How Much Do Luxury Car Owners In Malaysia Pay To Renew Their Road Tax Every Year?

RM6,000 a year is on the 'low' side.

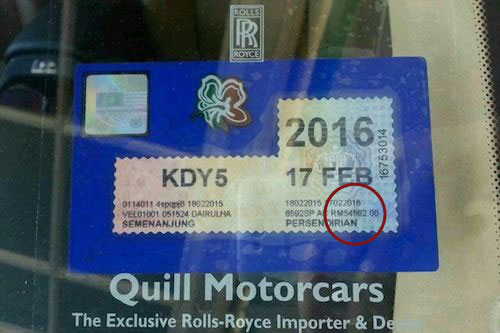

Can you imagine paying more than RM50,000 a year for the road tax of your car? Sounds unbelievable right? That’s how much the founder of Pelita, a famous nasi kandar chain, pays for his Rolls-Royce Ghost.

This Facebook post that went viral last year shows the eye-watering sum of RM54,502 a year! It's literally more than a thousand bucks a week!

Now, the million dollar question (pun intended) - why so expensive?!

Imported luxury cars are known be very expensive, both in terms of pricing and road tax. You see, the price of a car is determined by its manufacturer, taking into consideration various factors and market forces.

In Malaysia, no import duty is imposed for cars originating from Asean countries, while 30% import duty is imposed on vehicles imported from non-Asean countries.

Quick fact: we're the second most expensive place in the world to buy cars, right behind Singapore, according to motoring magazine Jalopnik.

How do you calculate the road tax for cars in Malaysia?

Depending on where the car was bought (Peninsular or Sabah and Sarawak), type of vehicle ownership (private or company) and engine capacity, road tax is one mandatory cost that you are unable to escape from.

For example, a privately owned Proton Preve of 1,597 cc that was bought in Peninsular Malaysia would sum to RM90 for road tax a year. A company owned Preve would sum up to RM180 a year. For owners residing in Sabah or Sarawak, the road tax is RM56 a year for both privately and company owned.

But things are slightly different for cars above 2.0 cc. Let's take the Honda Accord 2.4 VTi-L (2,356 cc) as an example. The base rate for a privately owned Accord is RM380. On top of that, RM1 is added on for each cc exceeding 2,000 cc. So, that's RM380 + RM356 = RM736 a year.

As for a company owned vehicle, a higher base rate of RM760 is charged, together with a progressive rate of RM3 per additional cc over 2,000 cc, amounting to RM760 + RM1,068 = RM1,828 a year.

Note that road tax for privately and company owned vehicles in Sabah and Sarawak are the same across the board.

As for the Rolls-Royce Ghost (6,592 cc), it falls under the company owned category with a base rate of RM6,010 and an additional RM13.50 for each cc in excess of 3,000 cc, amounting to exactly RM54,502 a year.

For MPVs, SUVs or pick-up trucks, both private and company registered vehicles get charged the same road tax.

For instance, the Toyota Alphard 2GR-FE with its 3,456 cc would only sum up to RM2,369.60 for road tax. While in Sabah and Sarawak, it is relatively cheaper at RM1,450.20 for both categories.

Curious, we calculated the road tax of 10 other imported luxury cars. Could it be as high as the Rolls-Royce Ghost? Let's take a look!

We used the handy road tax calculator on Carbase.my. It uses the latest JPJ formula, so you can be sure it's accurate!

1. Bentley Continental GT V8 S

Price of car: RM1.5 million

Engine capacity: 6,592 cc

Road tax for a privately owned model: RM18,294 (Peninsular), RM5,873.20 (Sabah and Sarawak)

Road tax for a company owned model: RM54,502 (Peninsular), RM5,873.20 (Sabah and Sarawak)

FUN FACT: Does the car above looks familliar? Yup, it's that white Bentley Continental GT V8 S that was famously given to Sarawak governor Taib Mahmud by his wife, Ragad Taib.

2. Bugatti Veyron

Price of car: RM2 million

Engine capacity: 7,993 cc

Road tax for a privately owned model: RM24,598.50 (Peninsular), RM7,764.55 (Sabah and Sarawak)

Road tax for a company owned model: RM73,415.50 (Peninsular), RM7,764.55 (Sabah and Sarawak)

FUN FACT: A member of the Johor Royal family owns a Bugatti Veyron, as you can see from the picture above. The vehicle is extremely limited and it has been recognised as it is currently one of the fastest cars in the world.

