"Aiyo, I'm So Broke" — 5 Reasons Why You May Be Short On Cash

Here's a lil' wake up call to help you manage your expenses better!

Ever had to survive on just bread or instant noodles towards the end of the month 'cause you were low on cash? We feel you. T_T

Even when making a decent income, there are times when you fall short, and don't have quite enough money for the month after making poor financial decisions.

However, it doesn't have to be this way. Being more savvy with your money is possible, but only if you're able to properly manage how you spend your money.

1. You become way too obsessed with the latest trends

Picture this: you've just discovered your favourite movie series has just released all kinds of new merch! From hoodies to tote bags, you're absolutely tempted to go on a shopping spree and bring it all home, perhaps even do a haul update on your Instagram. :P

However, in the midst of all the excitement, you may not realise until it's too late that you've exceeded your budget for the month. This also applies when you're shopping online, as we all know how easy it is to purchase something with just a few taps.

Here's what you can do: Before you hit the mall or store, implement no-spend days or create a shopping list. That way, you can be more thoughtful with your money. Plus, you don't have to spend a lot to share exciting updates online — try other things, such as free activities or exploring new places!

2. Ever watched Confessions of a Shopaholic? Yeah, you're the main character now.

If you've ever caught yourself suddenly buying something when it was never your intention in the first place, then you've definitely made an impulsive purchase before. The reality is that it does become a cause for concern when you start impulse-buying expensive things that are not within your budget.

Here's what you can do: Before making big purchases, always check your bank account on a regular basis! Not only will this help you keep track of how much you're spending, but also when you can afford to spend a little more for special occasions or fun getaways.

3. Buy Now, Pay Later is your go-to payment method for EVERY. SINGLE. THING.

You may have already started using Buy Now, Pay Later on e-commerce platforms that offer them. After all, they seem pretty convenient to utilise when you're a lil' short on cash, right?

While there is a time and place for split-payment options, you may end up with more expenses to your monthly commitments. What's more, if you're lacking the discipline to pay it back on time, you'll likely incur interest fees and late fees, which affects your credit score!

Here's what you can do: Instead of buying now and paying later, try starting a fun money-saving challenge, like saving all your RM20 notes for a certain time period, to purchase items you want. You can even start off with RM5 notes first, then increase the value as you become more disciplined with saving money.

4. You're guilty of signing up for multiple subscriptions or memberships... which you don't even use :/

Whether you've never shown up at the gym even though you've subscribed for a membership plan, or you pay for multiple streaming services while not watching anything, this kind of issue is more common than you think.

If you think that paying for these subscriptions isn't really a big deal, the truth is that all those monthly payments will add up to a significant chunk of your expenses.

Here's what you can do: Before signing up for a subscription or membership service, ask yourself, "Am I committed to using these services?" Then, review all memberships you have, and unsubscribe from those you no longer use. Now, you can prevent wasting money on memberships or subscriptions you rarely utilise.

5. You're clueless about investing, but you invest anyway simply to join the hype

From cryptocurrency to the stock market, you may have seen many of these so-called gurus online inviting you to invest, with the promise of helping you grow your savings. However, if you don't have adequate knowledge of the basics of investing, and are just doing so because the people around you are doing it, you are at risk of losing your hard-earned savings.

Here's what you can do: Talk to the experts to seek their advice, do your own research, and check if the investments you're considering are legit or not. Only then you should consider investing money once you understand the risks involved.

However, if you're looking for something safer and low-risk, you should start off by keeping your money in a savings account or fixed deposit. You can rest easy knowing that government authority Perbadanan Insurans Deposit Malaysia (PIDM) is protecting your deposits in the bank.

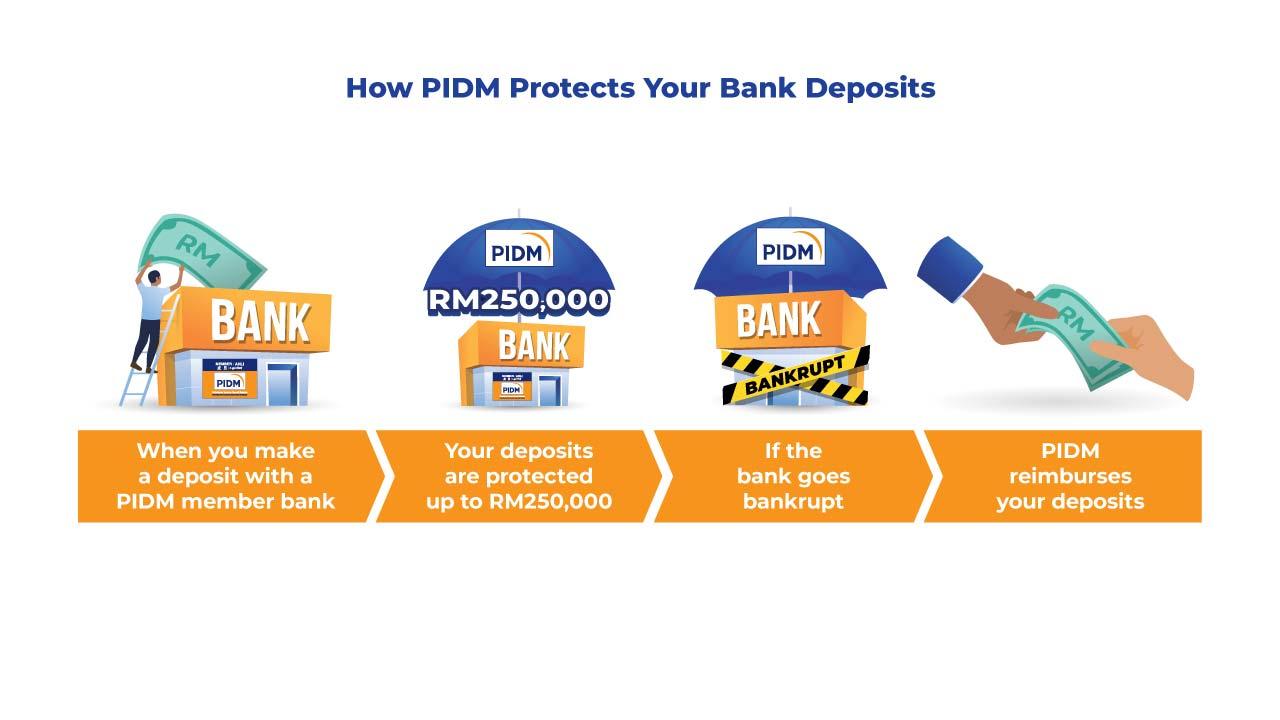

In case you didn't know, deposits in commercial and Islamic banks are protected by PIDM up to RM250,000. This means if a member bank goes bankrupt, you can be sure that PIDM will reimburse your deposits. This protection is provided by PIDM automatically.

At the end of the day, being in control of your finances is possible once you've dialled down your spending habits

Taking charge of your expenses is important because it'll allow you to live the life you want. Now that you know why you often end up with insufficient funds, you can start by avoiding these pitfalls and practising healthier spending habits. Not only will you be able to manage your money better this way, but you'll also be able to start saving for a rainy day, to provide you a safety net should emergencies that require large sums of money arise.

In case you didn't know, PIDM's #SediaPayungKewangan (SPK) microsite is filled with financial literacy articles, videos, and more to help you with your finances. You can even explore upcoming events and activities you can participate in!