Wanna Save More Every Month? EPF Is Offering You A Hassle-Free Way To Do It

Sikit-sikit, lama-lama jadi bukit!

We all have dreams we hope to achieve someday, whether it’s travelling the world, owning a home, pursuing higher education, or living comfortably after retirement

However, our savings alone may not be enough to make those dreams come true.

In fact, you might think that you need to take a big chunk out of your salary every month to reach your financial goals, but that's not necessarily true. You could actually get closer to your dreams by saving a little at a time, every month, with Employees' Provident Fund (EPF).

Yes, you heard that right! EPF has a simple and convenient way for you to boost your savings.

EPF introduces the Jom Tambah Campaign to raise public awareness and boost retirement savings. You can now top up your savings via KWSP i-Akaun app!

You can choose how much and how often you want to top up your savings, whether it's monthly, quarterly, annually, or as and when you want to.

By topping up your savings with EPF, you can enjoy many benefits:

- Guaranteed returns: EPF guarantees a minimum dividend of 2.5% per annum. This means that your savings will always grow, regardless of market conditions.

- Greater flexibility: You can withdraw your savings for various purposes, such as buying or building a house, funding your education, paying off your housing or educational loans. You can also choose to convert your savings to Simpanan Shariah if you want to follow the Sharia principles for managing your funds.

- Peace of mind: You can rest assured that your money is safe and secure with EPF, as it is backed by the government and regulated. EPF also has a strong governance and risk management framework to protect your savings.

There are two hassle-free ways to top up and make use of EPF's Jom Tambah feature

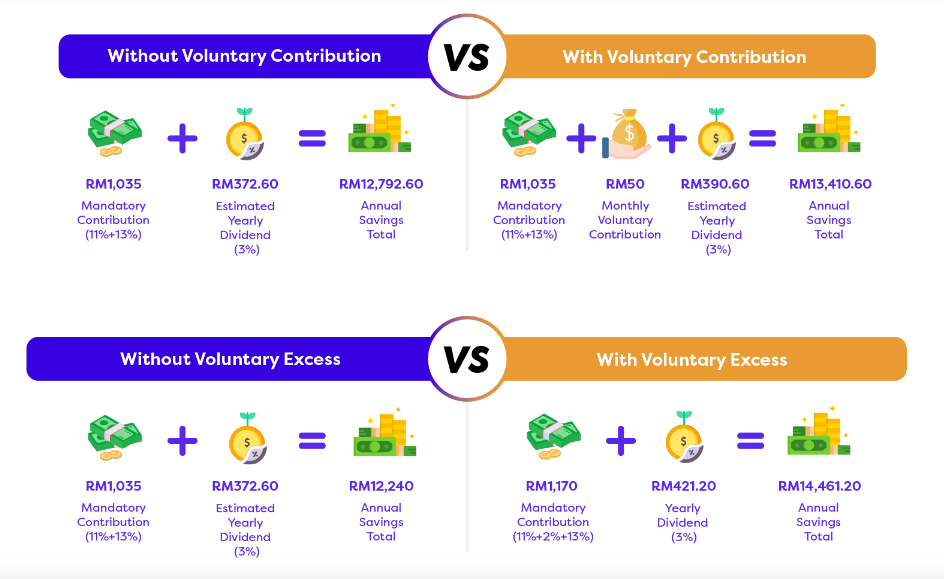

You can choose to opt for voluntary excess or make a voluntary contribution to your EPF account

Top up your savings via voluntary excess. Take control of your financial future by contributing more than the standard rate to your EPF. You decide the extra amount, inform your employer, and watch your savings soar effortlessly. Perfect for those in the formal sector with mandatory contributions, this option lets you set it and forget it, so you can enjoy peace of mind without the monthly savings hassle!

Voluntary contributions are extra payments that you make to your EPF account on top of the mandatory contributions. You can do this anytime you want, as long as the total amount does not exceed RM100,000 per year. This limit has been increased from RM60,000 to allow you to save even more.

So, what are you waiting for? Download the KWSP i-Akaun app today and start topping up your savings.

It doesn't matter how much or how often you contribute, as long as you do it consistently and regularly. Remember, #sikitsikitpunOK!