Bank Negara Malaysia: Help Is For Everyone. Here's How You Can Get Repayment Assistance

So far, banks have approved 98% of applications for loan repayment assistance. Don’t wait if you need help.

Earlier in the year, Bank Negara Malaysia (BNM) introduced a blanket six-month moratorium for loan repayments from April to September

Following that, they transitioned to Targeted Repayment Assistance (TRA) to continue to help those affected by the COVID-19 pandemic, including individuals who lost their jobs or saw a drop in income.

While some parties have called for an extension of the blanket moratorium to help individuals and businesses, it would not be sustainable in the long-run

The initial blanket moratorium was the right move for our country when we went through the movement restrictions. This has given people the breathing space and some time to restructure their finances. In fact, Malaysia was the only country to offer a six-month loan deferment for borrowers automatically.

However, an extended blanket moratorium would deplete the buffers that banks have in place, making it harder for them to lend to individuals and businesses and support economic recovery. Ultimately, the goal is not to encourage more debt, but to help people manage and repay their debt. In fact, 85% of borrowers have started making their monthly instalments.

That's why a transition from a blanket moratorium to a targeted approach is necessary.Targeted Repayment Assistance provides a tailored solution for everyone in financial need. Here's how you could benefit from it:

Additional repayment assistance as announced during Budget 2021 for B40 (BSH/BPR recipients) and microenterprises (with loan amounts up to RM150,000)

- Defer monthly instalments for three months OR

- Reduce monthly instalments by 50% for six months

Repayment assistance for individuals since 1 October 2020

- If you have lost your job in 2020 and have yet to find a job, you can apply for an extension of the loan moratorium for a further three months

- If you are still in employment but salary has been affected, you can apply to reduce loan instalments in proportion to salary reduction, depending on type of financing

Repayment assistance for other individuals and SMEs, which differ from bank to bank

- Allowing borrowers to pay only the interest portion of the loan over a period of time

- Lengthening the overall period of the loan to reduce monthly instalments

- Providing other forms of flexibility until borrower is stable enough to resume full repayments

However, Bank Negara Malaysia wants to remind Malaysians that this assistance is specifically for those who really need it

If you're able to repay your loans, you should do your best to repay them. This will help you to reduce your overall cost of borrowings and avoid a larger debt burden in the future.

So far, banks have received 650,000 applications and have approved repayment assistance for 98% of them

Of these applicants, 40% of them requested for a moratorium extension, while 60% of them chose to reduce their monthly instalments. If you'd like to apply or find out more, just reach out to your bank. They are committed to assisting you with a tailored repayment solution.

Find out how you can apply for Targeted Repayment Assistance here.

Some people may still have some questions about Targeted Repayment Assistance. Here are a few common misconceptions:

1. "Without a blanket moratorium, borrowers in difficulty will not get help"

The transition from automatic moratorium to target does not mean help is being taken away. Instead, this shift provides help to those who actually need it by giving each individual a tailored repayment solution.

2. "Targeted repayment assistance is only for B40"

Is not true that help is only given to B40. Help is for everyone whether you are low or middle-income earners and businesses affected by the pandemic.

3. "Banks require too many documents"

Banks have actually simplified the application process. For instance, the B40 group and microenterprises just need to select their repayment option with no additional documents needed. BPN M40 recipients can self-declare their reduced income. Minimal documents are required for SMEs.

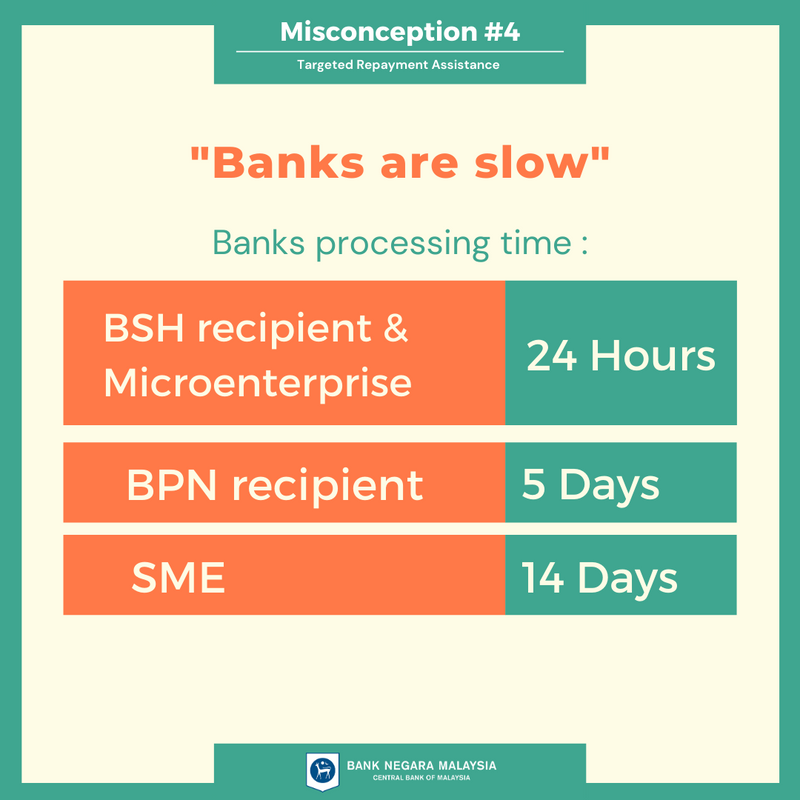

4. Banks have committed to a faster application time:

- B40 (Bantuan Sara Hidup recipient) and microenterprise: Within 24 hours

- Individual borrower (Bantuan Prihatin Nasional recipient): Within 5 days

- SME borrower: Within 14 days

5. "I can't apply due to EMCO or CMCO"

Even if you can't leave your house due to certain movement restrictions, banks remain open and reachable via phone, email, and online.

