Maybank Beyond Borders Lets You Make DuitNow Transfers & More Between M'sia & Singapore

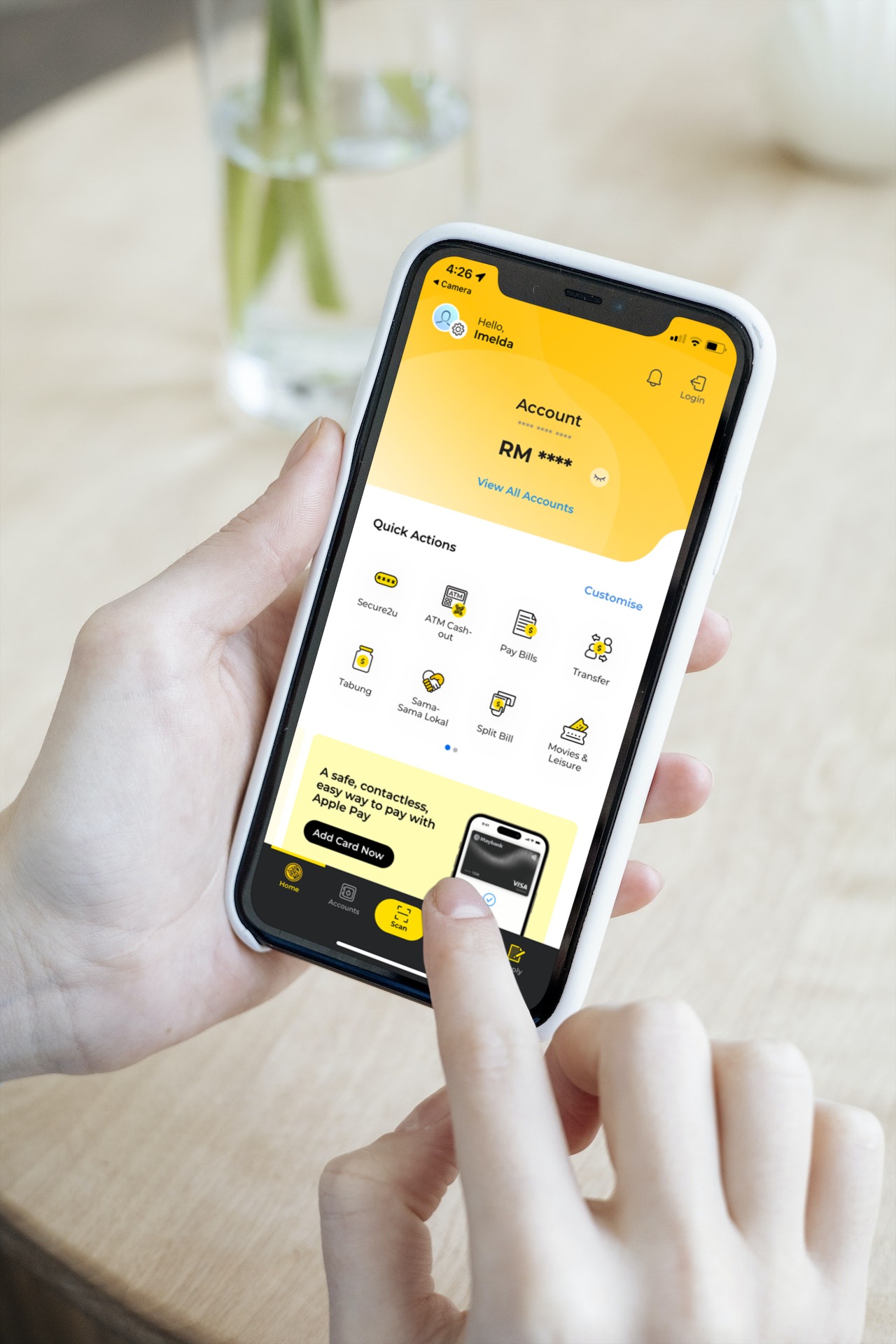

All of these can be done on the MAE app, whoa!

Always travelling to Singapore? Or do you have a loved one in the Lion City that you send money to?

Here's the good news — Maybank now has a new feature that offers fast, seamless banking between Malaysia and Singapore, yay!

Called Maybank Beyond Borders, this is in line with Maybank's efforts to become a strong regional player by easing and speeding up banking transactions and services, as well as offering more products between both neighbouring countries.

You can easily perform all these transactions on both the maybank2u website and the MAE app. Gone are the days of worrying about whether your transfers will reach on time!

1. You can now easily make cross-border transfers from Maybank Malaysia to any bank in Singapore with a low fee

In today's fast-paced world, we all have a natural tendency to seek fast, hassle-free transfers, so our time can be freed up doing other things. That's where the MAE app comes in!

And rest assured, there's no need to endure long waiting periods or be concerned about any potential fraud activities. With Maybank Overseas Transfer (MOT), you can now transfer money to ANY bank in Singapore! Your money will be instantly and securely transferred through real-time currency transfers.

The MOT feature is available from 10am to 6pm on weekdays, excluding public holidays and federal territory holidays. There is also a low service fee of RM10 per transaction, with no agent bank fee!

Ready for the convenience of MOT? Find the step-by-step guide here.

Additionally, you can now make use of the DuitNow Overseas Transfer feature to send money to Singapore, yay!

With just the touch of a button, you can send money instantly to Singaporean mobile numbers, NRIC numbers, or business registration numbers. So, whether you forgot to send money or simply need to make a hassle-free transfer to a Singaporean friend or colleague, Maybank has gotchu covered now. Talk about convenience!

2. You can view all your bank holdings from both countries in a single glance

One of the best features available is the 'Regional View' feature on the MAE app, which lets you view and monitor all your bank holdings in both countries at your fingertips. This is especially convenient when you're travelling or in a rush, and simply need to make sure that all your holdings are in check.

In fact, you can even look at your current and savings accounts, cards, loans, and wealth products across Maybank Malaysia and Maybank Singapore in a single glance!

3. You can instantly withdraw cash from Maybank ATMs with your Maybank ATM card

Although we're pretty much carrying little to zero cash these days, let's face it — there are times when we simply need cold, hard cash, especially if we're taking a taxi, eating at a hawker centre, or just stuck in a financial emergency.

Now, all you need to do is visit your nearest Maybank ATM in Singapore, and you'll be able to withdraw up to SGD3,000 (RM10,547.63)* per day with no additional service fee.

You'll be able to withdraw cash from the ATM from 6am to 12am daily.

*Converted amount accurate at the time of writing.

All in all, Maybank is now becoming a regional bank with the ability to connect your banking needs in both Singapore and Malaysia

Whether you are travelling to Singapore for a leisure trip, sending tuition money to your kids studying abroad, or making time-sensitive payments for your business, Maybank has eased the process of making swift and secure cross-border transfers.

It truly is convenience right at your fingertips!