[REVIEW] Top Apps To Effectively Help Manage Your Income And Expenses

In the fifth installment of our weekly column TECH TUESDAY, we're reviewing some of the top apps that help keep tabs on all your financial accounts: what goes in and what goes out.

Trying to manage expenses can be extremely tedious and time-consuming

Also, taking the time to track and analyze your income and where it's going is a very crucial element of managing your finances. It also help uncovers hidden money leaks that help you better allocate your resources, thereby ensuring you always get the most out your paycheck. And there are a panoply of options available to help you do you. Below, we take a look at some of the top apps available for both Android and iPhone.

1. To start off, Expense Manager (for Android) by Markus Hintersteiner is one of the best looking expense trackers

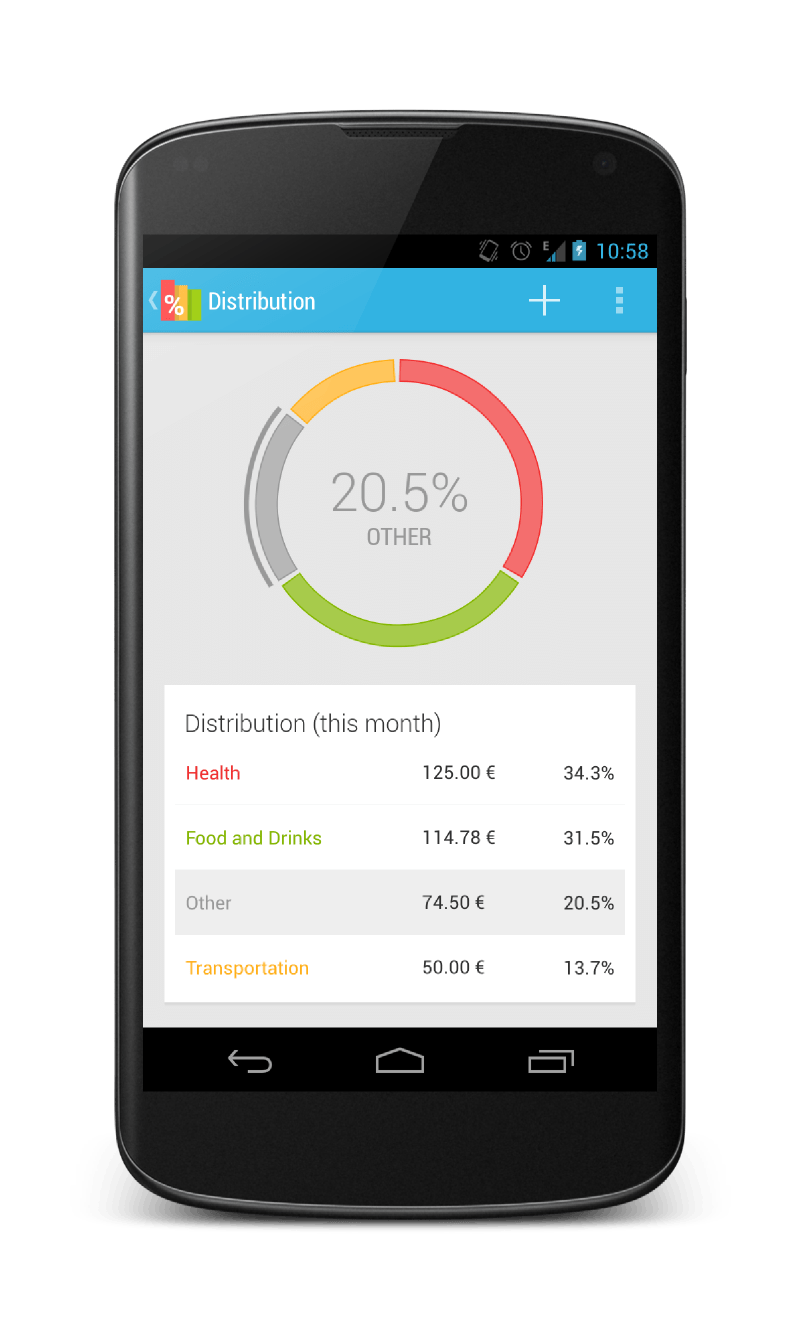

The app has 5 main sections. On launch you are greeted with an overview where you see how much you have spent this month in the various categories. The categories can be defined in the settings. You can also add a daily reminder for entry which is absolutely essential for an app like this.

