Study: 73% Of Malaysian Youths Aged 18 To 40 Are In Financial Debt

Among some of the top influences for why they took out a loan include financial constraints, inflation, and adopting luxurious lifestyles.

A recent survey published by Malaysian private university UCSI revealed that 73% of Malaysian youths are in debt and do not have sufficient funding for financial commitments

Referred to formally as research on Youngster Indebtedness in Malaysia, the study was conducted with 1,077 Malaysians between the ages of 18 and 40.

Breaking down the findings, it was stipulated that 42% of the pool took a loan due to financial constraints, 22% due to inflation, and 21% for wanting a luxurious lifestyle. Peer pressure and social media influence round up the top five reasons for taking a loan, making up 9% and 6% respectively.

"This indicates that about three-quarters of Malaysian youths do not have sufficient capital for financial commitments. Although the number of borrowers among youngsters is worrying, 83% of them could pay their loans on time," said Dr Hassanudin Mohd Thas Thaker, Associate Professor and UCSI University's Head of Research and Postgraduate Studies in the Faculty of Business and Management.

Findings for the influences that caused the pool of participants to take a loan.

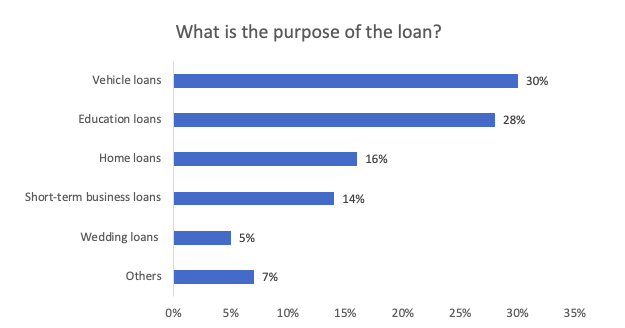

Image via UCSI University (Provided to SAYS)While the crucial factors of what influenced Malaysian youths to take loans were carefully dissected, the poll further broke down the issues by outlining the purpose behind taking their loans

A whopping 30% accounted for vehicle loans, 28% for education loans, and 16% for home loans. On the back end of the outcome, 14% accounted for short-term business loans, while 5% accounted for wedding loans.

"It is alarming to have vehicle loans on top of the pyramid, as according to the Insolvency Department Malaysia, vehicle loans (14.39%) have been the second causal factor of bankruptcy rate after personal loan (42.24%) in the year 2022," said Dr Hassanudin in the report.

Nonetheless, the professor also stated that the 73% of youths who are accumulating the debt are aware of the consequences should they default in their loan payment. He added that this further demonstrates that Malaysian youths are not applying for loans blindly.

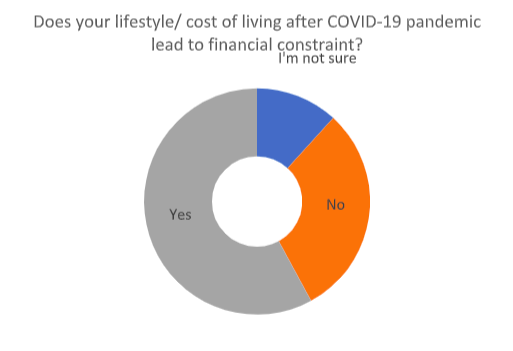

The poll also revealed that 58% of Malaysian youths felt that their financial status was affected by the COVID-19 pandemic, specifically due to an increase in commitments during that period

"The results of 58% respondents affected by COVID-19 may have been due to unemployment, unstable income, and the increase in commitments, as the pandemic has affected a lot of companies and individuals in Malaysia," reported the professor.

Findings for whether the COVID-19 pandemic led to financial constraints.

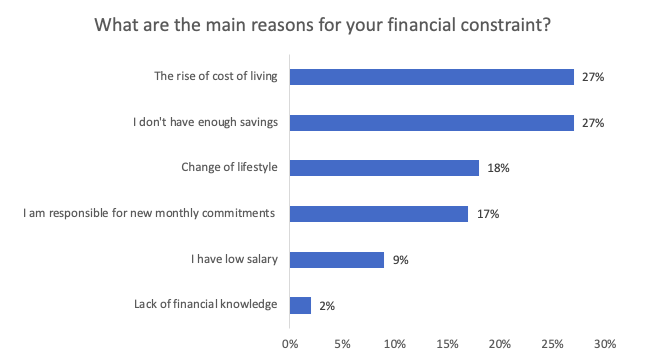

Image via UCSI University (Provided to SAYS)In accordance with that, the final poll conducted by the research team sought to find out the main reason for the financial constraints faced by the pool of youths.

The survey pointed towards an increased cost of living expenditure and insufficient savings as the top two contributors for the result, at 27%. While lifestyle changes trail as the third reasoning for such constraints, Dr Hassanudin explained that this may have been necessary due to the changes that happened during the pandemic.

"One of the examples are university students; the transition from physical classes to online classes requires each student to have their own laptop and home Wi-Fi for them to join online classes, which indirectly affected their daily financial well-being."

Closing out the study, Dr Hassanudin opined that it is understandable how most Malaysian youths are in debt, as they do not have enough savings to begin new chapters in their lives

"Based on the outcome of this research, it could be concluded that majority of the youngsters are having greater financial constraints due to the COVID-19 strikes.

"With the current financial crisis period, inflation has also contributed to the number of borrowers among youngsters in Malaysia. In addition, there's always a mismatch between the demand and supply, which lead to continuous problems," he said in conclusion of the study.

Nonetheless, a disclaimer was also added in the study to properly convey that while these opinions are an accurate reflection of the respondents who participated in the poll, a generalisation of this study to represent the views of all Malaysians should not be the accepted notion for this finding.