Here's How To Open A Bank Account For Your Limited Liability Partnership In Malaysia

5 easy steps and you're done.

Back in October 2015, I wrote an article about how to set up a Limited Liability Partnership (LLP) in Malaysia. If you search for "Limited Liability Partnership Malaysia", you will find it on the first page of Google. Which tells me one thing: There's huge interest, but there's also very little information out there about LLPs.

(So here’s my contribution to the local startup community: If you have any information or experiences to share about LLPs, do comment below, or maybe write a blog post about it too?)

Anyway, ever since I wrote that article — I’ve been getting a lot of questions about LLPs. While I would never claim to be an expert, I try my best to help. This article answers one of the most frequently-asked questions I get:

How do you set up a bank account for your LLP?

If you meet a bank teller who isn’t well-trained — they might not even know what an LLP is. But I assure you that it can be done. My girlfriend recently got hers approved, and she very kindly provided me the information for this article.

Here’s how to do it:

1. Visit your favourite bank branch

Sad but true — in this modern age where we get real-time traffic information beamed to our mobile phones via satellite, we still have to physically go to a bank to get some things done.

Setting up a bank account for an LLP is one of them. I suggest you visit your favorite bank branch and ask them for the full procedure, and all the forms required. There’s still too little information online, so I think it’s best to talk to the bank officers face-to-face.

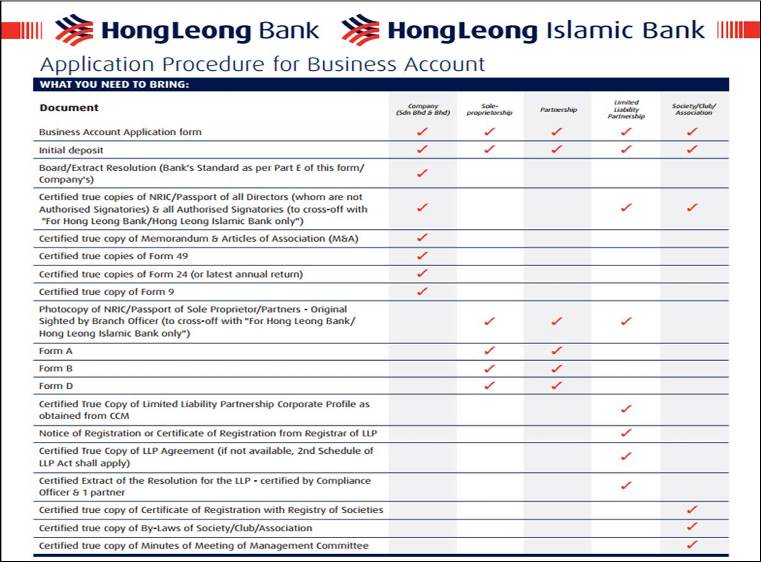

Searching through multiple pages of Google Search only got me the below information:

OCBC Bank’s “Application Procedure for Business Account”

HongLeong Bank’s “Application Procedure for Business Account”

Alliance Bank’s “Business Banking Application Form”

PS: If possible, go to the head branch in your state, or, at least, a big bank. I hate to be elitist, but hopefully, the bank officers there have heard of LLPs before and know what to do. A lot of people still haven’t.

2. Get the documents required

From your bank visit and websites above, we now know that you need:

1. Certified true copies of NRIC/Passport of all partners and compliance officers

2. Original NRIC/Passport of all partners and compliance officers (the bank officers need to see the originals, so you have to drag your partners to the bank with you)

3. Certified true copy of LLP corporate profile

4. Certificate of registration of LLP

5. Certified extract of resolution for LLP (certified by compliance officer and one partner. This is the document that says all the partners agree to open a bank account)

These are optional, depending on your LLP:

1. Practicing certificate (for a professional practice e.g. lawyers, accountants and secretaries)

2. Letter of approval from governing body (for professional practices like above)

3. Certified true copy of LLP agreement (this is the agreement made between all the partners of the LLP. If this is not available, “default LLP rules” a.k.a. 2nd Schedule of the LLP Act apply)

4. Annual declaration of LLP (if available)

Let's take a closer look at the mandatory forms:

Certified true copy of LLP Corporate Profile

The LLP corporate profile contains all the important information about your LLP, like: business code, contact details, address and partners’ information.

