Explained: Malaysia's Move To De-Dollarise And How It'll Impact Us

Former US president Donald Trump said recently that the waning of the US dollar is like "losing a world war".

Prime Minister Datuk Seri Anwar Ibrahim recently announced that Malaysia will reduce its reliance on the US dollar.

And the statement quickly made headlines around the world.

Depending on where you get the news — a media outlet or a finance content creator, the latter who may have inflated the issue to cause fear — you would probably think Malaysia's move to de-dollarise is either major news or an issue that could fly past your head, and your life would still be the same.

In this case, the cliche of 'the truth is always in the middle' wins.

To help you get up to speed, this explainer piece will break down the topic concerning de-dollarisation, the US dollar hegemony, and how moving away from the US dollar will affect Malaysia.

Even though this may seem like a complicated topic involving macroeconomy, history, geopolitical tensions, and geological resources, you will walk away more informed about the apparent waning of the "currency lingua franca".

1. What did Anwar say exactly?

Speaking in the Dewan Rakyat on 4 April, the Prime Minister said there is no reason for a country like Malaysia to continue to depend on the US dollar in attracting investments into the country, reported Bernama.

He said negotiations between Malaysia and other countries should use the currencies of both countries, adding that Bank Negara has made a proposal to spearhead such a transactional method using the ringgit and the yuan during his visit to China.

"A more important matter is about the Asian Monetary Fund (AMF) and the initial stage that I had proposed as the finance minister which was not well received in Asia because at that time the US dollar was very strong," said the Prime Minister, who was also the finance minister between 1991 and 1998.

"But now with the economic strength of China, Japan, and so on, I think this proposal should be negotiated at least about AMF and to utilise the ringgit and each country's currency accordingly."

2. Was Chinese President Xi Jinping interested in Anwar's AMF proposal?

Anwar (left) shaking hands with Chinese President Xi Jinping during a meeting at the Great Hall of the People in Beijing last month.

Image via AP via South China Morning PostAccording to Anwar, when he brought up the AMF, Xi "immediately" seconded the proposal.

"When I was at the Boao forum in Hainan last week, I openly suggested AMF (so we don't) rely on the US dollar or the International Monetary Fund (IMF)," he said.

"When I made the proposal, I was drawn (into it) because when I met with President Xi Jinping, he immediately said, 'I refer to Anwar's proposal on the AMF,' and he welcomed discussions."

3. So, what is the AMF?

Before we can answer that, it is important to understand what the International Monetary Fund (IMF) is, as AMF is likely to be modelled after that.

IMF, as described by Investopedia, is "an international organisation that promotes global economic growth and financial stability, encourages international trade, and reduces poverty" for all of its 190 member countries.

When financial crises strike a country, they are likely to turn to IMF to borrow money to "bail" them out of trouble.

As of 19 April, 94 countries owe IMF a whooping USD115 billion (about RM510 billion), with Argentina, Egypt, and Ukraine being the three biggest debtors, according to official data by IMF.

As per India Times, loans provided by IMF often come with conditions, which have been criticised for being "too tough on the public and politically influenced", hence earning the organisation the name "lender of last resort".

AMF may adopt similar functions to IMF and possibly encourage country members to trade in a common currency that is not the US dollar.

4. What are the disadvantages of de-dollarisation to the US?

De-dollarisation refers to the process in which countries reduce their dependence on the US dollar as the global reserve currency. While de-dollarisation may sound like a good idea for some countries, it can have significant disadvantages for the US.

One of the biggest downsides of de-dollarisation for the US is that it could lead to a decline in its value. The US dollar is currently the world's dominant reserve currency, meaning that countries around the world hold large amounts of US dollars in their foreign exchange reserves.

If more countries begin to move away from the US dollar, the demand for US dollars will decrease, which could cause the value of the dollar to decline. That could make imports more expensive and push up inflation, hurting American consumers.

Another disadvantage of de-dollarisation for the US is that it could reduce the country's ability to use economic sanctions as a foreign policy tool. The US has used economic sanctions to pressure countries like Iran, North Korea, and Russia. The latter of which had USD300 billion (about RM1.32 trillion) of its gold and forex reserves frozen by the US following its invasion of Ukraine, reported Reuters.

When countries can find a workaround for trading with the US dollar and hold less money in the global reserve currency, it will be more difficult for the US to enforce those sanctions.