You can set your monthly limit as well and there’s a small piggy bank on the overview that tells you how much you have left to spend. Navigation within the app can be done by swiping to the right. The history section lets you see all your entries across all the categories in descending order. You can edit any entry by tapping on it.

The distribution section has a nice circular chart that appears on the top colour coded category wise showing you how much you spent in each category. The statistics section has the lovely cards UI. You can see your monthly and daily performance in addition to a graph of your running versus overhead charges.

Adding an expense is very simple and can be done at any time by tapping the plus symbol on the top right. Each entry needs to have a category set and you can set any date and add a note to the entry as well. If you choose to cancel the entry, the entire entry page falls down like a card that has been swiped away allowing the app to slide in.

Expense Manager for Android is the best expense app on the platform complete with a great tablet UI and features modern apps have. It is available without ads for free on Google Play but the Distribution, Statistics and Income recording sections are available via a one time in app purchase of $3.

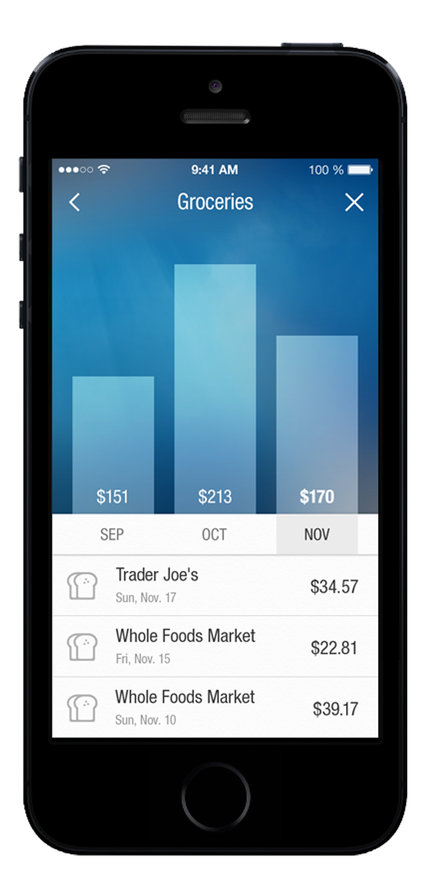

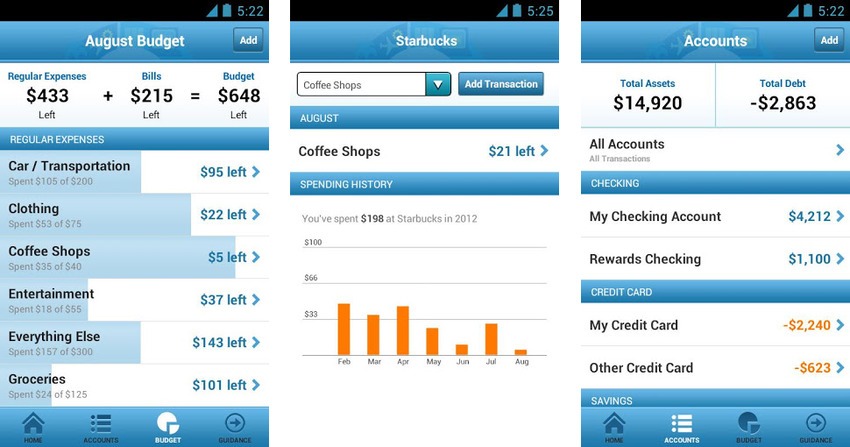

2. Mint.com, an automated money-tracking service. It offers a good mix of money management tools, and is very easy to use.

If you want to get a better sense of where your money is going, keep tabs on your net worth and chart it all with pie and bar charts for different time periods, then Mint is still the most comprehensive tool on the market.

With the Mint app, you can't move money around or make deposits or payments. But you can track all your accounts—banks, credit cards, loans, investments—in one place. You plug in the identifying information for any accounts you want to include, and the app will track all your activity and balances in all those accounts.

wsj.comThe Mint app's real power, though, comes from its analytical tools. Drawing on all your financial activity, it will, for instance, organize your spending into simple categories such as restaurants, gas, groceries, etc. The tablet version even offers multicolored interactive historical pie charts. You can also set up a budget based on those categories and keep track of how well you stick to it and where you overspend.

