Guide, as well as making the hypermarkets act as price setters.

13. Which government body will be administering and monitoring the GST?

The government has decided that the Royal Malaysian Customs Department (RMC) manages and administers the GST to be implemented in Malaysia.

GST monitoring committee to be chaired by Minister of Finance II Ahmad Husni Hanadzlah to ensure smooth implementation.

Presently the related government machinery such as the Ministry of Finance, the Customs Department, the Ministry of Domestic Trade, Co-operatives and Consumerism has taken steps to prepare the requirements for the GST implementation comprising the legislation, computer system development, logistics and infrastructure preparation, training and publicity including reorganisation.

Have something to say about this? Facebook or Tweet us!

Get all latest news here on SAYS (@SAYSdotcom). Tweet us and let us know what's happening around you! We'll feature it on SAYS.

SAYS is Malaysia's social news network. Find today's must-share stories, news and videos everyday, produce and brought to you by Malaysian social media users!

facebook.com

facebook.com