Business Owners, Rejoice! You Can Now Use One QR Code To Accept Payments From Customers

Merchants no longer have to display countless QR codes on their counters.

Have you seen these pink QR codes around recently?

Malaysia's National QR is finally here for hassle-free and convenient digital payments! Thanks to DuitNow, this QR code payment accepts transactions from participating banks and eWallet providers in the country.

This highly benefits merchants, retailers, and small and medium enterprises (SMEs) as they no longer have to display countless QR codes on their counters, which can be confusing for consumers. All they need is one DuitNow QR code! :)

DuitNow QR is a game changer for both business owners AND paying customers

What makes DuitNow QR so convenient is it can be integrated seamlessly and securely into existing eWallet providers and banks. Business owners can rest assured that all QR payments made via DuitNow QR will be instantaneous, in other words, received immediately*!

*Subject to terms and conditions of your acquirer.

If you're a business owner, here's how DuitNow QR can greatly benefit you:

1. Use just one QR code for all payments, regardless of bank or eWallet

Whether you're running a barber business or you're a home baker, you can display one QR code to receive payment from customers. Merchants no longer have to display countless QR codes on their counters.

2. Gain access to more customers

Before this, customers may choose other shops because they prefer a particular type of payment. But since DuitNow QR accepts payment from most banks and eWallets, you open up your business to more opportunities, because customers won't have to worry about how they will pay you.

3. Save the hassle by having a single consolidated payment report

It can be a hassle if you have different reports coming from various apps provided by banks or eWallet providers. Tallying the numbers at the end of day can be tedious and stressful work due to the multiple reports and settlement cycles. Thankfully, with DuitNow QR, you'll view all your payments in one consolidated report, saving you time as a business owner.

4. Conduct contactless payments online

For merchants conducting their business from home, you can share your DuitNow QR code via messaging apps, or post it on your social media or e-commerce platform to make it easier for accepting payments.

Here is the list of currently available banks and eWallets that allow payments via DuitNow QR:

1. Alliance Bank

2. Alliance Islamic Bank

3. Ambank

4. Ambank Islamic

5. Bank Muamalat

6. Bank of China

7. CIMB Bank

8. CIMB Islamic

9. Citibank

10. Hong Leong Bank

11. Hong Leong Islamic

12. HSBC

13. HSBC Amanah

14. ICBC

15. Maybank

16. Maybank Islamic

17. OCBC Bank

18. OCBC Al-Amin

19. Public Bank

20. Public Islamic Bank

21. RHB Bank

22. RHB Islamic

23. ShopeePay

24. Standard Chartered Bank

25. Standard Chartered Saadiq

26. UOB Bank

This list is not exhaustive, as more eWallet providers and acquirers like BigPay, Boost, GrabPay, Touch 'n Go Digital, and more will be going live with DuitNow QR over the next five months.

With a majority of banks, eWallet providers, and acquirers in Malaysia being integrated into the DuitNow QR ecosystem, this allows merchants and retailers to streamline their business processes with a unified and modern payment collection system.

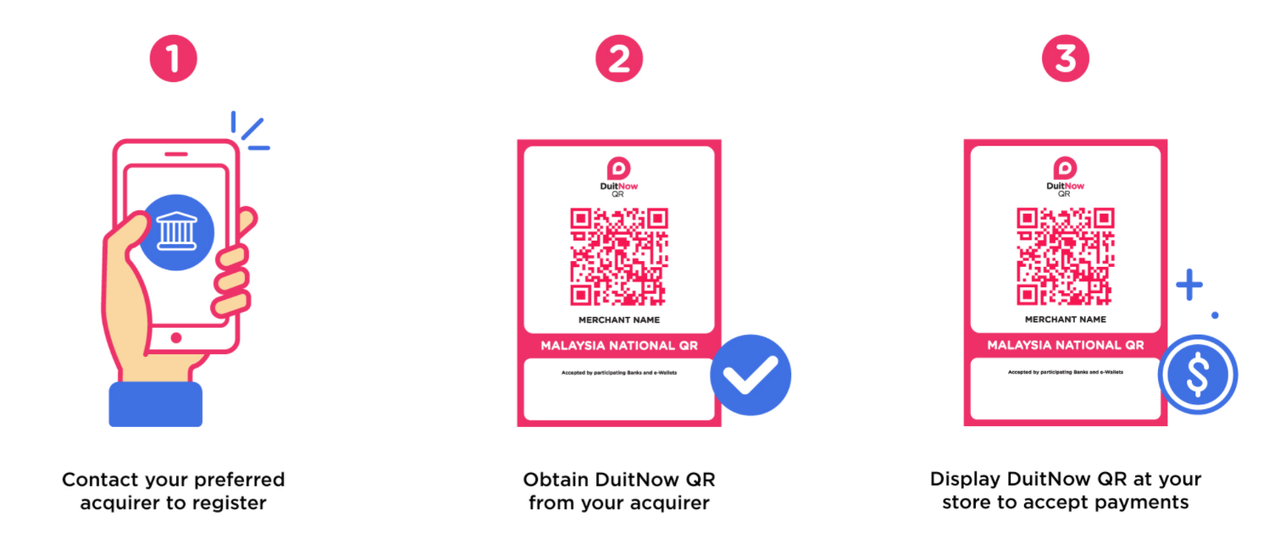

Setting up DuitNow QR for your business only takes three easy steps:

1. Contact your preferred bank/acquirer to register for DuitNow QR

2. Get your DuitNow QR code

3. Display it at your payment counters for consumers to scan and pay

DuitNow QR is the only #QRPayment method you'll need for your business. Find out more at their website here!