A third disadvantage of de-dollarisation is that it could reduce the ability of the US to borrow money at low-interest rates, reported the Council on Foreign Relations (CRF). Currently, because the US dollar is the world's dominant reserve currency, countries are willing to lend money to the US at low-interest rates. However, if more countries move away from the US dollar, it could make it harder for the US to borrow money at low-interest rates, which could make it harder for the government to finance budget deficits.

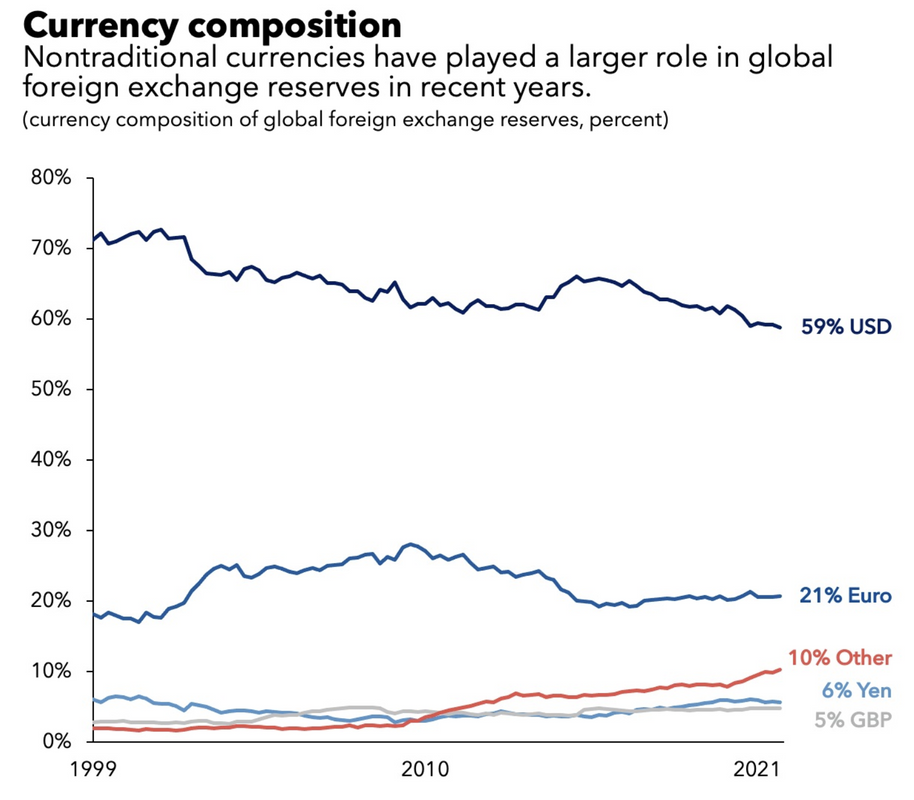

According to IMF's official figures, the holding of the US dollar by countries has shrunk from over 70% in 1999 to 59% in 2021. Eurizon SLJ Asset Management reported that the buck's status as a reserve currency eroded 10 times faster in 2022 over the past two decades.

In an interview with Fox News's Tucker Carson last week, former US president Donald Trump even likened the potential for China to push a large portion of the world off of the dollar standard to America losing a world war.

5. What are the benefits of de-dollarisation for other countries?

Other than avoiding the aforementioned disadvantages of de-dollarisation, a senior research fellow at the Malaysian Institute of Economic Research (MIER), Dr Shankaran Nambiar, told SAYS that Malaysia's move to stop relying on the US dollar will allow the country to be less subjected to the fluctuations of the US dollar and the policy changes in the US.

"Reducing dependence on the US dollar will reduce the costs of transactions. It is already being done, (which was) recently announced, between India and Malaysia, where transactions can be done in the Indian rupee. Both countries need to use our own currencies now," he said when contacted.

He also shared that the move can bring down the cost of Malaysia's trade with China, saying, "This will make goods from China cheaper."

Dr Mohd Afzanizam, a chief economist at Bank Islam Malaysia, commented further that when a country relies heavily on the US dollar, it becomes vulnerable to fluctuations in the value of the dollar, evidently from the aggressive interest rate hike by the US Federal Reserve System (FED).

It can lead to financial instability and economic crises. By reducing their dependence on the US dollar, countries can protect themselves from these risks.

According to him, it makes sense for Malaysia to find a solution to the matter.

