MARA And M’sian Businessmen Linked To Melbourne Property Bribe: 12 Facts You Need To Know

According to an exclusive report by an Australian daily, about RM13.7 million worth of bribes are said to have been pocketed by high-ranking MARA officials in the corrupt Dudley House deal.

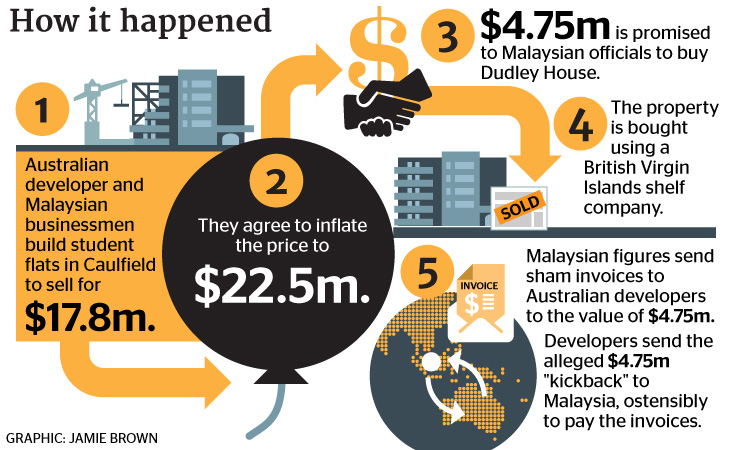

1. In 2013, Majlis Amanah Rakyat (MARA) bought Dudley International House, a 5-storey apartment block in Melbourne for A$22.5 million (RM65 million), allegedly with the Malaysian government's investment funds

The five-storey Dudley International House in the suburb of East Caulfield accommodates up to 115 Mara students attending Monash University.

About 20,000 Malaysians study in Australia each year, according to government figures, and Melbourne is a popular destination.

2. However, according to an exclusive report from Australian daily The Age, the property was only worth A$17.8 million (RM51.4 million) as per its original asking price

3. To uncover the mystery of the additional A$4.75 million (RM13.7 million), Fairfax Media - Australia's leading media company - launched an 8-month-long investigation, tracing suspicious money flows, court files, and corporate records across three continents

4. Dudley House was developed as a joint venture between Australians Chris Dimitriou and Peter Mills alongside Malaysian businessmen Yusof Gani and Abdul Azizi, who are reported to be 'Datuks'

According to the daily, the ring of Malaysians also included Azizi’s two sons, Erwin and Erwan.

Facebook posts show Azizi and his two sons, Erwin and Erwan, mixing with the elite and getting around in Porches and Ferraris. Erwan hangs out at the Kuala Lumpur Porsche club. There is plenty of international travel, including a family trip to Paris.

5. Citing confidential documents, The Age alleges that the A$22.5 million Dudley House deal with MARA was brokered by Azizi's "Porche-loving" son Erwan via a network of contacts connected to the government institution

In Malaysia, where wealth and political connections go hand in hand, the Azizis didn't just have the funds to invest in a multi-million dollar Australian property development. They also had the contacts to pull off a remarkable deal: the sale of this development to the Malaysian government at a massive mark-up.

6. The A$4.75 million is believed to have been laundered out of Australia and then paid as bribes in Malaysia to guarantee that funds would flow from the Malaysian government to buy the building

The bribe was paid via sham invoices issued to the Australian developers from Malaysian companies. The invoices demanded payment for non-existent services, including "professional advice" and "consultancy and advisory fees".

The Australian property developer involved, Peter Mills, last year conceded before a civil court that the $4.75 million was "paid to grease palms to get the deal done".

As the two Datuks' Australian manager Dennis Teen later explained in civil court proceedings lodged on behalf of the Dudley House creditors, "If we didn't agree on the $4.75 million, we would not have the deal."