Certificate of registration for LLP

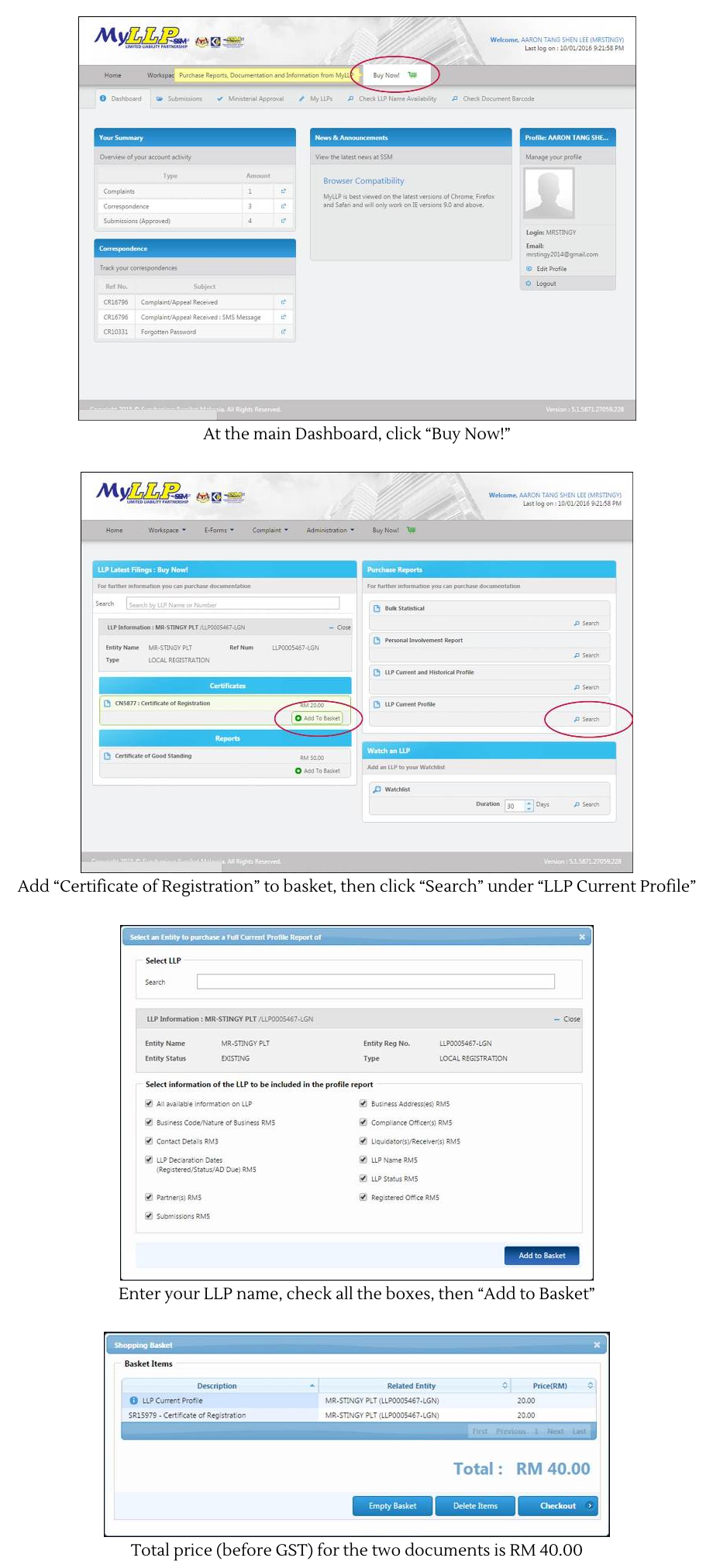

This is just like your LLP’s birth certificate. You can buy both these documents from the MyLLP system (although you’ll have to physically collect them from SSM). The process is really fast, and you can collect the documents as soon as you pay.

The screenshots below show the process:

Certified extract of resolution for LLP

A “resolution” is a document that tells outsiders what the partners of an LLP have agreed on. In this case, your resolution will say that your LLP is making so much money that you now need a bank account.

Each bank has a “standard format” for this document. Ask your bank officer if he can provide you a sample for you to follow. And just because I’m a nice guy, here’s a link to a board resolution document from HSBC.

3. Fill up the forms with your partners

Now that you have got all documents:

1. Fill up and get all the partners to sign the business account application form

2. Prepare copies of the partners’ NRICs/passports

3. Fill up the “resolution for LLP”

Some of the documents need your LLP’s rubber stamp. So you’ll have to make one if you haven’t already. Certain banks (like Public Bank) require a current account holder to “introduce” you to the bank. If that’s the case, you need to get your introducer to sign the form too. (Sorry, I can’t be your introducer).

Finally, if you like online banking, remember to fill up the “online banking application” form. Some banks (again, like Public Bank) don’t include that in the business account application form — so you’ll need to fill up another form.

4. Submit documents to the bank

You can now go back to the bank with the completed documents.

To be safe, bring originals of the important documents (especially your NRIC/passport), as the bank might need to physically see the original.

You don’t need to bring your introducer, but remember to bring all your partners along. And your rubber stamp.

5. Wait for the bank to call you back

The bank needs time to process your documents, so you’ll need to be patient. Even someone as good looking as my girlfriend had to wait three weeks for Public Bank to call her. But eventually, the bank will call: “Your account is now ready,” they’ll say. “Now please deposit RM 5,000 into account number xxxxx xxxx xxxx to activate it.”

Deposit the money, wait a day, then call the bank. Ask them if they’ve received the money.

Once they’ve confirmed the money is in, and they’ve activated your account — you can go to the bank and collect your checkbook (+ any online banking accessories).

Congratulations — your LLP now has a bank account. Now let’s make some money.

The full article originally appeared at mr-stingy.com.

This story is the personal opinion of the writer. You too can submit a story as a SAYS reader by emailing us at [email protected].

Previously from Aaron: