Here's A Year-End Tax Relief Tip That Could Actually Save You Up To RM900

You only have until 31 December to make the most of 2023 tax incentives.

While tax filing season might still seem far away, Malaysians have just until 31 December to make the most of 2023 tax incentives

You may think that maximising your tax savings is a big hassle — after all, there are so many kinds of tax incentives that change every year, and it's really hard to keep up.

However, it really doesn't require a lot of effort to make your hard-earned money work smarter for you.

If you're still not convinced, here are a few ways your tax savings could benefit you:

- You can use tax savings as a foundational fund for your dream home

- You can allocate a portion of tax savings for your children's or your own education

- You can channel tax savings into an emergency fund to build a financial safety net

- You can direct your tax savings to long-term investments for retirement

- You can use tax savings as a stepping stone to building a diversified investment portfolio

The good news is that you don't need to be some financial guru to maximise your tax savings

Contrary to popular belief, you don't need to go out of your way trying to save on taxes.

All you have to do is stay informed on available tax reliefs, and make use of areas that will benefit you, without overspending. While you're doing so, be sure to keep your receipts physically or digitally for at least seven years.

Not sure what the 2023 tax reliefs are? Here are a few highlights:

- RM2,500 for the installation, rental, or purchase of electric vehicle charging facilities for own use

- RM7,000 in study fees, including up to RM2,000 for skills improvement or self-improvement courses

- RM10,000 for medical expenses for serious illness and fertility treatment

- RM3,000 for deferred annuity and retirement schemes like Private Retirement Schemes (PRS)

One of the best ways to boost your tax savings is by delving into PRS, which not only gives you immediate tax relief, but also long-term financial security. PRS is a voluntary investment scheme designed to help you accumulate savings for retirement, and is a great complement to your Employees Provident Fund (EPF).

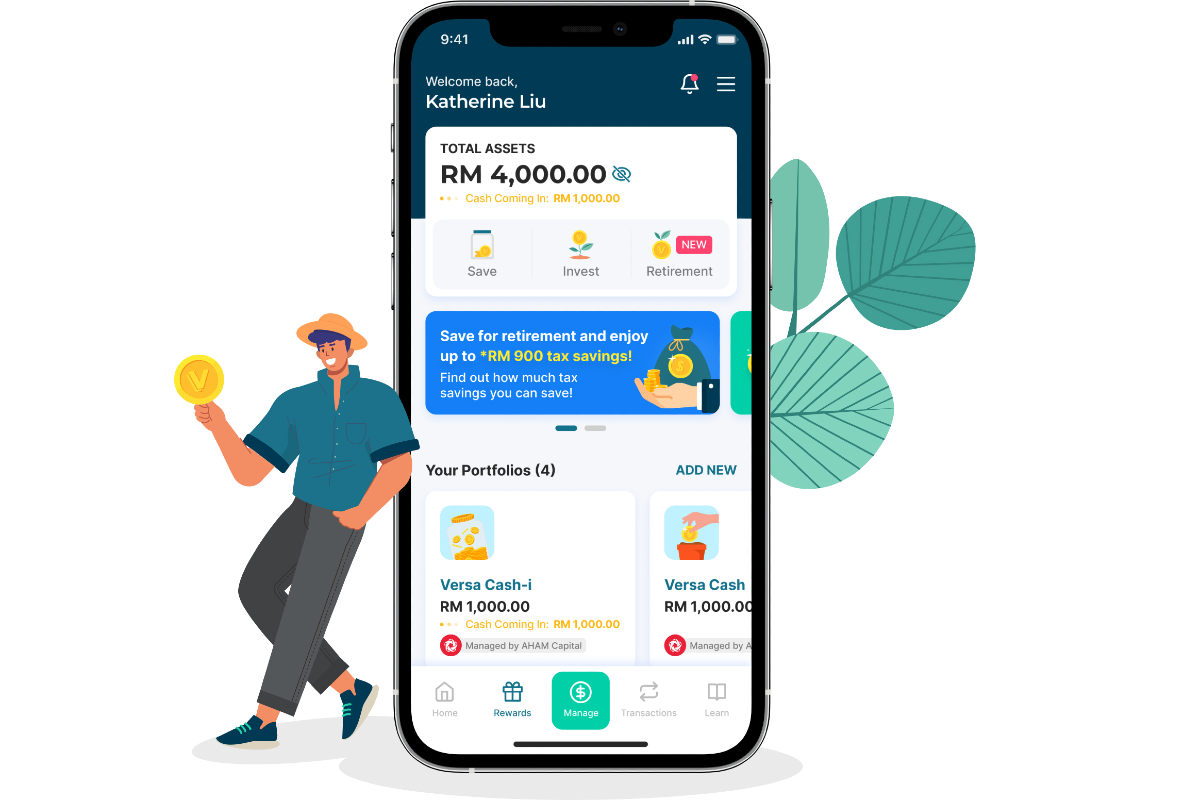

If you're thinking of investing in PRS before the year ends, Versa is an easy-to-use wealth management app that lets you do so

Versa offers significant benefits for your financial journey, including a hassle-free way to make the most of the RM3,000 tax relief for PRS investments. Just sign up on Versa, and you'll be able to monitor your PRS accounts conveniently in real time. In fact, Versa is more than a platform; it's like having a financial mentor guiding you towards financial freedom.

The best part? There is zero sales charge on every transaction, ensuring transparency without hidden fees for a straightforward investment experience.

Furthermore, from 12 to 28 December, Versa is sweetening the deal for you. When you deposit RM3,000 into PRS investments, you'll receive RM50 and an additional RM60 in Versa Cash for a starter reward totalling RM110! That's not all, when you refer someone, you'll both gain an additional RM50 in Versa Cash.

If you're curious how much RM3,000 tax relief will save you, here's a closer look at the numbers, based on your annual taxable income:

Pro-tip: Look at the 'Output Tax Savings' column to check how much you'll save.

In simpler terms, if you're earning RM100,000 a year and you invest RM3,000 in PRS, you could save RM570 on taxes compared to someone who didn't invest in PRS.

And the good news is that you're not just spending extra money, but you're saving towards the future while earning tax savings right now!

Don't miss your chance to maximise your tax savings this December! Download the Versa app on Google Play, the App Store, or HUAWEI AppGallery today.