CIA Claims That Mahathir's Government Was Involved In The Billion-Dollar BMF Scandal

The Bumiputera Malaysia Finance Limited (BMF) issue was the first major financial scandal that embroiled Malaysia.

America's Central Intelligence Agency (CIA) recently released declassified documents that suggest Tun Dr Mahathir's administration was involved in the infamous Bumiputera Malaysia Finance Limited (BMF) scandal in the 1980s

On 18 January, BBC reported that CIA has released more than 13 million pages worth of declassified documents, following years of pressure and efforts by freedom of information advocates including a lawsuit against the CIA.

In June 2014, a non-profit of information group, MuckRock sued the CIA, forcing them to upload the collection of information. About two years later, they won the lawsuit and in November 2016, CIA announced that they will be publishing the entire declassified CIA Records Search Tool (CREST) on the CIA Library website.

It was reported that the archive has more than 800,000 files including UFO sightings, psychic experiments from the Stargate programme, and the Mahathir's government's alleged involvement in the BMF scandal.

What is the Bumiputera Malaysia Finance Limited (BMF) scandal all about?

Malaysia's first major financial scandal erupted in 1983 when the authorities found out that Bumiputra Malaysia Finance (BMF), the Hong Kong-based subsidiary of Bank Bumiputra Malaysia Bhd (BBMB) has issued bad loans worth around USD1 billion (RM3.57 billion) to companies with vague and dubious track records including the Carrian Group that was based in Hong Kong.

The Carrian Group was founded by a Singaporean civil engineer, George Tan, who was working as a project manager for a land development company. The holding company rose to fame and success in the early 1980s when they acquired and owned properties in Malaysia, Thailand, Singapore, Philippines, Japan, and the United States. Some of the industries they owned businesses in were real estate, finance, shipping, insurance, hotels, catering and transport.

In just a few years after making their fortune, Carrian got involved in the BMF scandal for allegations of accounting fraud, the murder of a young Malaysian Bank Bumi auditor and the suicide of the firm's adviser. The Carrian group collapsed and declared bankruptcy in 1983. It was the largest bankruptcy case in Hong Kong.

How did Mahathir's government handle the issue?

At the first sign of trouble, in December 1982, Bank Bumi sent a team of investigators to Hong Kong to conduct an internal audit. A few months later, in March 1983, the then Malaysian Central Bank governor admitted that certain BMF officials have strayed from usual and legal banking practices but assured that Bank Bumi could handle the situation.

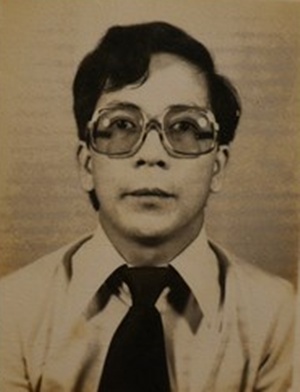

In the midst of that, in July 1983, the body of a young male was discovered with a towelling cord around his neck in an overgrown plantation in Hong Kong. All the authorities found was a Malaysian coin caught in the lining of his trousers. A day later, they ID-ed him as Jalil Ibrahim, a Malaysian banker with the Bank of Bumiputra on a business trip to Hong Kong. Jalil was BMF's assistant general manager.

After months of keeping mum on the issue, then Prime Minister Tun Dr Mahathir Mohamad finally broke his silence on the matter and admitted that BMF's bad loans to these dubious companies were imprudent and that he would take the necessary actions if the investigations reveal management malpractices.

In September 1983, according to CIA's recently declassified papers, Mahathir confirmed press reports suggesting that five senior BMF bank officials had accepted approximately USD600,000 (RM2.6 million) in consultation fees. Despite the fact that these fees are technically legal, Mahathir stressed that they are morally wrong and informed that these bank officials will be terminated from their employment.

BMF's potential losses from this financial scandal were estimated to be around USD700 million (RM3.2 billion), which is nearly the its entire loan portfolio.

Meanwhile, a few months later in April 1984, the testimony from the murdered bank official, Jalil's trial in Hong Kong linked the defendant to then Malaysian Finance Minister Tan Sri Tengku Razaleigh Hamzah and other unnamed cabinet officials. He strongly denied the connection. Previously, Razaleigh had also opposed the parliament's call for the establishment of a royal commission to investigate the BMF scandal.

At that point, BMF's losses were estimated to be around USD1 billion (RM4.44 billion).

In January 1984, after immense pressure from the parliament, Mahathir established a three-member Committee of Inquiry to further investigate the matter

However, CIA's papers say that this closed-door commission had no legal power to summon witnesses, subpoena documentary evidence from outside of Bank Bumi or require testimony under oath.

Later that year, the Committee of Inquiry released three separate reports, highlighting the financial irregularities that warrants police action and recommends Bank Bumi to file criminal complaints against the bank officials involved in the scandal. Following which, the government filed two complaints with the police related to payment of consultancy fees and granting of a USD40 million (RM118 million) loan without Bank Bumi's approval.

In January 1985, the government released a final committee report which alleged 10 cases of corruption linked to six BMF officials. Their assets were frozen and a civil suit was also filed against them for repayment.

While Mahathir was not involved and in no way implicated in the BMF scandal, the CIA said that it had tainted his administration, especially since it came right after he took over as the prime minister in 1981

The CIA report said the Malaysian government under Mahathir had a "surprisingly restrained" response to the scandal despite its enormity.

"Equally damaging to to the administration has been the perception that the government has only half-heartedly pursued the issue."

"The secrecy of the government’s investigation — defended as necessary under Malaysia’s Banking Secrecy Laws — and a year’s delay after the problems surfaced in effecting any management changes at BMF have made the government suspect."

"Many businessmen and bankers believe that the government is using the six accused BMF officials as scapegoats in an effort to avoid implicating senior government officials," read the report.

Mahathir has repeatedly denied any wrongdoing and has detached himself from the BMF scandal, stressing that he was not to be blamed for it

In 2015, at the height of the revelations about the 1MDB financial scandal, claims were made equating it to the BMF scandal in the 1980s.

Mahathir rebutted the claims and pointed out that he was never an advisor to the Bank Bumi, unlike how Prime Minister Datuk Seri Najib Razak, who is the chairman of the scandal-ridden 1MDB's advisory board.

"I don't steal money. The money was missing and it is the bank's money."

"I was not the manager of the bank, neither was I its advisor," added Mahathir in May 2015.

Commenting on the recent declassification of CIA's files, Mahathir said that it was meant to demonise him and that it was politically motivated, according to a report by The Star today, 25 January.

"Even when I do no wrong, they demonise me and accuse me of doing things I didn’t do," added Mahathir, today.

Do you think the then Malaysian government was involved in the BMF scandal? Let us know what you think in the comment section below!