"It appears that the US monetary policy has a direct impact on how emerging economies should manage their country and this can be an issue. Understandably, high reliance on the US dollar for international trade is the main reason why a change in the state of US monetary policy will have on emerging currencies, including Malaysia," he explained when contacted.

"While currency hedging is the common way to address the forex volatility, this comes at a cost. Therefore, it makes sense to find a solution that may include using other currencies for trade and investment," he added.

Economist Jomo Kwame Sundaram also seconded Anwar's suggestion to set up AMF, saying he had always supported the idea since the former finance minister brought it up during the 1997 financial crisis, reported Malaysiakini.

"You cannot set up such a fund in the middle of a crisis. So it is timely to think ahead," said the economist, adding that now is a great time for AMF.

"It (AMF) reduces our vulnerability without tying up too many resources."

All and all, de-dollarisation encourages greater economic and financial cooperation between countries and promotes greater financial sovereignty.

When countries are less dependent on the US dollar, they may be more likely to trade and invest in their own currencies or in currencies other than the US dollar. This can help promote regional economic integration and cooperation.

6. What countries have started trading or are considering trading in non-US dollar currencies?

France

On 9 April, French President Emmanuel Macron told Politico that Europe must reduce its dependence on the "extraterritoriality of the US dollar".

He cited the tensions between China and the US are no place for Europe to be close to, saying, "If the tensions between the two superpowers heat up... we won't have the time nor the resources to finance our strategic autonomy and we will become vassals."

His comments come after French multi-energy conglomerate TotalEnergies and China National Offshore Oil Corporation (CNOOC) completed their first yuan-settled liquefied natural gas trade in late March, reported China Daily.

The country has started various initiatives to trade in non-dollar units. Late last year, Russia began selling crude oil to China at steep discounts and settled the transactions in yuan, giving rise to the so-called 'petroyuan', a counter to the 'petrodollar', reported Business Insider.

Iran

The Middle Eastern country is currently working closely with Russia to create a cryptocurrency backed by gold. It essentially will be a stablecoin to replace the US dollar in international trade.

Both countries have been hit by Western sanctions over the years, and the cryptocurrency is seen as the "token of the Persian region" for use in cross-border transactions.

Brazil and Argentina

These two countries announced that they are teaming up to form a joint currency called "sur" (Spanish for south).

Both countries' leaders said in a statement that the common currency can help boost South American trade because it evades conversion costs and exchange rate uncertainty, reported Business Insider.

Brazil, Russia, India, China, and South Africa

Collectively known as BRICS, these five countries began talks last year to form a new reserve currency to fight against the US dollar hegemony.

Bloomberg reported yesterday, 24 April, that 19 other countries have requested to join the emerging-markets bloc, with 13 of them formally asking BRICS to become a member.

Saudi Arabia

A big one on this list as the oil-rich country is responsible for the birth of the 'petrodollar' when former US president Richard Nixon's administration executed an agreement with the Middle Eastern country to conduct its oil trades in US dollars in exchange for military support and hardware.

On 29 March, Saudi Arabia announced it has agreed to become a "dialogue partner" in the Shanghai Cooperation Organization (SCO), a China-led political, economic, and security organisation, designed to compete with similar Western organisations, reported Bloomberg.

This can be seen as an indication of strengthening ties between Saudi Arabia and China, especially after the Chinese Communist Party-led country managed to broker the former and Iran into an agreement to re-establish diplomatic relations.

Iran and Saudi Arabia are old rivals locked in a fierce struggle for regional dominance for forty years, reported Al Jazeera. China's success in mending the relationship between the two is a showcase of the might of its political influence.

Malaysia

Not forgetting Malaysia with Anwar's aforementioned statement.

7. When will the US dollar lose its status as the global reserve currency?

With all the statements by heads of state and special direct dealings between countries over the past few months, the standing of the US dollar as the world's currency reserve has been challenged for sure, but it will not be dethroned by another currency anytime soon.

South China Morning Post's columnist Alex Lo wrote that reports about the demise of the almighty dollar or 'petrodollar' are greatly exaggerated, saying individuals, companies, and economies love to trade in currencies that are freely convertible and highly liquid. He said the yuan has neither of the two qualities.

He is of the opinion, which is also echoed by the consensus, that it will take a long time for the US dollar to lose its shine on the global stage, but when it happens, it will collapse quickly, quoting political theorist Vladimir Lenin, "There are decades where nothing happens; and there are weeks where decades happen."