Successful Malaysians Don't Believe In These 6 Investment Myths

It's not as complicated as it used to be!

1. "I'm young! There's no need to invest yet, right?"

On the contrary, that's the exact reason why there's no better time than now to invest. After all, the earlier you start, the more you stand to gain.

Time is an important component in growing your wealth. Let's say a 25-year-old starts with RM100 initial investment, and contributes RM100 monthly with 10% returns annually. In 10 years, that's a RM20,405 headstart compared to a 35-year-old who's just starting out!

If you're going to take on risky investments, it's best do it while you still have minimal obligations. Even if it doesn't work out, you would be in a better position to deal with it than say, a 50-year-old with 3 mouths to feed and hefty monthly expenses and commitments to keep up.

Starting early will give you priceless experience in the investing world, and preps you for informed investing in your later years.

2. "I need to be super rich to invest."

Between a flimsy paycheck and increasing monthly expenses lies the painful question: How much can we even put aside for savings?

What most people don't realise is that investing doesn't necessarily require thousands of Ringgit; you can even start from as low as RM100. Let the power of compounding work its magic!

What you DO need, however, is financial discipline. In order for you to reap the benefits, commit to the investment plan you're making. If you've decided to start investing RM100 monthly in unit trust, for example, stick to the plan.

If you like something a little more dynamic, the latest buzzword in the investment world is leverage. Traditionally, if you had wanted to buy RM5,000 worth of stock, you would need RM5,000 cash in hand. With leverage, you would need a lot less.

Trading using leverage is like trading on credit and requires significantly less capital on your side. A good example of this is warrants, where you're able to invest in a listed company's shares but without paying the full amount. Think of warrants as a "reservation" to buy a predetermined number of shares at a certain price in the future.

3. "I need to be some kinda financial pro to invest."

Here's the short answer: NOPE.

Hey, we live in the digital age after all! Make full use of expert sites and blogs to find out extensive information on the type of investment you're interested in.

InvestSmart, for example, provides a great overview on various investment topics, from warrants to trading stock. Workshops are also provided if you're keen to learn in-depth on a particular investment topic!

You could also check out the Savings & Investment section of iMoney.my for a comprehensive view on unit trust investments, gold investment, share trading, and private retirement schemes. Handy calculators are also provided to give a rough idea of returns.

If you're particularly interested in stock market, catch up with the conversations at Bursa Market Place. Look out for their industry research posts and free upcoming events too!

Nothing beats that face-to-face interaction when it comes to your investment questions; you could also set an appointment with a wealth advisor who can offer financial advice based on your profile. They don't generally charge for the first consultation and if you find that you'd like to have them guiding you throughout your investment journey then great! But if not, don't worry; there are no obligations to engage them.

4. "It's too risky, and I'll probably lose all my money!"

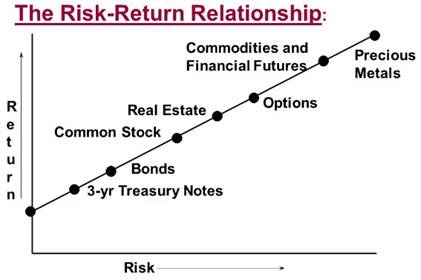

It's true that the more returns you want to earn, the more risk you're likely to have to take. But each form of investment comes with its own level of risk; some have high risks while some have little to none. The below diagram shows potential returns versus the level of risk involved in different forms of investment:

Before you invest in anything, always ask why you're doing it. If your objective is capital preservation, you'll most likely be going for low-risk options. Keeping your savings in a basic savings account, for example, means that the returns are relatively low but you won't face much risk of losing your money either.

If you're looking at capital growth, you'll mostly likely look into the upper right portion of the above chart. Investing in property, for example, is much riskier but may yield much higher returns than the relatively safe route.

Be clear on your investment goal, and go for a risk level that's aligned with that. Find out your risk profile here.

5. "Investing is basically gambling, isn't it?"

The truth is, they're not even remotely similar to one another. All you need to gamble is a huge dose of hope and if Lady Luck happens to be on your side, you win. But more often than note, that's not the case.

Doing investment right, on the other hand, is a whole different matter. It involves a lot of research, and making an informed decision based on your financial goals. With proper planning and monitoring, you're able to make a profit consistently and in that sense, "win" more than you "lose".

Even if you do lose money, don’t be discouraged! Everyone loses. You just need to learn to minimise your losses and maximise your gains. Experienced traders learn from their losses. Consider it your tuition fees, your price of learning!

Pro tip: There's a way to start with a small initial capital and still "win" big, and warrants are a great way to do this. The initial capital required is typically much less than that of stock trading, making it a more accessible investment option.

For example, you would need to invest RM10,000 for stock of that amount, but with warrants, you can invest RM2,000 and still obtain the same exposure of RM10,000. Learn more about how warrants work here.

6. "Investment is boring!"

Plot twist: Not always.

Cool new additions to the investment industry like the TradeHero app make the topic a lot more accessible! Built by former Wall Street execs and seasoned startup founders, the TradeHero app makes learning about trading fun by turning it into an addictive game!

You'll be given RM 1,000,000 in "virtual' cash to build up your investment portfolio and if you need some ideas on how to invest it, head to the "Discover" tab where you'll find bite-sized how-to videos that'll help you understand each investment topic better!

Test your new-found knowledge on warrants in the NagaWarrants Warrior Challenge on TradeHero! Climb the leaderboard from 4 October to 11 November and you could score a free trip to Australia or Japan! Find out more about the challenge here.

PS. There's no risk involved; even if you don't win, you won't lose actual money. But you will gain precious insight on investing in warrants! Win-win deals like these don't always come by, so grab them while you have the chance ;)

Ready to play? Download the app here: iOS | Android