I First Bought Bitcoin At USD567. I've Made Over 1,000% Today. This Is My Story.

Last month was the one-year anniversary of my first Bitcoin investment.

I wrote this article two weeks ago on 22 November 2017 when it went up to USD8,000. Yesterday Bitcoin passed USD16,000 so technically I've made about 2,800%. What the hell is going on?!

99% of the time, someone who shares a story about his investment growing 1,000% in one year is a conman

Well luckily you know I’m not a conman. But in case you’re not sure, how about you finish this article first — and then we make a decision. Fair?

It’s ironic, because maybe as recently as 1.5 years ago — if you told me of an investment that would rise 1,000% in a year — I would say: SCAM!

And yet, here I am — with >1,000% gains on my first money into Bitcoin.

This is the story of my one year-ish journey into the world of Bitcoin and cryptocurrencies. And here’s what I think you need to know.

Okay, first a refresher. Explain bitcoin to me in the simplest possible way?

Here’s my elevator pitch on what Bitcoin is:

- Bitcoin is the most famous kind of Internet money. It solves several weaknesses traditional money has, using clever science techniques like cryptography.

- Now think about how the Internet connects people all over the world. Bitcoin has several features which makes it just like the Internet:

a. It runs 24/7. You can’t switch it off.

b. It depends on a big number of connected computers all around the world.

c. These computers work together to give value to people like you and me.

Here’s an analogy to explain further. Imagine a small village of 10 people, where money as we know it does not exist.

Instead, the people there use their own currency known as “Stones.”

Everyone cares about security very much, so they’ve developed a very interesting way to use their Stones. Each villager has a special book called a “Ledger,” in which he/she records down any movement of Stones for the entire village.

And because they care so much about their money, every day all 10 villagers will meet for a “money discussion.” In this meeting they will review all movements of Stones (transactions) throughout the day.

Because it’s a democratic village, there is no “Chief.”

Instead, all the villagers work together to track the Stones. At the end of the meeting, the villagers will agree on what happened during the day. And then everyone will update their books to show the same information.

It doesn’t matter how many stones you say you have; it matters how many stones EVERYONE says you have

Image via Mr-stingyFor example, Alice decides to send 2 Stones to Bob

Let’s say Alice decides to send 2 Stones to Bob on 23 November. This is what would happen at the day-end meeting:

- “Hey everyone, I gave 2 Stones to Bob today for my new haircut,” says Alice.

- Everyone checks to see if Alice’s new hair makes her look prettier or not. Then they check their Ledgers (special books) to see how many Stones Alice had before. It turns out she had 15 Stones.

- “So Alice, now that you’ve given 2 Stones to Bob, you only have 13 Stones left,” says Carol (another villager). “Hey everyone else, can you check that this is correct?”

- “Correct. We can see from our Ledgers that Alice used to have 15, so now she has 13. Meanwhile, Bob used to have 10 Stones, so now he has 12,” comes the reply.

- “Okay everyone, let’s all update our Ledgers. Nice haircut Alice!”

- So Alice, Bob, Carol (and all the other villagers) write down this new information into their Ledgers. Then they move on with their happy lives; any further movement of Stones will be discussed during the next day’s meeting.

So in case anyone loses their special book, someone steals Stones, or maybe even a bad villager tries to create fake Stones — all the villagers need to do is to go to the meeting and check their books together. Those Ledgers hold the “ultimate truth.”

There’s strength in numbers.

The Stones are an analogy for Bitcoin. And if you’ve ever read the term “blockchain,” those are the “Ledgers/special books” that every villager has.

Just like in our happy village, all Bitcoin transactions are first verified by a bunch of people together. The verified transactions are then updated into the blockchain, so we know how much Bitcoin everyone rightfully has at a certain point in time.

But the really amazing thing is that instead of limiting it to a small village (where meetings happen once a day and everyone trusts each other), we can use technology to expand this system to anyone connected on the Internet.

It’s fast, and doesn’t need any “Village Chief” or “Treasurer” to act as the boss.

What made me buy Bitcoin?

But enough about the geeky stuff. If you wanna read more about that, check out my article here.

Let’s go back to September 2016, and talk about my reasons for buying Bitcoin.

It might surprise you, but when I first put money into Bitcoin, I wasn’t really expecting it to go up like crazy. Instead, I put money into it because:

- Most of my investments prior to this were in Malaysian ringgit. Well guess what happens when the Ringgit loses value. (Right — my investments lose value too.) Hence, I was looking for non-Malaysian-dependent investments to “hedge.”

- I found the idea of decentralised “Internet Money” fascinating. I’m very much a geek at heart — and the technology behind Bitcoin just blew my mind.

- I had some extra money to “play” with. And by this I mean money that I could afford to lose — even if it goes to 0.

Thankfully I’m doing okay financially. So I started small — with an intention to learn.

