How Will GST Affect Your Next Property Purchase?

If you're looking to buy a new home in the near future, here's a detailed breakdown on how the GST due to be implemented in April 2015, will affect you.

The Goods And Service Tax (GST) will be implemented in Malaysia April 2015 onwards

In Malaysia’s Budget 2014 speech, the implementation of Goods and Service Tax (GST) was perhaps the hottest topic. To be introduced in April 2015, it will replace Malaysia’s Sales tax (10%) and Service tax (6%). Under GST, most of the goods and services (except basic necessities) will be charged a tax rate of 6% at every stage of the supply chain. The question now on everyone’s mind – How will life be after GST?

The existing Sales Tax and GST have one thing in common: end consumers are not taxed when buying a residential property

One similarity between GST and the existing Sales Tax scheme is that no taxes are charged or will be charged to the consumer on the purchase of a home / residential property.

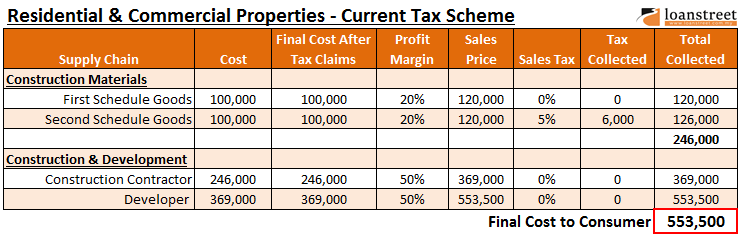

However, during the creation of the final product (also known as the input stage in tax parlance), under both tax schemes, developers would incur taxes during procurement of their inputs and materials. And this is where the differences start to become apparent between both tax schemes. The tax rate for inputs and materials vary between GST and Sales Tax.

Under the GST, developers will now have to bear additional tax costs for materials and services

Based on the Sales Tax Act of 1972, basic building materials such as bricks, cement and floor tiles fall inside First Schedule Goods, in which all the goods in this category will not be subjected to sales tax. Meanwhile, other building materials fall inside Second Schedule Goods, in which all the goods in this category will only be charged sales tax of 5%.

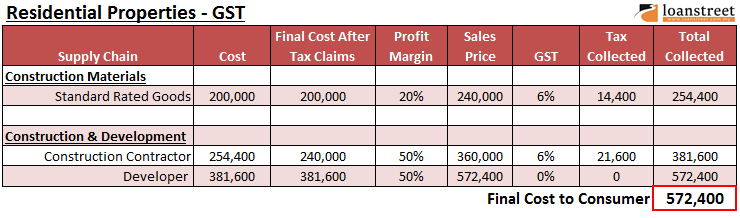

Under the new GST implementation, all building materials and services (E.g. Contractors, engineers) will be subject to GST with a standard rate of 6%. This will invariably raise the production cost for developers.

If you understand how GST works, you will notice that in most cases, the additional tax cost is simply passed on to the final consumer (Standard-Rated goods), or is claimed back from the government (Zero-Rated goods). But in this case (Exempt-Rated), the additional tax cost is borne by the party before the final consumer – The developer.

However, this doesn't exempt developers from raising property prices so that the cost of GST is absorbed by the consumer

The prices could be increased so that tax is to be absorbed by the consumers

Image via yourworldtoday.caThis seems like good news for home buyers as they do not have to pay GST when purchasing a home. However, one should not be too happy about this. It is no stretch of the imagination to think that developers would try to build in the additional tax costs into the final sale price implicitly.

Although a consumer has to pay more under the GST, there is a plus point for this

Overall, new residential properties may register a lower overall increase in tax burden compared to Commercial Properties that are Standard-Rated. This is because there still is the chance that developers may only transfer some and not all of their tax cost increases into the final retail price.

The downside is that the prices of the secondary house market will be affected

The secondary home market could see an increase in prices due to the knock on effect of the primary home market

Image via iproperty.com.sgThe downside to this is that where pricing for new commercial properties will be cleaner (Sales Price + GST), pricing for new residential homes would look inflated. This, in turn, will undoubtedly have a knock on effect on prices in the secondary house market.