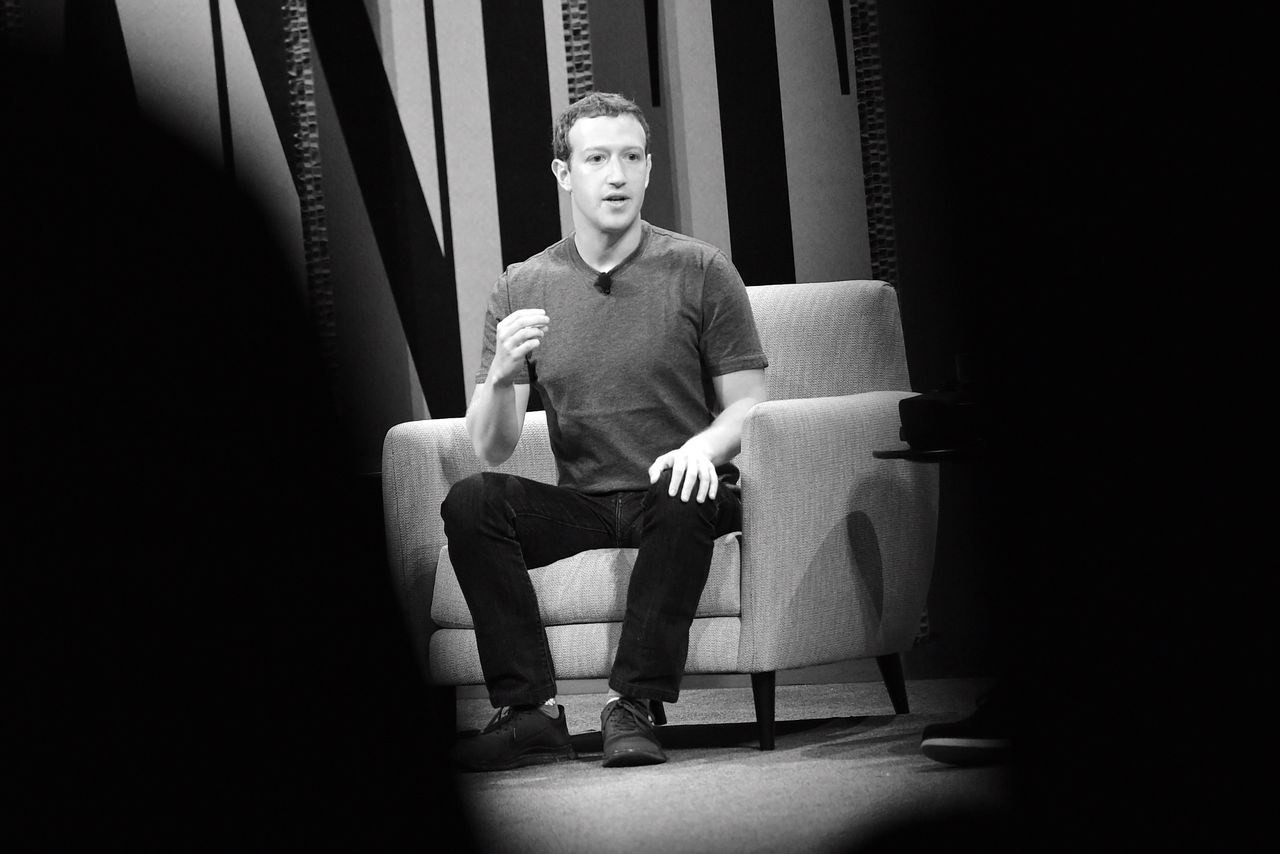

Mark Zuckerberg Says His New Foundation Is Not A Way To Avoid Taxes

The Facebook CEO says there's nothing negative about the Chan Zuckerberg Initiative.

On Thursday, 3 December, Facebook CEO Mark Zuckerberg posted an update on his Facebook page, explaining how he and his wife, Priscilla Chan, plan to administer the 99% of their estimated USD45 billion fortune which he announced to give away earlier this week

"The Chan Zuckerberg Initiative is structured as an LLC rather than a traditional foundation," he writes. "This enables us to pursue our mission by funding non-profit organizations, making private investments and participating in policy debates."

He also disputed the notion that it's a way for him to avoid taxes

"By using an LLC instead of a traditional foundation, we receive no tax benefit from transferring our shares to the Chan Zuckerberg Initiative, but we gain flexibility to execute our mission more effectively," he wrote. "In fact, if we transferred our shares to a traditional foundation, then we would have received an immediate tax benefit, but by using an LLC we do not. And just like everyone else, we will pay capital gains taxes when our shares are sold by the LLC."

Flexibility in how the money is deployed is key for Zuckerberg

"What's most important to us is the flexibility to give to the organizations that will do the best work -- regardless of how they're structured," he wrote. "For example, our education work has been funded through a non-profit organization, Startup:Education, the recently announced Breakthrough Energy Coalition will make private investments in clean energy, and we also fund public government efforts, like the CDC Ebola response and San Francisco General Hospital."

However, as Jesse Eisinger, a Senior Reporter at ProPublica, an independent, nonprofit newsroom that produces investigative journalism in the public interest, points out, while Mark remains completely free to do as he wishes with his money (it is, after all, his money), his new LLC, which can make political donations and can lobby for changes in the law, should not be called "charity"

What’s more, a charitable foundation is subject to rules and oversight. It has to allocate a certain percentage of its assets every year. The new Zuckerberg L.L.C. won’t be subject to those rules and won’t have any transparency requirements.

Instead of lavishing praise on Mr. Zuckerberg for having issued a news release with a promise, this should be an occasion to mull what kind of society we want to live in. Charities rarely fund quotidian yet vital needs.

Maybe Mr. Zuckerberg will make wonderful decisions, ones I would personally be happy with. Maybe not. He blew his $100 million donation to the Newark school system, as Dale Russakoff detailed in her recent book, “The Prize: Who’s in Charge of America’s Schools?” Mr. Zuckerberg has said he has learned from his mistakes. We don’t know whether that’s true because he hasn’t made any decisions with the money he plans to put into his investment vehicle.