3. McLaren P1

Price of car: RM4.7 million

Engine capacity: 3,799 cc

Road tax for a privately owned model: RM5,725.50 (Peninsular), RM2,102.65 (Sabah and Sarawak)

Road tax for a company owned model: RM16,796.50 (Peninsular), RM2,102.65 (Sabah and Sarawak)

FUN FACT: Adding to their extensive collection of luxury cars, the McLaren P1 also belongs to the Johor Royal family.

4. Audi R8 V10

Price of car: RM1.2 million

Engine capacity: 5,204 cc

Road tax for a privately owned model: RM12,048 (Peninsular), RM3,999.40 (Sabah and Sarawak)

Road tax for a company owned model: RM35,764 (Peninsular), RM3,999.40 (Sabah and Sarawak)

FUN FACT: The R8 is one of Audi's most famous cars to date. You might recognise it from the Iron Man movies. Few months back, the Audi R8 won the 2016 World Performance Car award.

5. Mercedes-AMG GT S

Price of car: RM1.1 million

Engine capacity: 3,982 cc

Road tax for a privately owned model: RM6,549 (Peninsular), RM2,349.70 (Sabah and Sarawak)

Road tax for a company owned model: RM19,267 (Peninsular), RM2,349.70 (Sabah and Sarawak)

6. Lamborghini Aventador LP750-4 Superveloce

Price of car: RM2 million

Engine capacity: 6,498 cc

Road tax for a privately owned model: RM17,871 (Peninsular), RM5,746.30 (Sabah and Sarawak)

Road tax for a company owned model: RM53,233 (Peninsular), RM5,746.30 (Sabah and Sarawak)

FUN FACT: The Aventador LP750-4 Superveloce is limited to just 600 units worldwide. Lamborghini Kuala Lumpur has been allocated five units and it's probably long gone by now.

7. Maserati GranTurismo Sport

Price of car: RM1.1 million

Engine capacity: 4,244 cc

Road tax for a privately owned model: RM7,728 (Peninsular), RM2,703.40 (Sabah and Sarawak)

Road tax for a company owned model: RM22,804 (Peninsular), RM2,703.40 (Sabah and Sarawak)

8. Porsche 918 Spyder

Price of car: RM3 million

Engine capacity: 4,593 cc

Road tax for a privately owned model: RM9,298.50 (Peninsular), RM3,174.55 (Sabah and Sarawak)

Road tax for a company owned model: RM27,515.50 (Peninsular), RM3,174.55 (Sabah and Sarawak)

FUN FACT: Only three units of the 918 Spyder were allocated to Malaysia. They were brought in by Sime Darby Auto Performance (SDAP).

9. BMW X6 M

Price of car: RM1.24 million

Engine capacity: 4,395 cc

Road tax for a privately owned model: RM8,407.50 (Peninsular), RM2,907.25 (Sabah and Sarawak)

Road tax for a company owned model: RM24,842.50 (Peninsular), RM2,907.25 (Sabah and Sarawak)

10. Jaguar F-Type R Coupe

Price of car: RM1.1 million

Engine capacity: 5,000 cc

Road tax for a privately owned model: RM11,130 (Peninsular), RM3,724 (Sabah and Sarawak)

Road for a company owned model: RM33,010 (Peninsular), RM3,724 (Sabah and Sarawak)

Well, it goes without saying that you would need a fat bank account to be able to afford and maintain the cars listed above...

:(

The government is confident that the car price would reduce by 30% by the end of 2018!

Vehicle prices will decrease by 30% by 2018, said Minister in the Prime Minister’s Department Azalina Othman Said.

Azalina in a written reply said the government remained committed to gradually reducing vehicle prices by 20-30% as pledged in the Barisan Nasional’s manifesto during the 13th General Election (GE13).

“As such, various measures have been taken, including providing incentives and reducing excise duty for car manufacturing companies involved in local value-added automotive parts.

“The incentives provided have produced results as total price reduction (vehicle prices) recorded in 2013 was 3%, followed by 7% in 2014 and 2.7% in 2015,” she said.