Borang TP1: The Lesser-Known Tax Relief Form Your Employer Did Not Tell You About

What if we told you that you can actually skip the hassle of filing your tax returns when tax season arrives?

It's that time of the year again - time to crunch some numbers and file your tax returns for 2014, that is!

The 2014 assessment year goes according to the calendar year, meaning you will be filing your income tax return forms for 1 January 2014 to 31 December 2014. The due dates for submission are as follow:

1. Employers (Form E) by 31 March 2015.

2. Residents and non-residents with non-business income (Form BE and M) by 30 April 2015.

3. Residents and non-residents with business income (Form B and M) is 30 June 2015.

4. Partnerships (Form P) is 30 June 2015.

First things first, in order to be taxable, you would have to earn about RM30,667 per year after EPF deductions (about RM2,556 per month), inclusive of all benefits, allowances, bonuses, overtime, and commissions

If you're earning anywhere below that figure, then there's no need for you to open up a file for tax to be deducted from your income.

However, if you do earn above that, you need to have a tax file opened with your income tax automatically deducted from your income.

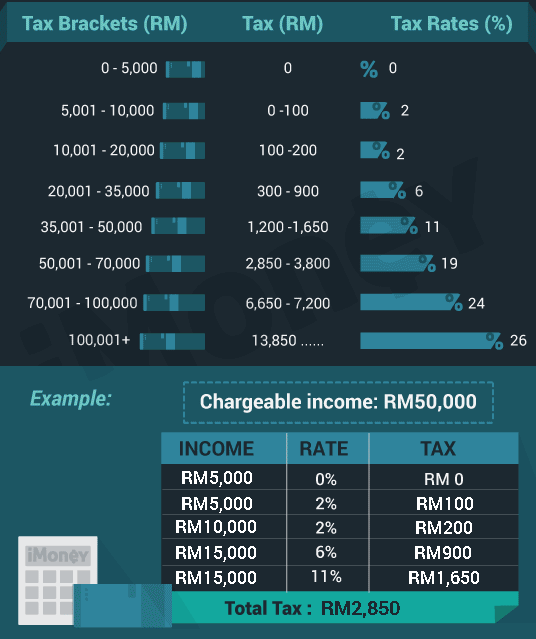

Your payable tax is determined by taking into account your tax rate bracket based on your chargeable or taxable income, which is calculated after tax exemptions and tax reliefs.

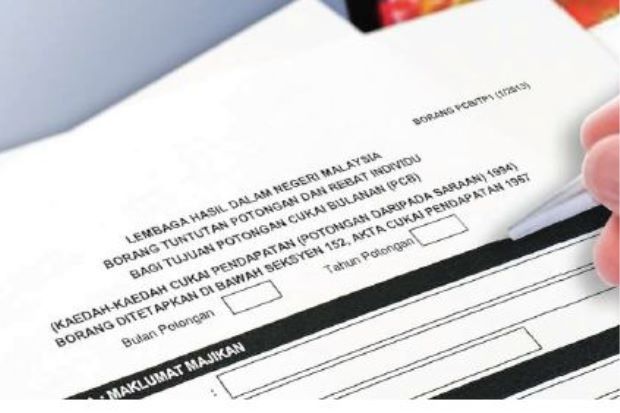

Usually, your employer would have already deducted a certain amount from your salary every month under the Monthly Tax Deduction (MTD) / Potongan Cukai Bulanan (PCB) scheme, which goes towards paying your tax for the year on your behalf.

By the end of February, your employer should have issued the EA (private sector) or EC (public sector) Form summarising your entire year's gross earnings as well as EPF and relevant tax deductions

However, employers primarily rely on personal data submitted to Human Resources (HR) - such as your annual salary, marital status, and number of children - to estimate how much tax you will be paying.

Because the deductions do not take into account other tax reliefs you are able to claim, they may have been overpaying tax on your behalf. This is why you should be filing your taxes - to claim back your hard-earned money!

Full list of and claimable tax reliefs and tax rebates on the LHDN website.

Alternatively, you could be earning outside income (property rental, dividends from share investments etc.), which the PCB system does not take into account, and your employer may have been underpaying your tax, causing you to be liable for more income tax.

What you might not be aware of is that you can actually opt to submit Form TP1 to your employers instead of filing your tax returns on March/April every year.

Form TP1 ensures that your employer takes into account relevant rebates and reliefs such as insurance, book purchases, and medical expenses to adjust your MTD accordingly, thus avoiding them from overpaying tax on your behalf.

The form can be downloaded here.

Additionally, a new ruling proposed in Budget 2014 is allowing taxpayers to have MTD as their final tax from 2014 onwards thus skipping the hassle of filing their tax returns, as their income tax would have already equalled the MTD paid to the Inland Revenue Board of Malaysia (IRB).

The catch is that they would have to fulfill the following criteria:

2. MTD of such employee must be made under the Income Tax (Deduction from Remuneration) Rules 1994; and

3. Such employee must serve under the same employer for a period of 12 months in a calendar year (i.e. Jan 1 to Dec 31).

This change is effective from year of assessment 2014 meaning employees under MTD as final tax plan who have been submitting their Form TP1 no longer need to submit their tax returns by the deadline next year (i.e. April 30, 2015).

imoney.my

imoney.my

You do not have to include any receipts or supporting documents when submitting Form TP1, but the one problem with submitting the form is that there is no set time for submission... so that could mean more paperwork for your employers

To help ease the burden of the HR departments, you may work out with HR departments to submit TP1 once or twice a year. With TP1 submission, you have basically claimed your tax reliefs and therefore your PCB paid would equal to total tax payable.

In a nutshell, the main takeaway is that there are now two ways - submitting Form TP1 or claiming reliefs one-shot come tax season - to ensure your taxes are paid in an accurate and timely manner while taking into account relevant reductions.

Both routes ultimately come down to the same result, hence, one should opt for whichever method that is most convenient and the one they are most comfortable using.

imoney.my

imoney.my