Why Is There A New Deduction Called 'EIS' In Your Latest Payslip?

You're contributing to the Employment Insurance Scheme (EIS), which came into effect on 1 January 2018.

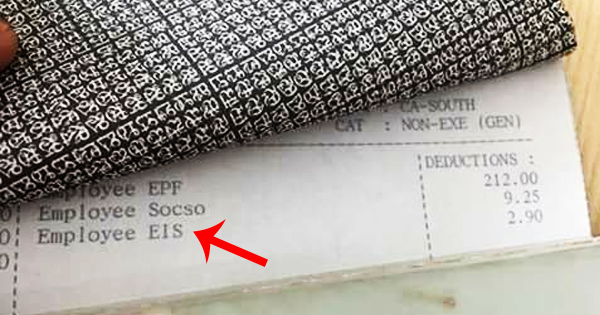

If you're an employee, you may have noticed this thing called 'EIS' that appeared on your payslip from January this year

On top of the EPF (Employee Provident Fund) and SOCSO (Social Security Organisation) deductions, payslips should also display the amount of contribution an individual makes to the Employment Insurance Scheme (EIS) or Sistem Insuran Pekerjaan (SIP) in Malay.

The EIS came about after the Employment Insurance System Bill 2017 was passed in the Dewan Rakyat in October 2017, affecting about 6.6 million workers and 430,000 employers in the private sector.

All employees in the private sector aged between 18 years to 60 years old must contribute to this scheme, unless they are aged 57 years and above and no contributions has been paid before reaching 57 years.

EIS chief Datuk Mohd Sahar Darusman reportedly said earlier this year that the implementation of EIS, which began last month, would see a total collection of RM479.5 million contributed by the workforce in Malaysia.

1. How much do I contribute each month?

Every month, employees need to make a 0.2% contribution of their salary to EIS. On top of 0.2% contribution from employees, employers must also make another 0.2% contribution for their each of their employees into the accumulated fund managed by SOCSO, which is also known as PERKESO (Pertubuhan Keselamatan Sosial) in its Malay abbreviation.

SOCSO has outlined the rate of contribution based on salary range groups in a briefing document.

For example, if an employee's gross monthly wages is RM2,900 but less than RM3,000, then the EIS contribution would look like this:

Employee contribution = RM5.90

Employer contribution = RM5.90

Total contribution = RM11.80

It is noted that the contributions to EIS is capped at a monthly salary level of RM4,000. This simply means that if a person earns more than RM4,000 a month, the contribution is still fixed at RM7.90.

Employers who do not comply with the EIS could be subjected to legal action, including maximum fine of RM10,000 or two years' jail, or both, if found guilty.

2. Why must employees make this contribution?

Malaysian Employers Federation (MEF) executive director Datuk Shamsudin Baradan

Image via The Malaysian ReserveMalaysian Employers Federation (MEF) executive director Datuk Shamsudin Baradan revealed that about 30,700 people were retrenched as of September 2017, TheSun Daily reported last month.

In a step to protect the interest of employees, the government has implemented EIS, following the footsteps of countries such as South Korea and Canada, which have implemented a similar system.

Basically, EIS is a job-loss coverage scheme designed to help workers who have lost their jobs by providing them with temporary financial assistance, among others. SOCSO will provide unemployed workers with job search allowance for up to six months based on a scaled amount, but this will only kickstart in 2019.

There are also other assistance offered under EIS to help the unemployed to find work such as providing career counselling, job matching and placements, and trainings programmes.

It was learned that the government has allocated a total of RM136 million for employees to receive an interim benefit in the year 2018, in the form of a cash allowance of RM600 per month for a maximum of three months.

3. Who will benefit from EIS?

The scheme was established as a social security net to ensure that employees in the private sector would have access to these benefits if they:

• lost their job due to retrenchment or redundancy;

• accepted VSS/MSS (voluntary/mutual separation scheme)

• lost their job due to force majeure (unexpected, unavoidable accident) such as natural disasters, riot, fire, or gas leak incidents

• lost their job due to employers who absconded (without following the proper process of separation), became bankrupt, or closed down

• lost their job due to business restructuring, automation, or digital and technology

• lost their job due to a downsizing exercise

• lost their job due to constructive dismissal (forced into resigning by the employer's conduct) or breach of contract by employers

• were ordered to perform work beyond normal scope that endangers the safety and health of the employee

• resigned due to personal or family threats, or due to sexual harassment on the employee

A person is not qualified if they:

• lost their job due to misconduct at work

• tendered voluntary resignation

• stopped working due to retirement

• stopped working due to expiry of fixed term contract

The information above was retrieved from SOCSO's resources.

4. How will EIS affect me?

Prime Minister Datuk Seri Najib Tun Razak previously said that it will benefit both employers and employees in the long-term.

"EIS will add to the efficiency of the labour market (in the country) through a better system of matching supply and demand, and lead to increased productivity and competitiveness of the industries," Najib was quoted as saying.

However, EIS came under great scrutiny after Shamsudin made an estimation and said that about 50,000 Malaysians will lose their jobs this year due to various factors including the implementation of EIS, whereby employers would have cope with the increase operating costs because they need make a 0.2% contribution based on each worker's base salary.

However, the matter was dismissed by Mohd Sahar, who pointed out that retrenchment figures in the country hardly exceeded 40,000 annually for the last 10 to 20 years.

Meanwhile, the Malaysian Trades Union Congress (MTUC) said that it welcomes the government move in implementing EIS but stressed the need for strict regulations so that employers will not use EIS as an easy route to reduce their workforce.

"We support the EIS but we wanted the EIS not to be abused.

"With EIS, employers can tell workers, 'I will retrench you because now you can get money from EIS'," said MTUC secretary-general J. Solomon, as reported by The Malaysian Insight.