CIMB Is Letting You Earn Up To 3% P.A. On Your Foreign Currency Deposits. Here's How

Perfect if you’re interested in foreign investments or have kids studying overseas!

Thinking about investing overseas or supporting your child's education abroad?

Introducing CIMB's Foreign Currency Current Account/-i (FCCA/-i)!

When it comes to foreign currency, it can be a hassle (and costly) to exchange money every time you need to wire funds overseas, be it for foreign investment purposes or your child's tuition fees.

This is where having an FCCA/-i can come in handy. CIMB's foreign currency account allows you to hold and manage funds in major foreign currencies like Singapore Dollars (SGD), Australian Dollars (AUD), or British Pounds (GBP).

Having a CIMB FCCA/-i allows you to safeguard your savings from future currency fluctuations, while making it more convenient if you need to remit to other banks/countries, withdraw to your own CIMB account or to even conduct dual-currency investments!

Whether you're a keen foreign currency investor, have kids studying abroad, or simply looking to expand your investment portfolio with opportunities abroad, a foreign currency account is definitely worth exploring.

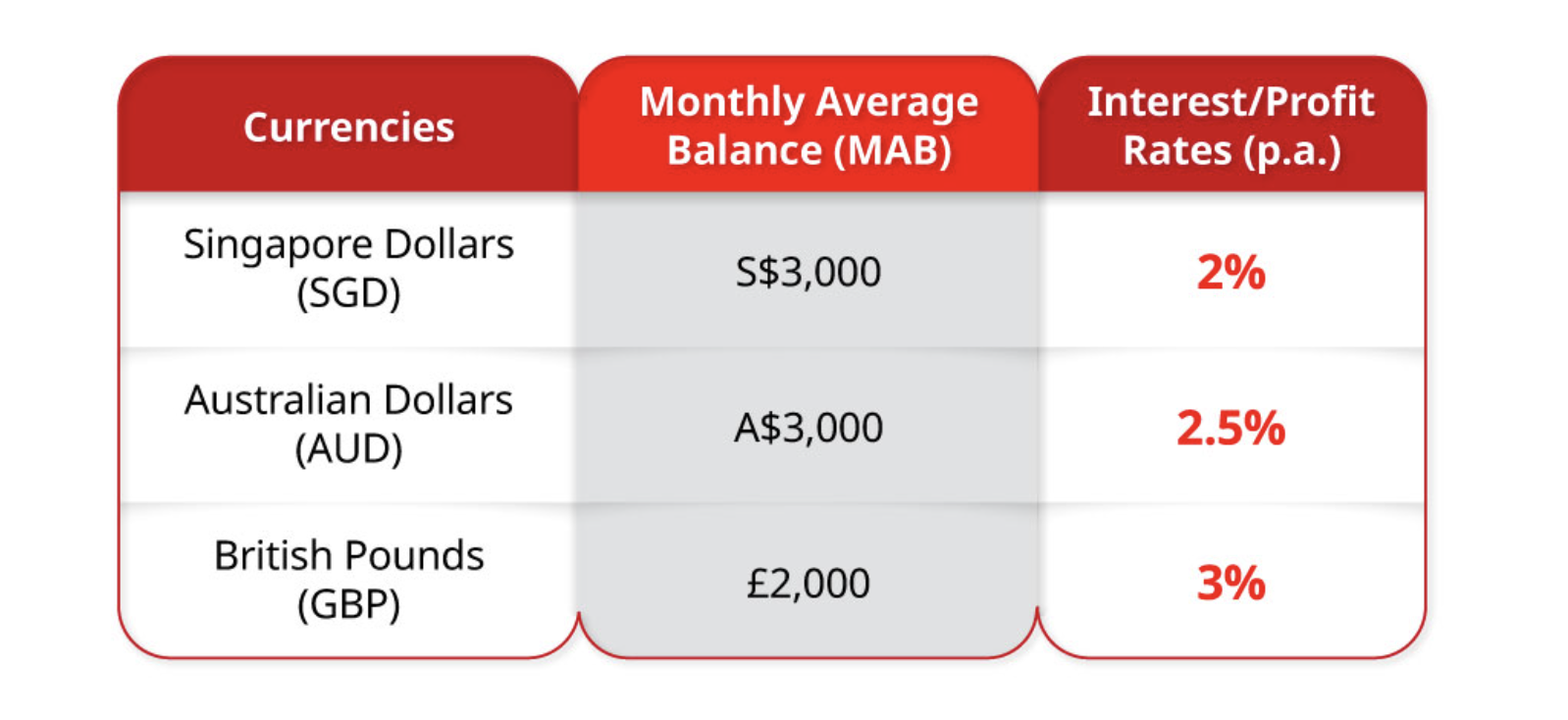

What's more, CIMB is now offering up to 3% p.a. interest rates for up to three months when you open an FCCA/-i account and maintain your monthly average balance

Opening an FCCA/-i account in SGD, AUD, or GBP could allow you to safeguard your savings while gaining flexibility in managing your financial needs, whenever the exchange rates prove favourable!

All you have to do is maintain your monthly average balance to enjoy high interest/profit rates on your foreign currency savings.

