7 Things You Should Know About Alibaba And The Biggest IPO In History

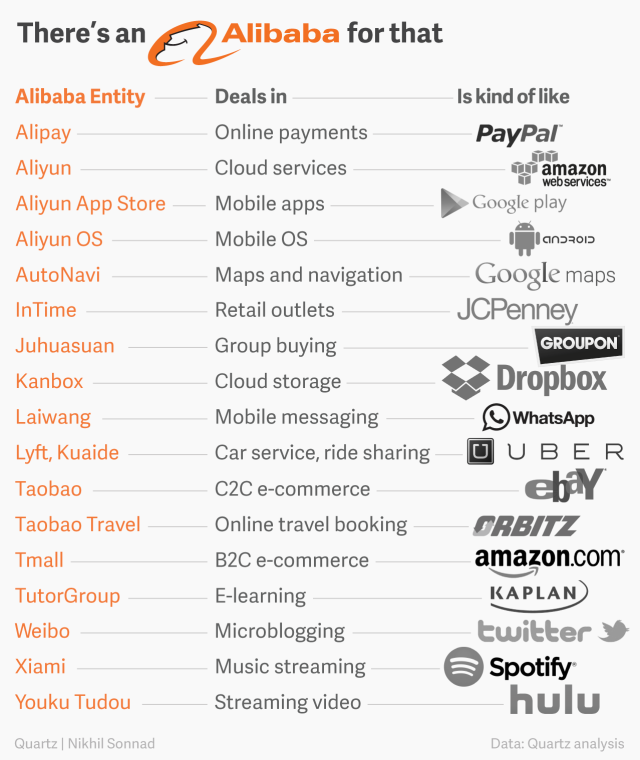

Alibaba isn't just the "Amazon of China"—it's also the Dropbox, PayPal, Uber, Hulu, and much more. On 19 September, Alibaba debuted as a publicly traded company. We curate a list of all that you should know about the Chinese Internet firm's historic U.S. Initial Public Offering (IPO).

2. Many compare it to Amazon, but Alibaba isn't just that—it's also the Dropbox, PayPal, Uber, and more. In fact, its distinct businesses resemble over a dozen major Western companies.

3. But what exactly is Alibaba?

Alibaba and its founder Jack Ma have a storybook tale. The company grew out of his small apartment in Hangzhou back in 1999 into a multi-billion dollar company today. Alibaba is China’s – and by some measures, the world’s biggest online e-commerce company. Its three main sites – Taobao, Tmall and Alibaba.com – have hundreds of millions of users and host millions of merchants and businesses. Alibaba handles more business than any other e-commerce company. It makes money through online marketing, transaction fees it receives from merchants and membership fees.

4. Tell me about its IPO. How big is it?

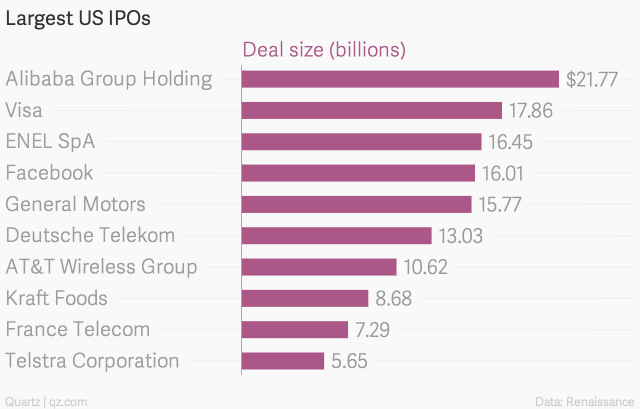

There are spectacular amounts of money involved. At its offering price of $68, and based on yesterday’s closing prices, the company’s market value would the 22nd biggest in the S&P 500 if included, ahead of Citigroup. The company’s underwriters are likely to exercise the greenshoe option, which could boost the deal value above $25 billion and make it the biggest of all time. In fact, Alibaba is expected to easily pass Bank of America, Intel, Oracle, and Coca-Cola in market value:

5. Who are the top shareholders? Are they selling their shares?

Japan’s Softbank owns 34% of Alibaba. The company has said it doesn’t plan to sell any shares, but after the IPO, its stake will be diluted to 32.4%. Yahoo, which owns 22.4%, said it plans to sell 121.7 million shares, equivalent to a 4.9% stake. Alibaba founder Jack Ma, who owns 8.8%, will be offering 12.7 million shares, or 0.5% in the offering. Joseph Tsai, executive vice chairman, will be selling 4.3 million shares, equivalent to a 0.2% stake.

6. What is Alibaba's market capitalisation ranks among the world's biggest companies?

Alibaba will be the 36th-largest publicly traded company in the world by market capitalization, according to S&P Capital IQ. Of the companies ranked above it, six are from Asia and four of those are based in China. There are also six European companies with bigger market capitalizations and one from Australia. While it will not be included in the S&P 500, at $168 billion, Alibaba would be the 23rd largest company in the index, according to S&P Capital IQ. There are currently 22 companies in S&P 500 with market caps above $170 billion.

It would be the eighth largest tech company in the S&P 500, trailing only Apple Inc., Google Inc., Microsoft Corp., Facebook Inc, International Business Machines Corp., Oracle Corp. and Intel Corp., according S&P Capital IQ. Alibaba is far ahead of any other company that has gone public in terms of market cap. The next largest was the China Agricultural Bank Ltd., which was valued at $133 billion after its July 2010 IPO, according to Dealogic.

Alibaba’s offering also knocks Facebook down one notch on the list of the biggest IPOs. The social-media giant’s IPO now stands as the fifth largest world-wide by market cap, and the second largest U.S.-listed IPO by market cap. Facebook’s offering, which was valued at $104 billion at the time of its IPO, remains the biggest by a U.S. company. Alibaba dwarfs all other IPOs of Chinese companies. The next largest IPO of a Chinese company, PetroChina Ltd., raised $2.9 billion and valued the company at $28.9 billion, according to Dealogic.

7. What's so great about Alibaba anyway?

The giant Chinese e-retailer has a reputation for fostering talented women. Lucy Peng and Maggie Wu are stellar examples.

Image via wordpress.comIt has a business model similar to eBay in that it acts as a middleman between buyers and sellers. Alibaba has also successfully gone where Amazon and eBay have yet to break through: business-to-business products. Alibaba’s online sales platform lets businesses – big and small – to order supplies, from vanilla copy paper and pencils to more elaborate custom-built car engines and parts. The Chinese retailer has a standout track record for developing talented women in its top ranks. A third of Alibaba’s 18 co-founders are women, and two top females, Lucy Peng and Maggie Wu, are the duo responsible for the company’s IPO behind the scenes.