BNM Receives Backlash For Alleged "U-Turn" On No Extra Interest For Car Loan Deferments

Bank Negara Malaysia says a previously published illustration might have caused misperceptions about the deferment.

Bank Negara Malaysia (BNM) has allegedly backpedalled on its initial decision to allow deferment of hire purchase loans and fixed-rate Islamic financing for six months without any additional interest

In an updated Frequently Asked Questions (FAQ) sheet, BNM said interest or profit will accrue over the deferment period for the two loans.

However, the former FAQ, published on 27 March, purportedly stated that "No additional interest/profit charged during deferment".

The FAQ dated 27 March has since been removed from BNM's website and replaced with the FAQ dated 1 May.

Many quarters have criticised BNM for allegedly reneging its own promise

Those include the Malaysian Consumers Association (MACONAS), the Malaysian Trade Union Congress (MTUC), and politicians such as Kuching MP Kelvin Yii and PKR president Datuk Seri Anwar Ibrahim.

Both politicians criticised BNM for allegedly "U-turning" a policy that the rakyat desperately needs. The Kuching MP even took the effort to dig out the purported old FAQ published by BNM and questioned if the public misunderstood its former "No additional interest" statement.

However, BNM denied it had backpedalled its six-month moratorium on the loans, contending that the policy was meant to ease cash flows of borrowers during the pandemic and it will continue achieving that

The 10th question in the FAQ asks: "Following this announcement by BNM, I feel short-changed. I thought the repayment terms on HP and fixed-rate Islamic financing after the payment deferment period ends are not supposed to change. Will I now lose out from benefitting from the six-month payment holiday?"

To which BNM responded, "We sincerely regret any confusion and anxiety that this announcement may have caused.

"The deferment package is meant to ease cash flows for borrowers/customers who are affected by the COVID-19 pandemic. This intent remains the same."

BNM added that it had previously published an illustration that resulted in misperceptions about the deferment and it had led banks to relay the erroneous message to their customers.

"BNM's illustration was not intended to preclude interest/profit rates to accrue over the deferment period," it said.

As of now, the six-month moratorium on the loans are technically no longer "automatic" as borrowers are expected to personally opt-in as required by the law

"The payment deferment is still automatic for hire purchase and fixed-rate Islamic financing. What is required now is an additional step to comply with procedural requirements under the Hire Purchase Act 1967 (HP Act) and Syariah," said BNM.

"This additional step is required to incorporate the changes to the payment schedule and/or amounts as a result of the six-month payment deferment in the loan/financing agreements."

BNM said in a press release that borrowers should expect to receive a notification from their respective banks in the coming days about the necessary steps that they need to take to complete the process of deferment.

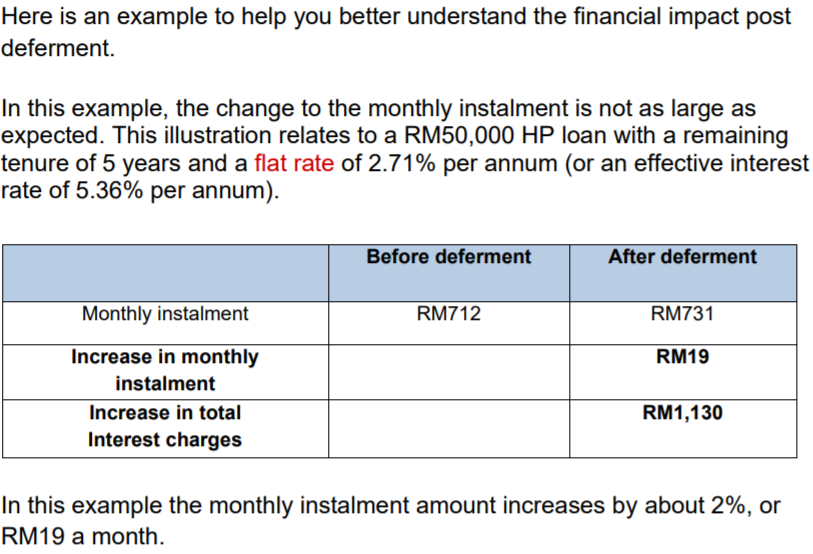

BNM also illustrated an example of a RM50,000 hire purchase loan with a remaining tenure of five years and a fixed interest of 2.71% (or an effective rate of 5.36%) per annum

Before the deferment, the borrower pays an instalment of RM712 per month. If the borrower decides to opt-in to the deferment, their monthly instalment will balloon up by RM19 to RM731.

"In this example, the monthly instalment amount increases by about 2%, or RM19 a month," BNM said.

You can read the full FAQ here.