What You Should Do To Your ATM Card Before You Travel Overseas

Important steps.

Running out of cash while travelling overseas is a predicament we know all too well

You could be well prepared, assuming there's enough cash to last the entire trip.

But nobody wants to be stingy right? Especially when the trip was all you were looking forward to the entire year.

So you spend... and overspend.

Of course, there's the credit/debit card. But what if you need to purchase that cheap bag from an auntie who doesn't accept card payments at a flea market?

Cash and loose change are often required to get food and drinks from stalls and vendors too.

Maybank

For Maybank account holders, you can activate your ATM card via the Maybank2U app or any Maybank ATM machines in Malaysia.

Do note that RM12 will be deducted from your account for every cash withdrawal made overseas.

For more information, head over to Maybank's official website or drop them a line at 1-300 88 6688.

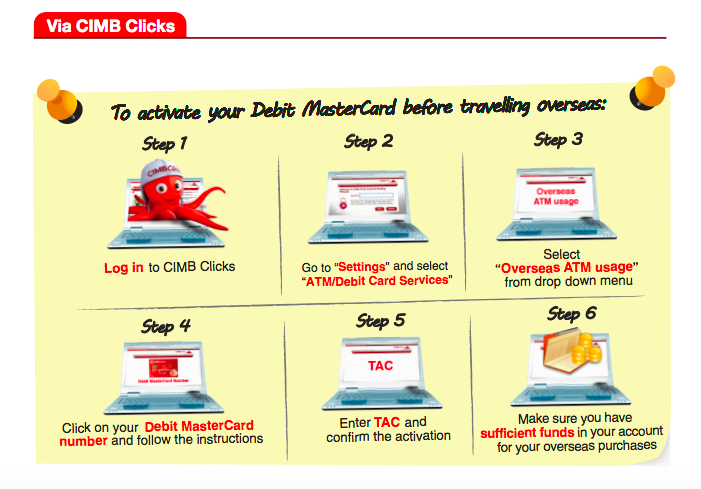

CIMB Bank

To enable overseas cash withdrawal, CIMB users can opt for activation through the CIMB Clicks app, CIMB ATM machines nationwide, or call the customer service centre at 603 6204 7788.

Under its ATM Regional Link, CIMB enables users to withdraw cash without incurring extra charges across the company's ATM network across Malaysia, Singapore, Thailand, Indonesia, and Cambodia.

For non-CIMB ATM machines, extra charges vary from RM8.48 to RM10.60 per transaction.

If you require additional information, visit CIMB's official website here.

Public Bank

Unlike Maybank and CIMB, Public Bank users won't be able to apply for overseas cash withdrawal through an app. Users can have their cards verified at Public Bank ATM machines or by calling the self-service terminal centre at 603-2179 5000.

As expected, there will be a small service fee per transaction.

More details and information here.

RHB Bank

In its FAQ document, RHB Bank states that the activation process can only be done through its 24-hour customer service centre.

It is unclear how much does the financial institute charge per transaction.

Call RHB Bank at 03-92068118 or visit the website to inquire more.

AmBank

Call AmBank's service centre at 03 2178 8888 and they will assist to activate your card for overseas transactions. Alternatively, you may also activate your card at the nearest AmBank ATM or AmBank branch.

Visit AmBank's website if you have further questions.

Hong Leong Bank

Hong Leong Bank users have the flexibility of activating for overseas withdrawal through Hong Leong Bank's mobile app or website. Alternatively, they can drop the call centre a line at 03-7626 8899 or visit any Hong Leong Bank branch.

Should you require more details, check out Hong Leong Bank's website here.

OCBC Bank

Call OCBC Bank's customer service centre at 03-8317 5000 or visit any OCBC branches to complete the application process.

Withdrawal at OCBC ATM machines in Singapore, Indonesia, Hong Kong, and Macau are free of charge.

You can view OCBC's full FAQ here.