This interest rate promotion is available for a limited time from 15 October 2024 to 31 January 2025, but don't worry about signing up late!

As long as you open a new FCCA/-i SGD, AUD or GBP account and maintain the minimum average balance (MAB), you can still earn interest/profit for up to three months!

So even if you open an account in January, CIMB will still pay out interest/profits on your balances until March.

But why wait? Here's how you can get started with CIMB's FCCA/-i account today:

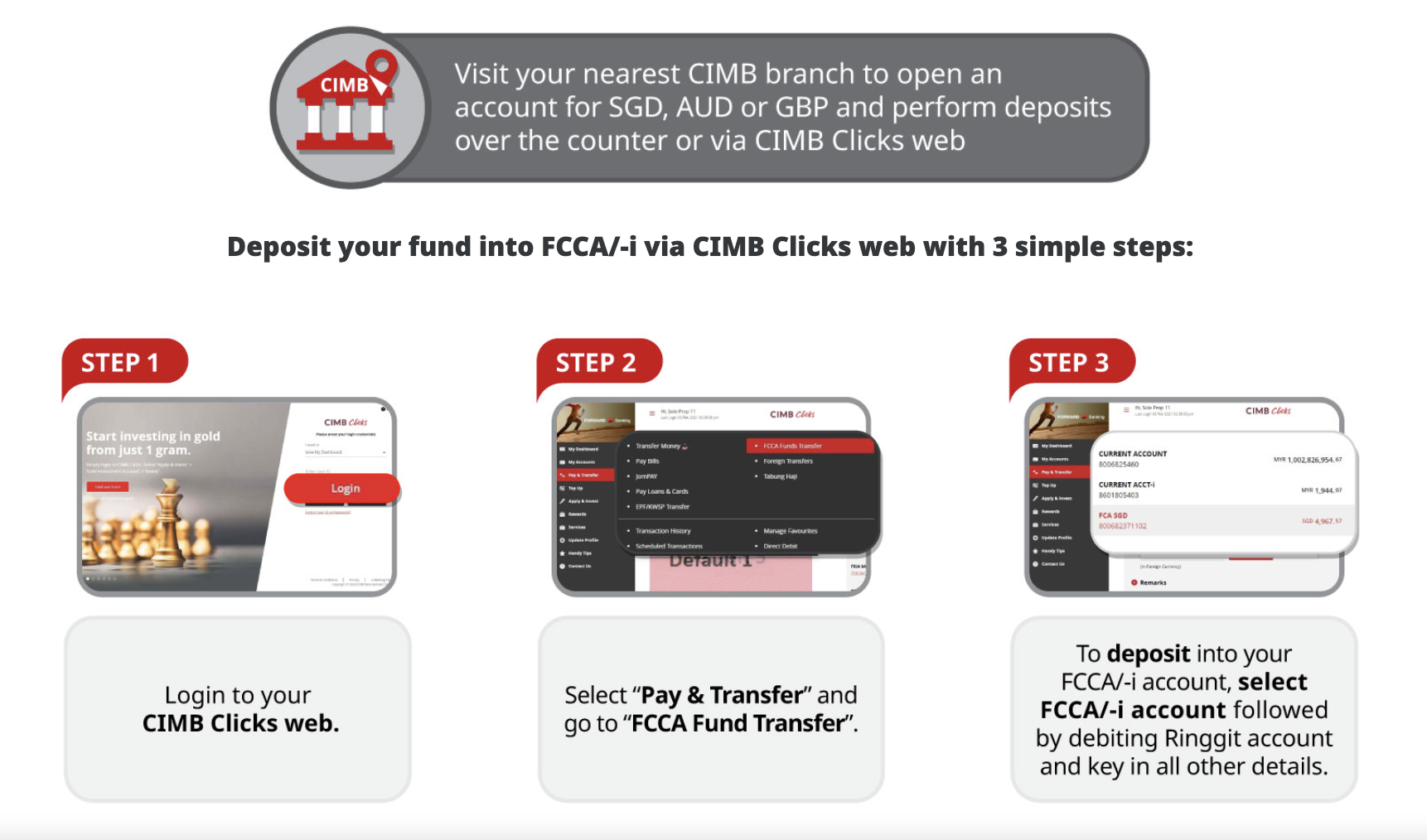

First, visit your nearest CIMB branch to open an FCCA/-i account for SGD, AUD, or GBP. Once you've done that, you can perform deposits over the counter or via CIMB Clicks web.

Here's a step-by-step guide to depositing with CIMB Clicks web:

STEP 1: Login to your CIMB Clicks web

STEP 2: Select "Pay & Transfer" and go to "FCCA Fund Transfer"

STEP 3: To deposit into your FCCA/-i account, select it followed by debiting from your MYR account and keying in all other details

Find out more about CIMB's FCCA/-i on their website today

CIMB Foreign Currency Current Account/-i is protected by PIDM up to RM250,000 for each depositor.

Terms and Conditions apply.

Member of PIDM.

CIMB BANK BERHAD 197201001799

CIMB ISLAMIC BANK BERHAD 200401032872