The app will alert you if you're going over budget, and it can warn you if any of your balances are low, if there are bills to be paid, or if there is any unusual spending. On the investment front, the iPad app can show your latest asset purchases and the account's latest value.

wsj.comMint users, estimated at two million by the company, can now track their spending, income and net worth via the mobile app, but people will inevitably find something that doesn’t quite work for them. The app requires maintenance because its categorization is not flawless. The app is available for Android and Apple.

3. Next on the line is HelloWallet, a free app, but to use it you need an account with HelloWallet.com, which costs USD8.95 a month

Like Mint, HelloWallet can slice and dice your financial information and present it in helpful charts, and help you set goals and track your progress. HelloWallet also prides itself on offering suggestions based on the behavior patterns of other customers who have similar spending patterns.

wsj.comHelloWallet offers consumers tools to track their finances on web and mobile, initially on iPhone before launching on Android in summer 2012. On the app, users could view budget details, their cash balance, as well as the company’s unique location-based spending guidance, which used the phone’s GPS to determine how much you had left to spend at a particular venue, based on how much you had budgeted for that spending category (e.g. shopping, dining, etc.)

One nice touch: Customers typically receive a subscription to HelloWallet through their employer, the company says, which means it can sometimes tell if they're paying for a gym membership their employer otherwise would offer for no charge.

Some people don't want to give such free access to their financial information to a third party, which is why many other apps don't connect to your accounts and so can't as easily sort and analyze your financial data.

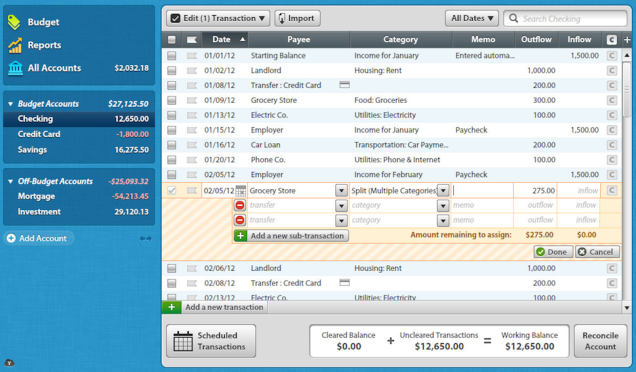

4. You Need A Budget is a budgeting program that requires you to enter or import everything manually, though much of that can be done by syncing the program with its app

If you are reluctant to hand over passwords to your financial accounts, this could be a good option. You can give it a test run for 34 days. After that, it will cost USD60 for the program.

If you are looking for an application that also manage your investments, as the name implies, this isn’t it. There is no feature to manage your investment and retirement accounts. It sole purpose is to help manage your budget. And, in this case, your budget as it relates to your month-to-month income and expenditures.

investorjunkie.comThe app itself is available for Windows and OS X, with mobile versions for iOS and Android. Since the app runs locally, you have access to your financial information offline if you need it, and YNAB still imports transactions from your banks, credit cards, retirement funds, and other accounts to deliver a single-pane view of your financial health.

lifehacker.com

lifehacker.com

The app guides you through setting financial goals and sticking to them, helps you reconcile accounts when your numbers feel off, and walks you through the budgeting process in a simple, understandable way. The idea behind its method: Give every dollar a job. The program does seem geared for dedicated, disciplined self-starters who don’t mind spending a chunk of time each week going over their spending.

YNAB is ideal for someone who is just looking to create a budget, whether it’s to manage monthly cash flow, or to help you get out of debt. If your finances are fairly simple, and you just need a little help with planning YNAB can be a great tool.