7. The money is then said to have been wired to the bank account of a Singaporean shelf company, leading investigators to a young baker who directed them to "a Malaysian government agency" and several front companies who may be involved in the deal

Among a cache of documents, a strange email dated March 8, 2013 and sent by a man purportedly working for Malaysian government officials was discovered. It stated that in return for the Malaysian government agency MARA buying Dudley House, a payment of "AUS$4,785,000 in the form of introduction and consultancy fees" would have to be wired to a mysterious Singapore shelf company.

Fairfax Media tracked down the director of this company, who turned out to be young wedding cake-maker Hanna Kamruddin. She nervously revealed she'd been appointed a director of the shelf company after her brother introduced her to three men who wanted an offshore company and bank account set up. Hanna agreed to help them in return for $1000.

"I'm so naïve," she said when asked about the arrangement. "When I look back it was a very stupid decision."

Hanna insists she does not know the identity of the Malaysians who paid her the $1000, but she remembered that they were somehow linked to a Malaysian government agency.

8. It then emerged that one of such companies have been taken over by top officials of MARA's investment arm MARA Inc. - chairman Datuk Mohammad Lan bin Allani and chief executive Datuk Halim bin Rahman

When contacted by Fairfax Media, Allani said he couldn't recall the Dudley House dealings, even though he visited Melbourne to inspect the property in May last year, according to a Malaysian Consulate website.

He said he was involved in setting up offshore companies in tax havens as a "convenient" way of selling property bought by the Malaysian government. When questioned about his knowledge of any alleged kickbacks, the former politician hung up the phone.

9. Malaysians officials have also been implicated in the purchase of about A$80 million worth of Australian property through shelf companies based in tax havens such as Singapore and the British Virgin Islands

A company called Thrushcross set up in notorious tax haven, the British Virgin Islands, was used to purchase Dudley House, along with a $23.5 million property on Swanston Street, near Melbourne University. (Datuk Azizi's son, Erwan, signed some of the paperwork associated with the deal.)

Malaysian officials from MARA have also used other shelf companies in Singapore, which is also regarded as a tax haven, to purchase properties in Queens Street and Exhibition Street in Melbourne's CBD for around $40 million.

10. The dubious deal would have remained in the dark if not for John Bond, owner of a window and door company, who was never paid for his work on the construction of Dudley House.

"This deal has ripped off Australians and involves serious corruption but no one has been held to account," he said.

Tradesman John Bond who has recently gone into liquidation due to non-payment for services by a developer.

Image via Simon SchluterWhen Bond, 53, won a lucrative job to help outfit Dudley House, he dreamed of dramatically expanding his business. However, after working on the development for many months, Bond, along with his own staff and dozens of other contractors, were owed several million dollars.

"They [the developers] kept putting it off. It became one week. Then one month. Then six months. And I thought to myself, something is terribly wrong here. They seem like they are never going to pay us."

By 2013, Bond had spent two years working on the project. He was broke and desperate. Determined to find out who had got rich from Dudley House while he was left facing ruin, he went to the Victorian Supreme Court with several other creditors and demanded the appointment to the project of a new liquidator, Pitcher Partners boss Andrew Yeo.

11. About 150 creditors - including Bond and several builders - have suffered massive financial losses with some facing bankruptcy. Hopes of being paid were rekindled when the property's value rocketed, only to be instantly crushed after the company linked to the deal collapsed.

This inflated sale price of $22.5 million should have increased the prospect of tradesmen like John Bond getting paid. But Bond's fears that he and his fellow creditors were about to be ripped off dramatically increased when the Australian developers Mills and Dimitriou appointed an administrator, indicating their company would not be able to pay the bills of the tradesmen who built Dudley House.

12. Now a civil court case, one of its developers - Dimitriou - said that the A$4.75 million "went to Malaysian parties" while his partner, Mills admitted that the deal in indeed "corrupt"

When quizzed directly about these apparent "kickbacks" in court, developer Chris Dimitriou stated: "To the best of my knowledge, that $4.8 million went to Malaysian parties."

His fellow developer Peter Mills was more forthcoming, telling Fairfax Media in a phone interview that the deal was corrupt.

"I suppose I have to [take responsibility]. But no one told me about it beforehand. Otherwise, I wouldn't have gone along with it."