Apple Pay Vs PayPal: Which Digital Payment System Is Better?

In the 19th instalment of our weekly TECH TUESDAY column, we take a look at how Apple's new payment system compares to the Internet's biggest digital payment network, PayPal and how it hopes to change the way people make purchases both in-stores and in-apps.

Apple Pay, the Cupertino giant's new payment system, has been put up against PayPal. Who will win? Who will lose?

While PayPal has long held the monopoly on online payments, now with Apple Pay in the mix, it seems only fair that the two should be put head to head to see who has an upper hand here.

Apple Pay vs PayPal: Ease of Access

Everyone wants to be able to access their money and transfers easily, here are how the two contenders stacked up: PayPal is definitely easier to use, maybe its because we are more used to the functions. However, the main deciding factor was that Apple Pay is exclusive to iOS whereas Paypal is universal.

dailygadgetry.comAnd in terms of Ease of Use...

Apple Chief Executive Officer Tim Cook speaks during an Apple special event in Cupertino, California.

Image via bloomberg.comPaypal requires you to open the app, find the store and check in, whereas with Apple Pay all you have to do is position your phone between the payment point at the store and touch your finger to the sensor. With one vibration, your transaction is successful.

dailygadgetry.comApple Pay vs PayPal: Security

Recent security breaches will likely help adoption. Customers are becoming increasingly less willing to provide their credit card data to merchants. PayPal hides payment details from suppliers, and buyers like it that way. Apple will hide payment data from merchants, which can be a selling point.

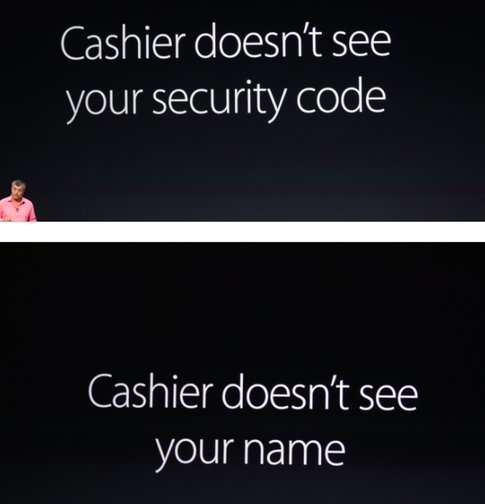

forbes.comOn 9 September, during their event, Apple played up consumer distrust, emphasising the security:

So when it comes to security between Apple Pay and PayPal, Apple Pay has an upper hand. Here's why:

Paypal stores personal information like credit card numbers and addresses on their system. Even though they promise that its heavily guarded, nothing on the internet is really ever safe.

dailygadgetry.comIt is more difficult to steal a fingerprint than other payment methods and in this case they’ll need: (1) your phone, and (2) your finger. For those worried about thieves cutting off their finger, the sensors are heat sensitive.

forbes.comWhen it comes to Apple pay, merchants do not see any information and your credit card details are given a unique device number which is encrypted. When its time to make a purchase, rather than using your credit card number, the device account number is used instead.

dailygadgetry.comApple also has no idea what you are purchasing and also offers a point system. The only way someone can access your Apple Pay information is if your phone is lost, but even then you can wipe it completely from another device.

forbes.comWhile the timing of the latest Apple security breach is not ideal, it's one of the most trusted companies in the world. And even though PayPal is easier to access, it may only be a matter of time before Apple Pay starts dominating the market controlled by PayPal.

Meanwhile, going by the buzz Apple Pay created, which was actually equivalent to the launch of the new iPhones, and that too when it is not available worldwide, it is safe to assume that the future of mobile payment looks very promising

Mobile payments are undoubtedly going to be the future of transactions. Earlier people were talking about traffic and now they are talking about traffic growing faster on mobile. Mobile is here and it’s happening, it’s a question of who will emerge as a leader in mobility.

iamwire.comAnd while PayPal has an almost unrivaled dominance in online payment systems, that doesn't mean its resting on its laurels, or that competitors like Venmo And Google aren't keen to try and snap up some of its customers and clients

Venmo is actually a subsidiary of PayPal, but is a good example of interest in mobile payments by PayPal, and thus the rest of the world. Mobile payments are probably the fastest growing part of online payment systems, with more than $250 billion estimated to have passed through mobile payments last year. Even that number seems paltry compared to the expected $700 billion or more in mobile payments in a few years. Whether or not PayPal co-opts ideas from Venmo or imposes its name on the popular app remains to be seen, but there's no question that Venmo is a side of online payments that is rising to prominence.

Google hasn't had quite the success with online payment systems as it has in other arenas. Much like its venture into social media, Google Wallet struggles to get much in the way of merchant or consumer interest. But a company like Google has other options in the form of acquisitions. Rumors abound claiming Google may want to acquire Square, or is even looking at buying PayPal itself. It could be the solution for what is currently a moribund field for Google.

Amidst all this, it is also worth noting that Twitter is teaming up with Groupe BPCE, one of France's biggest banks, to allow customers to transfer money via tweets

The move by Groupe BPCE, France’s second largest bank, by customers, coincides with Twitter’s own push into the world of online payments as the social network seeks new sources of revenue beyond advertising. Twitter is racing other tech giants Apple and Facebook to get a foothold in new payment services for mobile phones or apps. They are collaborating and, in some cases, competing with banks and credit card issuers that have run the business for decades.