This Insurance Is The First To Cover Genomic Test For Cancer. Here's Why You Should Care

Find out how this can benefit you especially if your family has a history of cancer.

Did you know that early cancer detection and treatment can prevent an estimated one-third to one-half of cancer deaths in Malaysia?

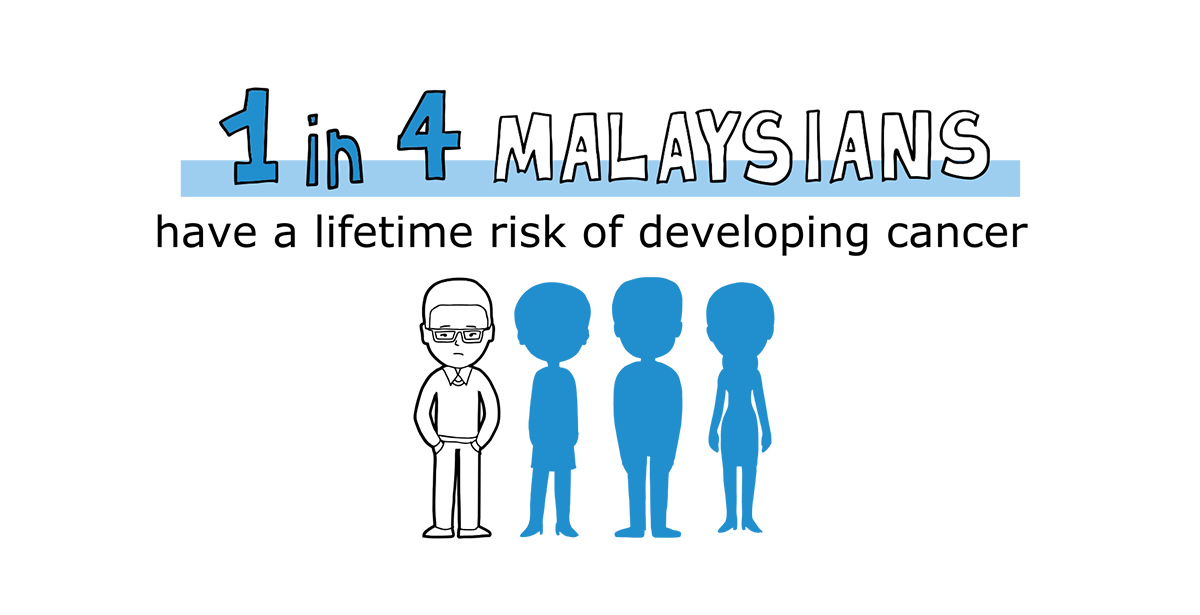

Cancer remains a taboo topic in Malaysia. Nevertheless, the fact remains that cancer will affect 1 in 4 Malaysians by the time they reach 75 years old.

Here are some of the top cancers among Malaysians:

Sadly, a big proportion of cancer patients in Malaysia only consult doctors during late stages of their cancer. This means they are missing out on possible early treatment options that could increase their chances of survival.

There are many risk factors associated with cancer, including age, lifestyle choices, genetic predisposition, and family history

While having a family history of cancer doesn't mean you'll get cancer, 5% to 10% of cancers are strongly related to an inherited gene mutation. That's why it's important to be open to these conversations, especially if your family members have had cancer.

Certain cancers become more prevalent as you grow older. Lifestyle choices like smoking and alcohol can also increase your risk of getting cancer. This is where early detection and prevention come in.

Most Malaysians tend to take a "healthy unless proven otherwise" approach, which is why they don't even consider health screening

However, you don't need to feel unwell before going for a screening. Instead, screening actually helps doctors find and treat several types of cancer early on, even before there are symptoms. It also helps you assess your risk of developing cancer and steps you can take to lower the risk.

A positive family history of cancer increases your risk of having cancer especially if:

- Your immediate family members have cancer.

- Multiple people on one side of your family have the same type of cancer.

In the unfortunate case that cancer is detected, doctors will discuss with patients the possible treatment options, whether it's chemotherapy, radiation, surgery, or a combination

After a patient is diagnosed with cancer, doctors may also suggest doing a genomic test to find the most suitable treatment

What is genomic testing?

According to Cancer Treatment Centres of America, genomic testing may help identify genetic mutations that may be driving the growth of a cancerous tumour. By taking a biopsy or blood sample, this test may give new insight and help doctors recommend suitable treatments for the specific type of cancer.

Why is it important?

When someone is diagnosed with cancer, doctors usually prescribe a series of

chemotherapy, radiation treatments, or even surgery. However, each person responds to treatment differently, and genomic testing allows doctors to personalise the treatment to suit each patient more efficiently.

To safeguard yourself against the financial burdens of dealing with cancer, AmMetLife has come up with the first insurance plan in Malaysia that covers genomic testing for cancer

As an insurance company, AmMetLife believes in offering their customers the best medical care to cope with life's unexpected events like cancer. Ultimately, genomic testing will allow customers to make more informed choices and find the most effective treatment for them.

The HCC BoostUp Rider can only be attached to AmMetLife's HealthCare Choice Rider, and further enhances the plan with additional coverage. Besides genomic testing, HCC BoostUp Rider + HealthCare Choice Rider also covers an overall annual limit of RM1 million and above, outpatient dengue fever treatment, and more. Find out the details on their website.

While cancer may be a life-changing event, you can do your part to detect it and treat it early on. You can also cover yourself financially so your loved ones will not have to worry.

AmMetLife's HCC BoostUp Rider and HealthCare Choice Rider help customers meet their needs while managing increasing healthcare costs. Thanks to AmMetLife's insurance plans, you can now enjoy peace of mind knowing that even if you fall sick, you won't have to worry about exorbitant medical bills.