EPF's Investments In The US Is For Members To Enjoy Profits, Says Najib

Najib recently proposed for the pension fund to make additional investments to develop infrastructure in the US.

Prime Minister Datuk Seri Najib Razak recently proposed to expand EPF's (Employees Provident Fund) investments in the US

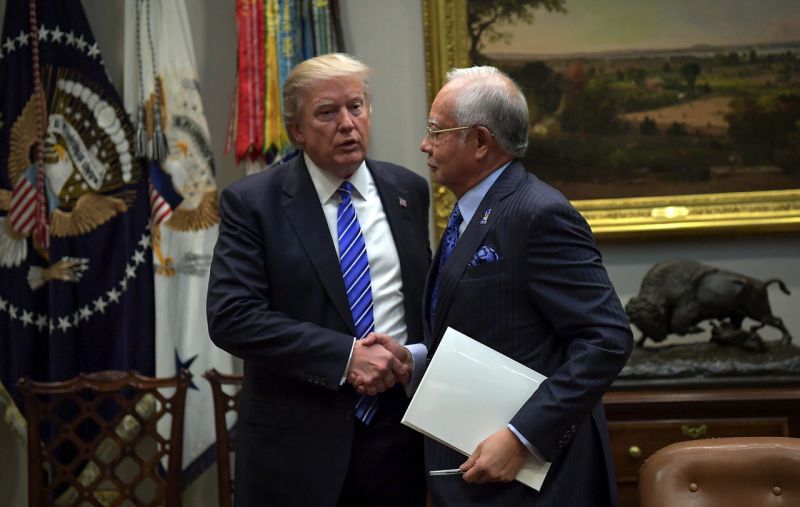

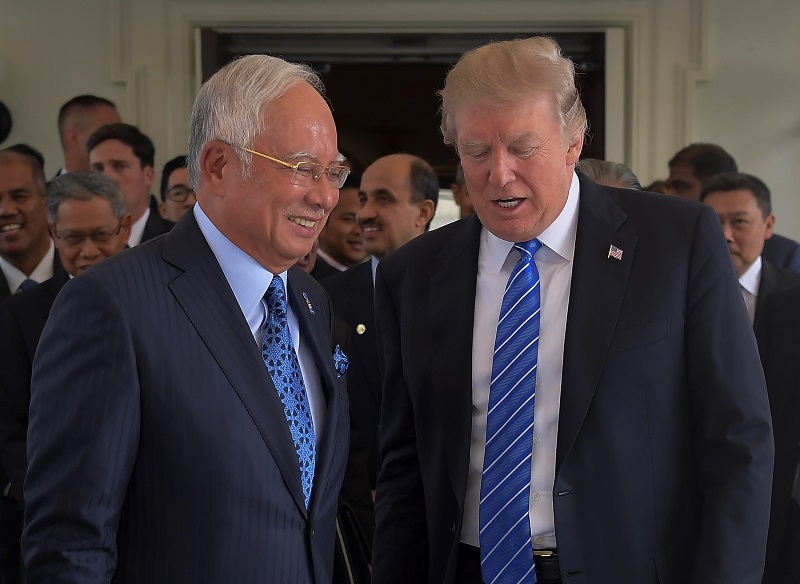

He said this when he met US President Donald Trump during his working visit to the White House on 13 September.

It was learned that the EPF alone is expected make additional investments worth between USD3 and USD4 billion to support Trump's infrastructure redevelopment programmes.

According to Najib, EPF enjoyed better returns at 11.1% through US investments

The premier said that this figure was higher compared to the average 7% returns on local investments.

"Those who benefit (from the US investments) are employees, EPF contributors (from) your dividends. So, we must have a global strategy to invest in the US. This is nothing new, it started in 2008," he was quoted as saying in a Bernama report yesterday, 25 September.

Najib added that this is part of EPF's global investment strategies to enable EPF members to enjoy higher dividends.

"When we invest and get profits, we will repatriate (the money)," he said.

Bernama reported that the premier also chided detractors who had "misled and inflamed" the public on EPF's investments in the US

"When I was invited by President Donald Trump to the White House, I went there to represent a successful country. I was there not to kneel or ask for alms or loans from him."

"I went there to inform him that our country has the ability to become a global investor," Najib said, as reported by Bernama.

It was reported earlier that Najib said his conversation with Trump on wanting to help strengthen the US economy was "misconstrued" by leaders to confuse the rakyat.

Najib's plan has drawn criticisms as some have accused the prime minister of abusing his position to instruct EPF to make the investments in the US as per his proposal

Responding to this, Najib said, "I did not direct it (the agency), but I called for the investments made to be based on best returns plus low risks. We have to balance between the two criteria."

He added that it was the EPF Investment Committee who made the calls, and not the prime minister or other politicians.

"This was neither my decision, nor the politicians'. The decision was made by the investment committee. These were done by the professionals. I did not instruct them to do so," Najib was quoted as saying by Malaysia Gazette.

EPF, being the world's seventh largest pension fund, is known for its stringent investment approvals process.

On 15 September, PKR vice-president Rafizi Ramli pointed out that the EPF has almost reached the 30% threshold for foreign investments

"What he (Najib) does not realise is that his announcement goes against the rules set by the Finance Ministry, which limits EPF’s foreign investment to only 30 percent of its total investments."

"I do not have to mention the maximum stupidity shown by Najib as finance minister, who... announced to the investment world EPF's additional investments in the US, which goes against rules set by his own ministry," Rafizi said following Najib's pledge to strengthen the US economy, as reported by Malaysiakini.

EPF said in a statement recently that the fund's overseas investments (which contributed 32.5% to the total investment income) accounted for 29% of its total investment asset — just below the maximum limit permitted - as at 30 June 2017.

According to EPF, foreign investments have been a "significant revenue driver in recent years" even when they currently make up less than 30% of the fund's total investment portfolio.

"The increase in global asset values mitigated the negative effect from the strengthening of the ringgit, providing opportunities for us to realise profit," EPF's chief executive officer Datuk Shahril Ridza Ridzuan explained.

Back in February, Shahril Ridza Ridzuan also revealed that the fund's global investments have increased in recent years and nearly reached the 30% cap

Shahril reportedly said that the current maximum limit for foreign investments may be increased, however, the matter would be first discussed with the Ministry of Finance.

He also stressed that despite global investments being so close to the threshold, this was a non-issue for the time being.