Worried Over The Ringgit's Fall? Things Will Only Get Worse Throughout The Year

However, the Finance Ministry is of the opinion that the ringgit will strengthen.

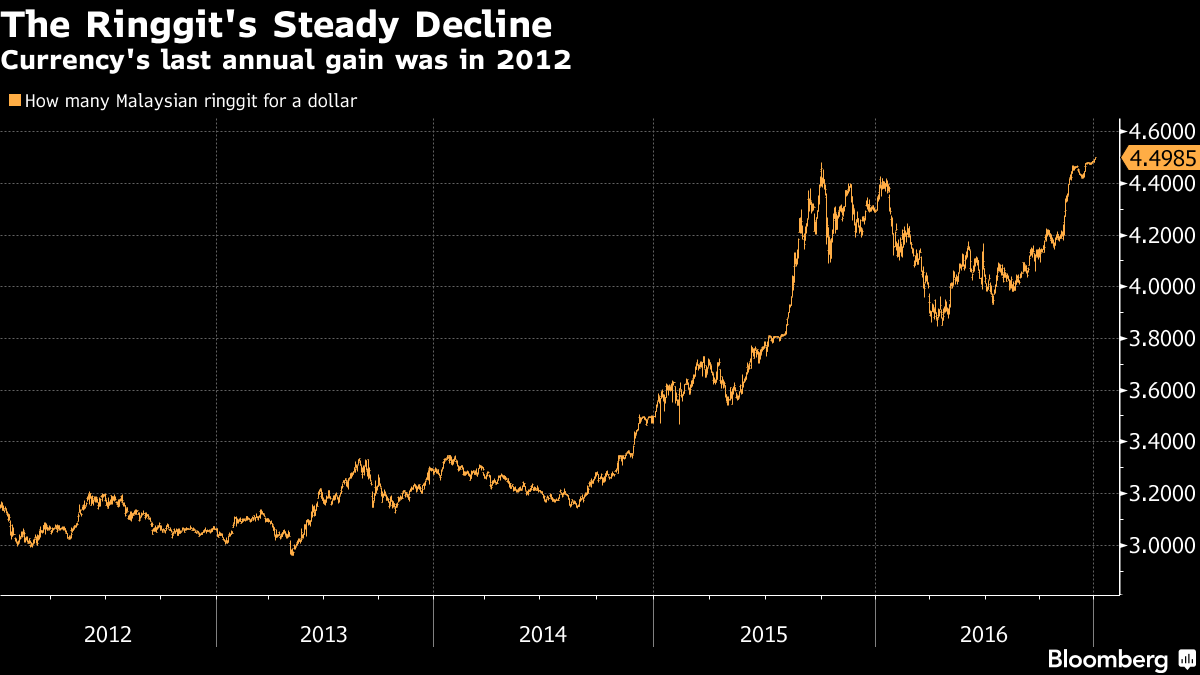

The ringgit's continued decline, which touched an intra-day low of 4.5002 against the greenback over the week, the lowest level since 1998 during the height of the Asian financial crisis, is a major cause of concern for Malaysians

Currently, the ringgit, which have lost 0.27% against the US dollar since the start of 2017, is the third-worst performer among Asian currencies, after the yen and INR.

But things are only going to get worse for the ringgit, one of Asia's worst-performing currencies in 2016, according to BMI Research, which said it has further to fall.

According to BMI, a research firm that provides analysis on macroeconomic, industry and financial market, one reason behind the ringgit's decline is because it's affected by the yuan, which is going to remain under downward pressure

"The Chinese economy remains mired in a medium-term slowdown as the structural weaknesses such as overcapacity in the industrial sector and dominance of inefficient state-owned enterprises persist," Bloomberg reported BMI as saying.

"Given that China is Malaysia’s largest export partner, we believe that Malaysia's export-driven economy remains exposed and is likely to be negatively impacted."

Apart from the decline in Yuan, other factors such as global bond market weakness and a likely slowdown in global trade in the wake of the protectionist trade policies of the incoming Trump administration in the US will also affect the ringgit, whose last annual gain was in 2012, BMI said

Ringgit fell 4.3 percent against the USD in 2016 after an 18.5 percent plunge in 2015.

According to BMI, the ringgit's fate also depends on how far and how fast the US Federal Reserve increases interest rates. A hike in rates in the US will trigger higher outflows from Malaysia and put the ringgit under added pressure, Bloomberg reported.

BMI, which has lowered its forecast for the ringgit, expects it to average 4.50 per USD this year and 4.40 in 2018, from 4.00 and 3.88 previously.

However, while BMI added that the ringgit is likely to cut some losses over the longer term, according to Asian Development Bank's lead economist on trade and regional cooperation, it would be a long shot to predict that the ringgit would recover by the third quarter of 2017

The Malay Mail Online in a report quoted Dr Jayant Menon saying that the US dollar is currently appreciating against most Asian currencies and it would be over-ambitious to expect the ringgit to buck this trend.

"An improvement in commodity prices in general, and oil, in particular, could stem the decline [of the ringgit to a certain extent]. But domestic uncertainties relating to fiscal and other conditions especially related to the stronger US dollar will likely limit the strengthening of the ringgit."

Even Lee Heng Guie, the Executive Director of Socio-Economic Research Centre, shared the same view, saying that the ringgit would remain under pressure in 2017.

On the other hand, though, Deputy Finance Minister I Datuk Othman Aziz said that the ringgit would rebound to its "fair value" of 4.10 against the USD between July and September

"This is a cycle and it is not the first time we are experiencing this, because we have seen the worst level of RM5.3 (to the USD) before," Bernama quoted him as saying.

"Some people say something worse will be coming, but we will first wait for Trump's swearing in. What you are hearing now is not a firm thing, it's just hearsay," he added.

Additionally, Treasury Secretary-General Tan Sri Dr Mohd Irwan Serigar Abdullah rubbished claims that the country is headed for an economic meltdown while claiming that it was the negative perceptions dragging the ringgit down

According to him, this perception was intentionally stirred by interested parties and needs to be corrected. He believes that if what he says is published, "the ringgit will strengthen you know. So you need to give positive statements again and again."

Among others, there was a perception that 1MDB and Najib's leadership were having a negative effect on the performance of the ringgit, he said.

The Treasury-Secretary-General blamed the alternative media and people who are writing certain things that are not true about the country.

"It’s all you know, the alternative media, some groups of people making noise as though the whole country is in trouble. It’s a small group, you know, writing this thing and you are reading too much on alternative media. You newspaper people also," he was quoted as saying.

He stressed that the "real economy is performing and we are managing it properly."

Treasury secretary-general Tan Sri Mohd Irwan Serigar Abdullah.

Image via Yusof Mat Isa/The Malay Mail Online