MasterCard's Gonna Allow You To Pay For Things With Your Face

So, how much is your face worth?

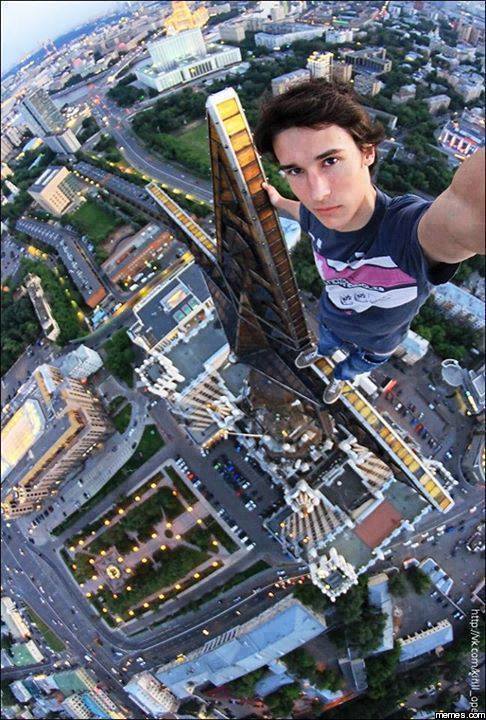

Millennials love taking selfies. We take selfies in the car, in the train, and in rare cases - on top of a 50-story building because #YOLO

Since we love our faces so much, MasterCard has taken the liberty to allow card holders to pay with - you guessed it - our faces!

Introducing the MasterCard's new ID Check security system. The feature which is still in the works allows card holders to pay for transactions through facial recognition.

So how does it work? It's pretty simple - when buying something in the store or online, choose facial recognition payment with the MasterCard app and blink!

When paying for something in the store or online, you can choose whether to verify your identity with a fingerprint or an image of your face. If you choose face, you just hold up your phone and blink. (This is so thieves can’t use a picture of you to dupe the system) That’s it!

gizmodo.com

gizmodo.com

According to CNN, MasterCard has partnered with numerous smartphone makers to make this idea a reality

To pull this off, MasterCard said it has partnered with every smartphone maker, including Apple, BlackBerry, Google, Microsoft, and Samsung. The credit card company is still finalizing deals with two major banks, so it wasn't ready to say whose customers will get this first.

cnn.comIt's pretty obvious that MasterCard is capitalising on this generation's loathsome selfie habits with this marketing stunt. However, alternative passwords like emojis seem to be the way forward - they're safer.

The credit company has yet to release any details on the availability of this feature. However, a pilot version will be available for 500 customers as a trial run.

The company is due to launch a pilot version of the program limited to 500 customers. Once it is final, the new capabilities will supplant the company's current SecureCode system that requires users to enter a password when shopping online with their card. SecureCode was used in 3 billion transactions in 2014.