Did You Know: Merchants Are Not Supposed To Set A Minimum Amount For Card Payments

It's really common.

It's a familiar situation for most Malaysians.

You are at a store of some kind, buying RM20 worth of stuff. You pull out your payment card, but before you can proceed, the merchant points at a sign that says:

The cashier or waiter won’t swipe your card for purchases under a certain amount. Awkward.

You mumble some sort of apology and sheepishly reach out for your banknotes to pay before exiting.

But have you ever wondered if it is permissible for merchants to set a minimum charge for card payments?

From restaurants to convenience stores, we've seen merchants setting minimum charges ranging from RM10 to RM50 for card payments.

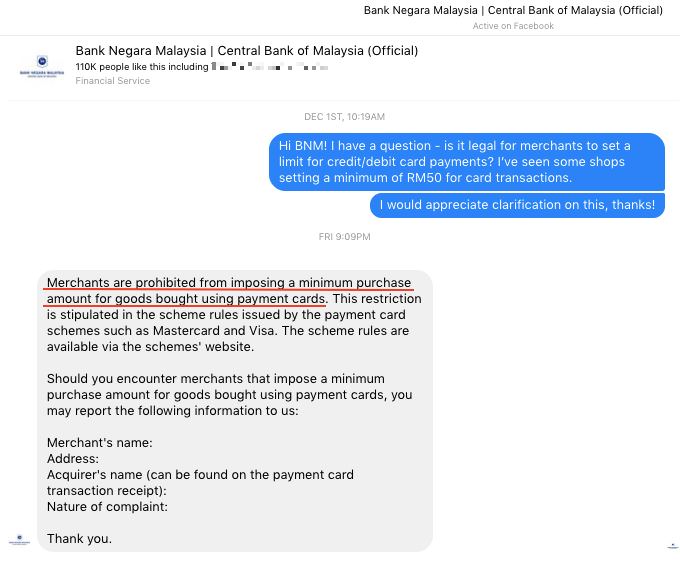

Curious, we've reached out to Bank Negara Malaysia (BNM) via Facebook for clarification and this is what they had to say

BNM through its official Facebook page told us that "merchants are prohibited from imposing a minimum purchase amount for goods bought using payment cards."

The Malaysian central bank added that this restriction is actually stipulated in the scheme rules issued by payment card schemes such as Mastercard and Visa.

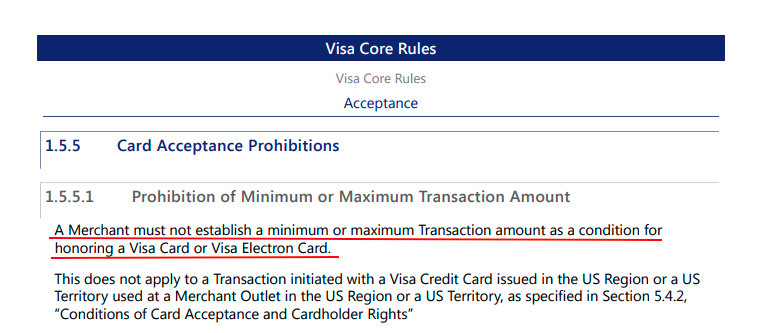

As revealed by BNM, we looked through Visa and Mastercard's rulebook and found that both companies don't allow merchants to establish a minimum or maximum transaction amount

Under Section 1.5.5.1, 'Visa Core Rules and Visa Product and Service Rules' states that "a Merchant must not establish a minimum or maximum Transaction amount as a condition for honouring a Visa Card or Visa Electron Card."

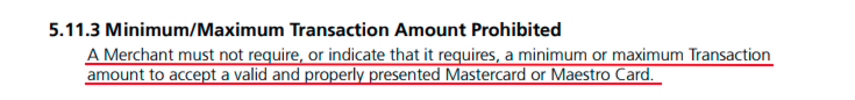

As for Mastercard, the restriction could be found in its 'Mastercard Rules' document.

Section 5.11.3 under Chapter 5 points out that "a Merchant must not require, or indicate that it requires, a minimum or maximum Transaction amount to accept a valid and properly presented Mastercard or Maestro Card."

Those are pretty clear-cut instructions from BNM, Visa, and Mastercard. But why do some merchants still insist on setting a minimum charge?

Merchants have to pay fees every time a card transaction occurs. Interchange fees for credit and debit cards are different in Malaysia. At a minimum, merchants would have to pay an interchange fee of 0.21% for each debit card transaction.

The total amount assessed may be higher and some merchants hate having to pay additional fees for an RM5 item.

Meanwhile, the Association of Banks in Malaysia (ABM) said that it doesn't endorse such practices and would carry out random checks to ensure that merchants don't set a minimum charge for card transactions

In a letter to The Star Online, ABM also revealed that members of the association have taken action against merchants that are found to be imposing a minimum charge for card transactions, be it debit or credit cards.

While we understand that cashless payment is the way forward for Malaysia, it's still best to carry some cash with you for now!