6. "Repayment assistance is unaffordable"

Whatever your financial situation, you can discuss it with your banks to come up with a suitable repayment solution. If you need further help, you can always reach out to Agensi Kaunseling & Pengurusan Kredit (AKPK).

7. "Targeted repayment assistance comes with no additional cost"

Interest will continue on instalments amount whether it is reduced or deferred. So evaluate your options carefully according to what is best for you.

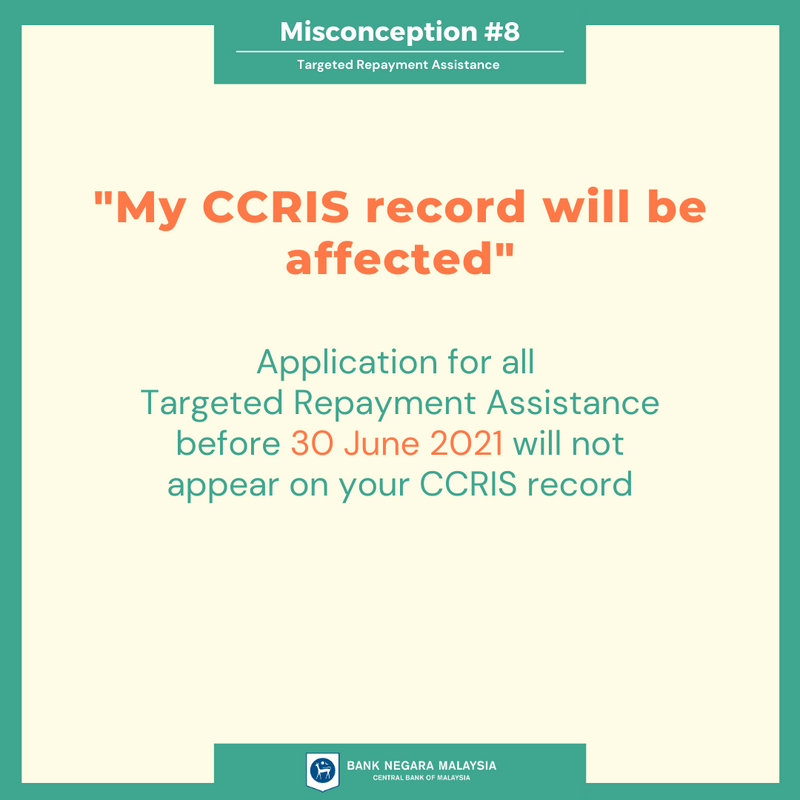

8. "My CCRIS record will be affected"

Central Credit Reference Information System (CCRIS) is a system under Bank Negara Malaysia that provides your credit report. You won't have to worry because application for all Targeted Repayment Assistance before 30 June 2021 will not appear on your CCRIS record.

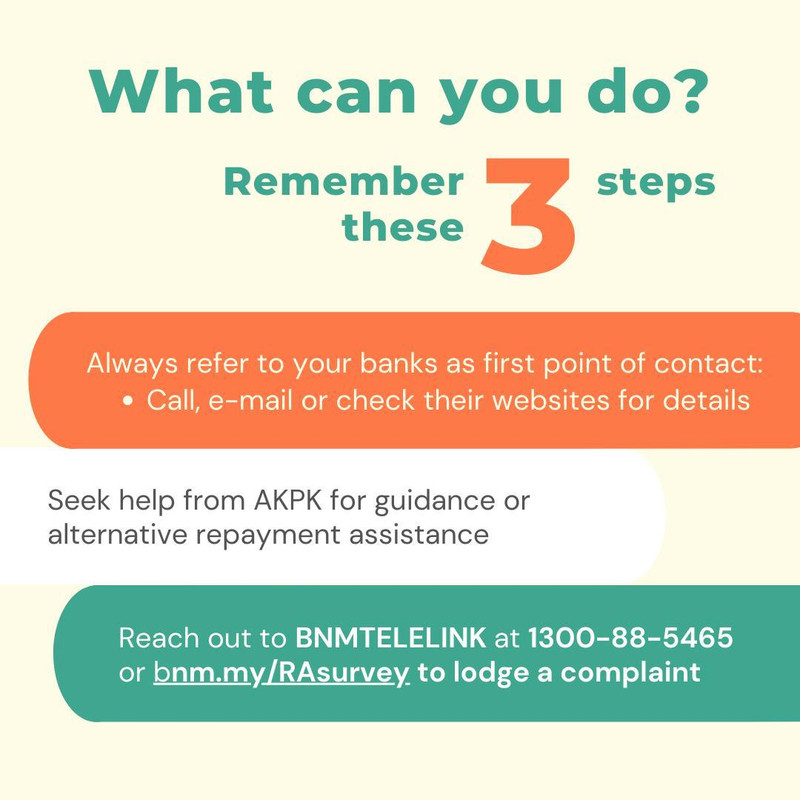

Ultimately, if you are in need of financial help, there are various ways that you can get assistance

STEP 1:

Always refer to your banks as your first point of contact. They will be able to help you figure out which kind of repayment assistance best suits your needs.

If you're not sure where to start, drop them a call, an email, or visit their website for details. You can also check the list of banks and links to their repayment assistance programmes here.

STEP 2:

For those who need guidance or alternative repayment assistance, you can seek help from AKPK. They provide holistic assistance if you have loans with multiple banks or are unable to meet your bank's requirements.

STEP 3:

If you have contacted your banks but haven't heard back from them, you can reach out to BNMTELELINK at 1300-88-5465 or lodge a complaint by filling up this form.

Find out more information about Targeted Repayment Assistance and how it could benefit you on BNM's Website today