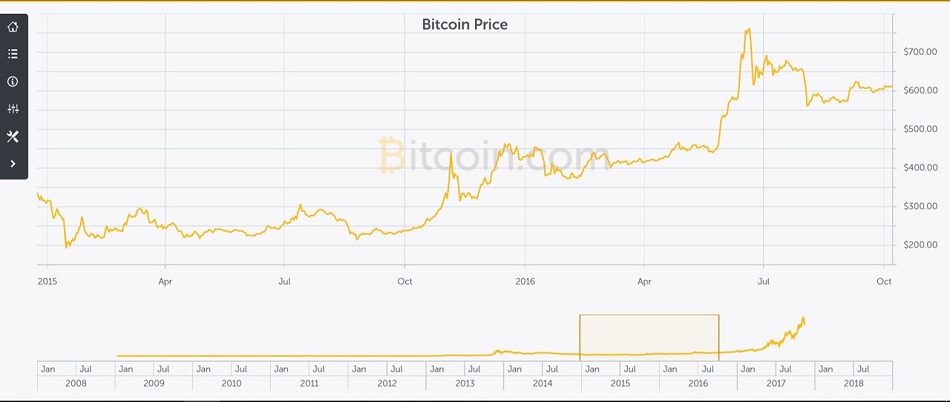

When I first bought in, Bitcoin was selling for USD567 per bitcoin (BTC). I thought it was freaking expensive.

Especially considering how it used to be in the USD200-300 range for most of 2015.

But I also really wanted to experience cryptocurrency “investing.” So I opened my friend Suraya’s article and followed the step-by-step instructions on how to buy Bitcoin.

It was uncomfortable. I might be the kind of person who tries risky things with my career, but I’m usually very conservative with my money. Would I lose all my money and regret it in one year? I reminded myself this was money I could afford to lose — but the learning might be priceless.

I made sure the bitcoin transaction went through, the BTC was safely in my wallet — then I shut down the computer. Over the next few days, I would occasionally look at the price of Bitcoin, and play around with my bitcoin wallet.

Then after a couple of weeks, I just let it be.

On the way to the moon

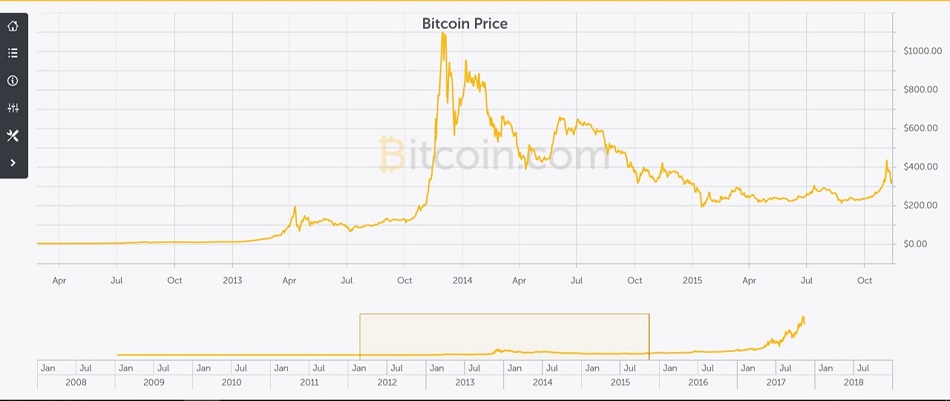

Before 2016, the highest Bitcoin had ever gone was USD1,242 / BTC. This was back in November 2013, when the infamous Mt. Gox exchange hadn’t declared bankruptcy yet.

After I got in, Bitcoin rose steadily (though “steadily” in crypto terms means “OMG CRAZY” in traditional investing) till the end of December 2016. But Quarter 1 2017 was when it really started to get mass attention. Why?

In March 2017, Bitcoin set a new all-time high at USD1,290 / BTC.

I was getting hooked. At the same time, a young cryptocurrency called Ether was taking the world by storm. I felt I needed to get in too.

In April 2017, ~8 months after my first investment into cryptocurrencies — I bought my next portion of Bitcoin and converted some into Ether. The price of Ether at this point was about USD92 / ETH.

Meanwhile, Bitcoin’s price had already almost tripled to USD1,444.

Sell, buy or hodl?

At this point, I had a decision to make. I had it for less than a year, but Bitcoin was already the best investment I had ever made with my money. Should I sell?

(For comparison’s sake, if I had a more conventional investment like stocks giving 8% a year — it would take me ~15 years to triple my money).

Like most fans, I started reading everything I could about Bitcoin on the Internet. I read how “gurus” like Vinny Lingham predicted Bitcoin would hit USD3,000 by end 2017.

I read how legend John McAfee predicted Bitcoin would hit USD500,000 in three years, or he would eat his d*ck on TV. And I also read how skeptics said Bitcoin was worthless and this was all a huge bubble.

