Will Malaysia's New Tax Rates On Beer Affect Your Alcohol Consumption?

Malaysia imposes the third highest alcohol tax rate in the world.

On 2 March, news of the Malaysian Finance Ministry mulling over the idea of increasing the alcohol tax spread, with many in the alcohol trade expressing concerns about the effects of the tax increment

The alcohol tax on beer and stout is expected to go up by at least 10 per cent this week, a source in the alcoholic beverage industry said.

The Finance Ministry is expected to announce the revised rate at a press conference tomorrow. The last tax revision was a decade ago.

“We do not know by how much the government will increase the tax. It is now at 15 per cent and we think it can go up by an additional 10 per cent,” the source said.

“The manufacturers are now preparing a plan to raise their prices depending on the percentage announced by the ministry. Beer and stout will definitely cost more.”

Confirming that the government will be announcing the new alcohol tax rates today, 3 March, Guinness Anchor Berhad (GAB) managing director Hans Essaadi informed that they have already made price adjustments to their products accordingly

"GAB acknowledges the news that the government has decided to raise excise duty on beer and stout effective 1 March 2016. As a result, we have made price adjustments to our portfolio of products in line with the new tax structure," read the press statement by GAB’s managing director Hans Essaadi, as reported by Malay Mail Online yesterday, 2 March.

"We are also concerned that the demand for illicit and unregulated alcohol products may increase," said Essaadi, adding that the current state of economy may make matters worse for those in the legal liquor industry.

He also said the hike would make their business harder amid an economy that is already bearing down on businesses and consumers,

"The state of the economy is having a significant impact on businesses and consumers and the latest increase in excise duty on beer and stout will make the environment more challenging to our industry," said Essaadi.

Meanwhile, the Malay Mail Online was reportedly given a revised wholesale price listing of GAB’s alcoholic drinks by a pub-keeper and the rates inclusive of the six percent Goods and Services Tax (GST) are as follows:

In Peninsular Malaysia, a 24-pack carton of Guinness stout now costs RM202.12 from RM192.13 previously while the 24-pack of 500ml cans now costs RM280.89 compared to RM262.03 previously.

A carton of Tiger beer now costs RM173.77, an increase of RM5.92 from RM167.85 previously, while its 24-can pack of 500ml costs RM238.79 compared to RM229.44 previously.

One 24-can carton of Heineken beer costs RM213.76 from RM208.61 previously, while a 4X6 can bundle costs RM213.76 from RM208.61 previously.

One 24-can carton of Anchor beer is now RM142.15 now from RM143.90, a reduction of RM0.75.

The list further revealed the the pinch will be greater for those living in East Malaysia, as there is a price hike up to 7% as opposed to the 5% in West Malaysia

One 24-can carton of the Guinness stout now costs RM191.63 compared to RM181.63, while one 24-can carton of Tiger beer costs RM181.99 from RM176.07 previously.

One 24-can carton of Heineken meanwhile costs RM190.66 from the previous RM185.50, and one 24-can carton of Anchor beer costs RM139.61, from the previous RM141.35, registering a reduction of RM1.74.

The Malaysian Singapore Coffee Shop Proprietors General Association president Ho Su Mong lamented that about 30% of their members are already doing poorly due to the increasing cost of living and implementation of GST

Malaysian Singapore Coffee Shop Proprietors General Association president Ho Su Mong

Image via The Star"Of our 20,000 members, some 30 per cent are struggling as it is. The increase could put them out of business and cause a loss of livelihood.

"Many members have pleaded with us to urge the government to consider postponing the tax hike till we are in better economic times," said Ho, adding that manufacturers would be forced to increase their prices which would cause a domino-effect that would lead to retailers hiking up their rates too.

“In the end, our patrons will be paying for it and we will have to deal with the fallout from an angry public," explained Ho when speaking to the Malay Mail Online.

Speaking about the tourism industry, Alcohol Consumer-Rights Group founder Deepak Gill, said that high alcohol prices in Malaysia may push tourists to consider other destinations, thus affecting both the tourism and alcohol industry

“It is not possible to underestimate the role these beverages play in drawing tourists. Rather than a tax hike, the authorities should instead reduce the tax on beer and stout.

“We already have tourists complaining that our beer prices are ridiculously high and they are considering other destinations,” he said.

Deepak said last year saw prices of alcohol shoot up by at least 15 per cent post GST and the depreciating ringgit had compounded the problem.

“Hops and barley have to be imported. This means the industry is already under strain and the additional pressure this hike will cause does not bode well for consumers,” he said.

Malaysia imposes the third highest tax on alcohol worldwide, and the highest excise tax rate on beer and stout in Asia

Compared to neighbouring Asian countries, Malaysia continues to levy the highest excise tax rate on beer and stout.

Following three consecutive tariff hikes (2004 to 2006), Malaysia now has the second highest duty on beer in the world after Norway. The excise duty for beer is RM7.40 per litre plus 15 percent ad varolem tax.

The high excise duty imposed on the industry impacts the affordability of legitimate beer products for consumers and may potentially have a significant impact on the industry and on government revenue.

The Confederation of Malaysian Brewers have stated a number of impacts that the high prices for legitimate beer products may pose, namely;

1) Smuggling and contraband beer products

- Contraband beer products have become an attractive option for drinkers as the high excise duties have led to relatively high prices for duty paid beer. As a result, it is estimated that the Malaysian government loses over RM900 million annually in alcohol tax revenue including excise and import duties due to illegal smuggling of contraband beer and stout products.

2) Cheap Imported Beer (CIB)

- Cheap imported beer (CIB) refers to imported beers that do not pay taxes as they are smuggled into the country, allowing them to be taxed at a lower price than locally-produced beers that pay sales and excise taxes. Based on industry estimates, the volume of CIBs in the market has grown five-fold to 250,000 hectolitres between 2010 – 2013. This equates to approximately RM310 million in Government tax losses.

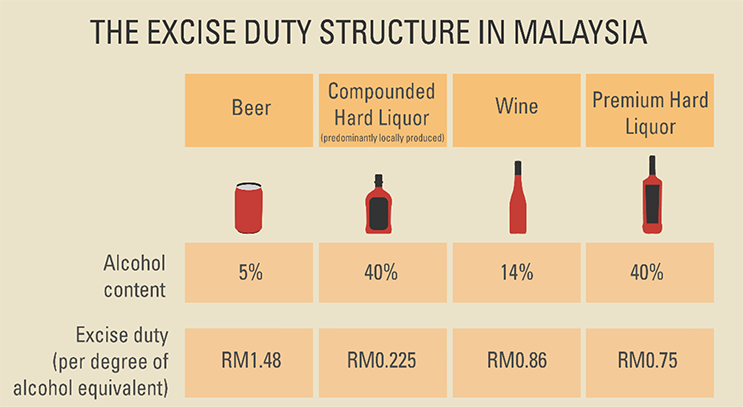

3) Compounded Hard Liquor (CHL)

- Compounded hard liquor (CHL) refers to products made from imported raw alcohol which is locally blended or “home brewed”. Because CHL in Malaysia is currently taxed at a lower rate than other alcohol products, it has become an attractive alternative for consumers. The consumption of CHL poses risks as many of these CHL products do not adhere to stringent production, health and safety standards and can be harmful when consumed.

What do you think about the government's sudden move to increase the already hefty alcohol tax? Take our poll to let us know your views: