Malaysians Offer Their Two Cents' Worth As Ringgit Breached RM4 For A Dollar

Facebook comments and tweets flood in as netizens lament the currency exchange rate but it raises the question - Are Malaysians now currency experts?

For the first time since 1998, the Malaysian Ringgit (RM) slumped beyond RM4 to a 1 US Dollar (USD) as the economy continues to be clouded by uncertainties

Analysts said China’s surprise devaluation of the yuan also pressured the ringgit, the worst-performing currency in Asia over the past year.

Malaysia’s economy has been dogged for months by concerns that slumping oil prices will harm growth in the oil-exporting country.

“Malaysia’s vulnerability is heightened by deteriorating terms of trade, high debt, and a fragile fiscal position highly dependent on oil-related revenue,” said Chua Hak Bin, an economist with Bank of America Merrill Lynch.

“Political uncertainty and 1MDB are also hurting consumer and business confidence."

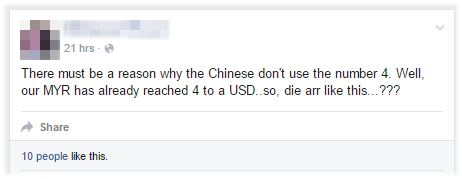

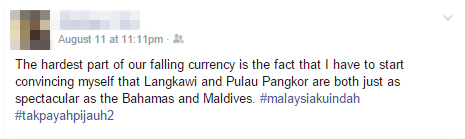

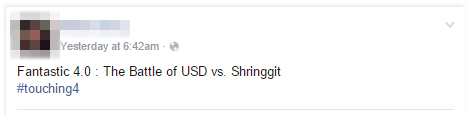

Once again, Malaysians were quick to respond to the news and some even got their creative juices flowing on social media

USD 1 = MYR 4.00 How I wish that was my CGPA

— Johnny Toh™ (@Johnny_Toh) August 11, 2015

Alhamdulillah, bendera negara dah dekat nak sama. Cuma Amerika kahwin 1, kita kahwin 4. #1M4U sebenar. pic.twitter.com/3QzpX5abFv

— Pok Pok (@jembalanque) August 11, 2015

1 MYR : 4 USD = 1M4U.

— The Mameow™ (@The_Mamu) August 11, 2015

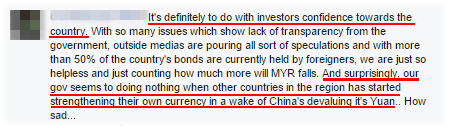

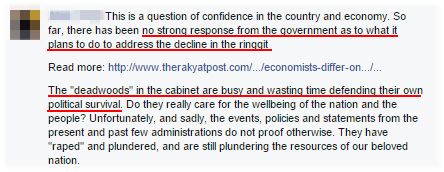

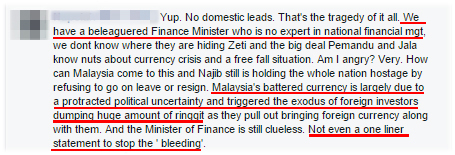

On a serious note, Malaysians are urging the government to start taking significant measures to improve the situation

However, in an open letter that went viral yesterday, Goh Wei Liang questioned whether Malaysians now are currency experts, pointing out that other currencies were also performing poorly against USD

When I logged in to my Facebook and Twitter accounts, 9 out of 10 posts that appeared on my timeline were slamming the Government on the Ringgit.

To sum them up, youths who dominate social media today were posting comments as though tomorrow spells the end for Malaysia.

Of course, when you have a narrow, myopic view, you will tend to miss out the fact that over the 5-year period,

• Russian Roubles lost 114% against USD (American dollar)

• Indonesian Rupiah lost 51% against USD

• Indian Rupees lost 38% against USD

• Norwegian Krone lost 37% against USD

• Australian Dollars lost 24% against USD

• Euro lost 20% against USD

• Thai Baht lost 10% against USD

Goh added that Ringgit is performing well against other currencies, citing Yen and Rupiah among others

When we look at the Ringgit,

• we strengthened against Canadian Dollars (2%)

• we strengthened against Indian Rupees (10%)

• we strengthened against Japanese Yen (14%)

• we strengthened against Indonesian Rupiah (18%)

Before he ended the letter, Goh posed a few questions on how to determine whether the exchange rate really affects Malaysians

But the next time before you get upset and share your anger on Facebook or Twitter, ask yourself whether or not the Ringgit-Dollar exchange rate affects you, and how.

1. Do you shop online from US websites?

2. Are you planning to fly over to US for a holiday?

3. Are you a Malaysian studying in the US?

4. Do you import goods to be resold in Malaysia?

5. Do you buy necessities and food from the US to use here?

6. Do you at all use the US dollar in your daily life?

Because, my dear, only if you answer yes to the above, are you affected. Otherwise, what are you shouting and so worried about?

Sure, no one can deny that it has some impact to some segments especially imports and our plans to travel to US, UK etc. I am also of the opinion that there are many things Najib can do (which he isn’t at all now) and I will share more soon.

And guys, the international ratings agencies — Fitch, Moody’s and S&P — have all maintained Malaysia’s outlook as stable.

According to experts and consumer groups, the situation will not get any better with the prices of goods and services looking set to increase further

"The objective of every business owner is to maximise profit. Hence, it is unavoidable for prices to go up. The group of consumers that will suffer the most will be the fixed-income earners, more specifically the lower and some middle-class consumers,” Tan Sri Ramon Navaratnam, Chairman of Centre for Public Policy Studies said.

"With the depreciation of the ringgit, the prices of products will go up because the cost of production has also increased. This is because most of the components to manufacture these products are imported. Items like dairy products which are important will now cost more,” Datuk Seri Saw Choo Boon, President of Federation of Malaysian Manufacturers said.

"The effect on the prices of goods has taken place since the ringgit began to slide in April. The drop was due to political issues causing investors to lose confidence in the country. The economy has been on a downward trend, partly due to the domino effect of the implementation of GST. Businessmen being businessmen, they have to make profits and have taken advantage of the situation to hike up their prices. If consumers find that prices have gone up absurdly, they should not remain ignorant but report it to the relevant consumer groups,” Datuk Amarjit Singh Gill, Secretary-general of Malaysian Consumers’ Association said.

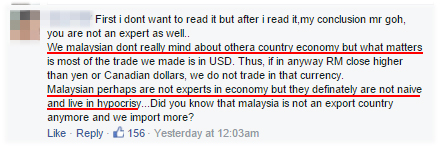

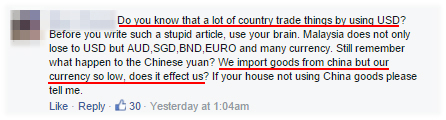

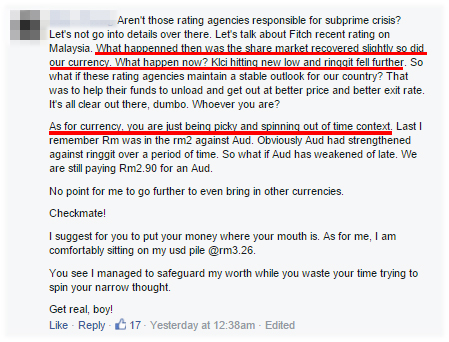

facebook.com

facebook.com