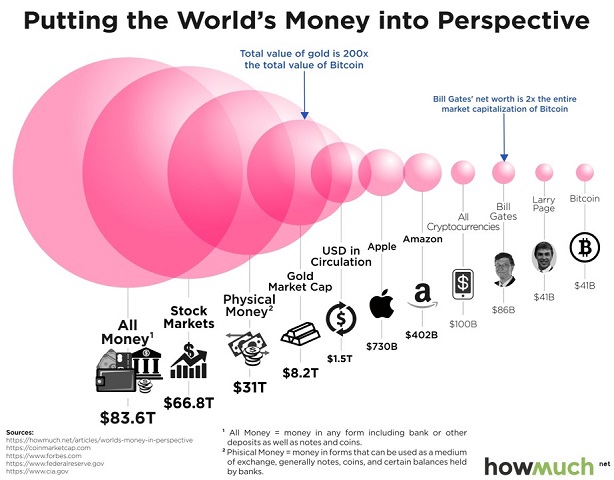

There are a lot of extremely smart people predicting the future of Bitcoin, but ultimately I realised that no one really knows. Stock markets have existed for more than 200 years, but can anyone really predict stocks accurately? And Bitcoin is just 9 years old.

I made a promise to myself: I would only put in money that I was willing to lose. And because I believed in the long-term prospects of Bitcoin and cryptocurrencies, I wouldn’t lose myself in the emotions of wild price fluctuations by becoming a trader. I would hold.

So I became a HODLer.

How to triple your money in one year

Last month was the one-year anniversary of my first Bitcoin investment.

I’ve continued to put in money periodically, similar to how stock market investors use dollar-cost averaging. Yes, I sometimes try to “time” the market — but usually end up feeling stupid, because it’s too unpredictable to get in at the “right time.” Looking at prices drop after I’ve bought makes me feel like shit too.

How do I deal with fear, uncertainty and doubt? By reminding myself I’m investing for the long term; and it’s money that I’m prepared to lose.

I’ve also invested in other cryptocurrencies apart from Bitcoin and Ether. I really like several interesting projects like decentralised computing (Golem), decentralised storage (SiaCoin) and Blockchain-as-a-Service (Stratis).

And who can forget NEO, the so-called “China killer app” that can do everything Ethereum does and more! Naturally, I bought into NEO at its all-time high, and then it crashed. I’m still waiting for it to recover. :(

So win some, lose some. Based on yesterday’s prices, my cumulative investments have quadrupled (4x) in value so far.

But wait… you said 1,000%

Yeah, and here’s an important lesson. I’ve been writing online for a couple of years now. In that time I’ve analysed lots of headlines and written hundreds of headlines myself.

You can write something that is very true, and still adjust it to become as sensationalised or as boring as you want.

The truth is, my first money into Bitcoin (from Sept 2016) is up >1,300%. But the latest amount I bought (early Nov 2017) is obviously not.

I could have made my headline click-baity like below, and it’d still be true:

- My Bitcoin investment just went up 1,300%. Find out how!

- Stock market investors HATE him for making so much in Bitcoin!

- 10 Secrets of Bitcoin investing for beginners!

I could also have written it as boring as: How to make money slowly with Bitcoin

Why am I telling you this?

Because you’re gonna see a lot of crypto news/articles/videos in the coming weeks and months. And a lot of these publications will try to steal your attention in sometimes irresponsible ways.

So please stay away from articles that shout “Now everyone can be a Bitcoin millionaire!”

But what’s even worse than irresponsible headlines is this: people are gonna try to cheat you of your money — in the name of Bitcoin.

So, should you buy Bitcoin?

I’m not a financial adviser, so please take my advice with a pinch of salt. Actually, please take anyone’s advice with a huge pinch of salt — even so called “experts.”

Here’s what I would do if I were you…

Make sure your basic finances are in order first, like:

- No credit card debt.

- Have 3-6 months’ worth of expenses in emergency savings.

- Own some other safer investments like Amanah Saham (Government Trusts) and ETFs.

When I first bought Bitcoin, I bought a sum that I was comfortable to “test” with. (No, you don’t need to buy a whole bitcoin. You can buy small quantities of it down to 0.00000001 BTC).

Use this money as a learning opportunity. Plenty of things to learn such as:

- How to buy/sell Bitcoin.

- How to transfer it to other wallets anywhere around the world.

- Keeping your Bitcoin safe.

- What to do if you forget your password.

- How to convert Bitcoin into (and buy) other cryptocurrencies like Ether and Monero.

Yes, you could read up on all the above even before you get into Bitcoin. But without skin in the game, you’re probably not gonna be as motivated to learn right?

On 21 November, the price of Bitcoin touched USD8,000 for the first time ever

Ether was hovering around USD350. People are already predicting a USD10,000 Bitcoin, and many analysts say big institutions are gonna start pouring money into Bitcoin soon.

(Yes, most big market movers like banks, pension funds and mutual funds haven’t even joined this roller coaster yet.)

Will we ever see the USD1 Million Bitcoin predicted by Silicon Valley’s first believer, Wences Casares? Will John Mcafee eat his d*ck on TV because Bitcoin drops to 0? And will big banks start to embrace cryptos, or end up like what Amazon did to bookstores?

I don’t know. But I know the world is changing; a lot faster than most of us ever expected. We’re in for a wild ride, so hang on tight.

What an exciting time to be alive!

The full article originally appeared on mr-stingy.com.

This story is the personal opinion of the writer. You too can submit a story as a SAYS reader by emailing us at [email protected].