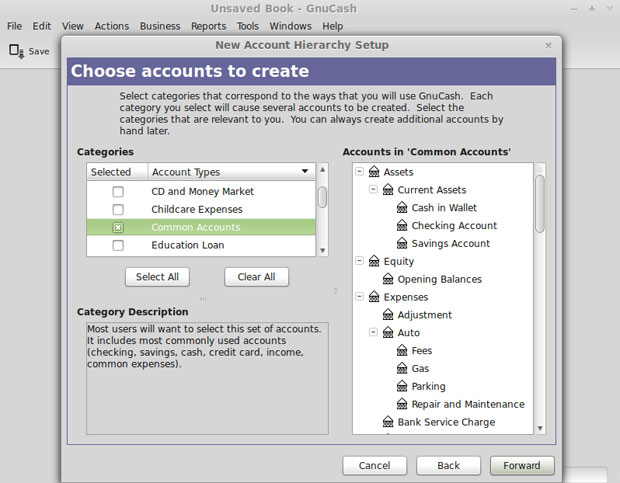

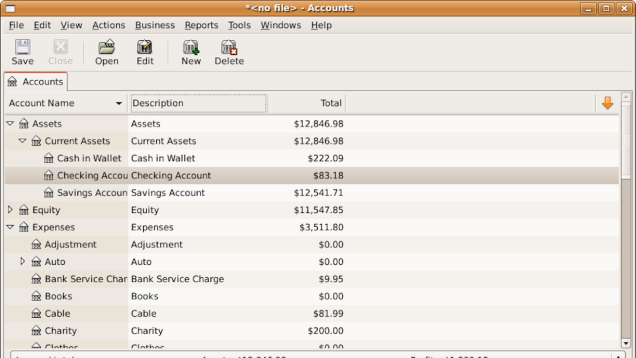

investorjunkie.com5. GnuCash, for anyone who would rather have an open source, free alternative to tracking their finances that doesn't necessarily require a connection to their banks or an external service to work

It's completely cross platform, available for Linux, BSD, Solaris, OS X, and Windows systems, so fair bet there's a version for you.

lifehacker.com

lifehacker.com

It tracks bank accounts, investments, income and expenses. You can use GnuCash just to handle your checking and savings accounts -- but it is capable of doing much more. GnuCash is based on professional accounting principles to ensure balanced books and accurate reports. If you venture beyond basic banking registers, you might find its double entry bookkeeping procedures a bit intimidating. In short, every transaction must be entered as a debit in one account and as a credit in the same amount in a corresponding account.

One of GnuCash's most significant improvements is the ability to save financial data in an SQL database using SQLite3, MySQL or PostgreSQL. Not all money applications cater to users' needs for customizing graphs and reports to the extent that GnuCash does. For example, an integrated module displays graphs of your financial data in bar charts, pie charts or scatter plots. A full suite of standard and customizable reports includes balance sheet, profit and loss and portfolio valuation.

lifehacker.com

lifehacker.com

The app supports split transactions, helps you reconcile accounts, and can create detailed reports and graphs to help you understand what you're spending money on and when. GnuCash is more than a simple checkbook register, although it can be used for that purpose. Its real power is in the features supporting small business use and managing multiple accounts. Its basic features are intuitive, but if you don't have a bookkeeping background, be prepared to spend some time with the user guide in order to fully appreciate its advanced capabilities.

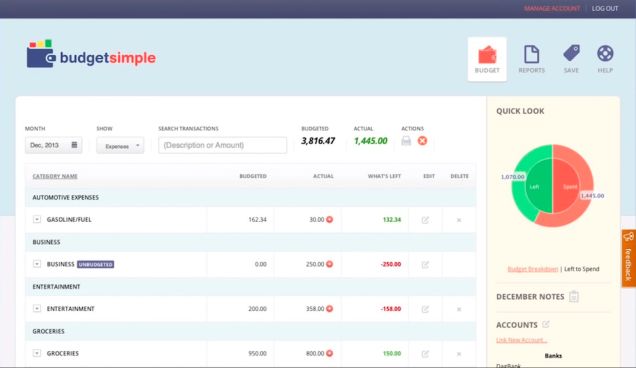

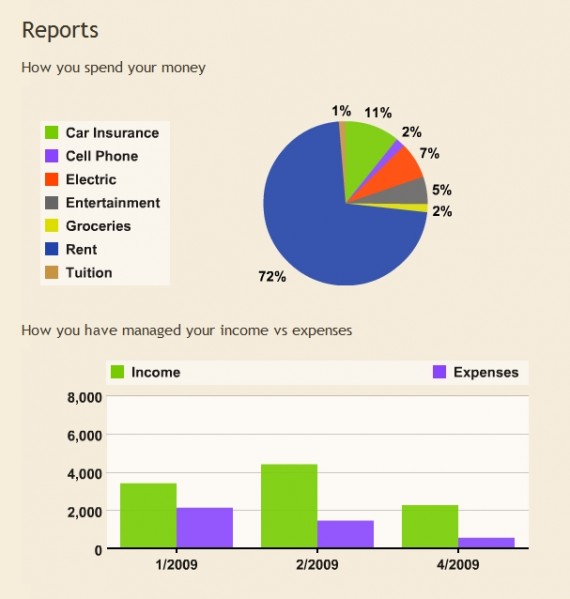

6. Last but certainly not the least, BudgetSimple is a free budgeting and personal finance tool that focuses squarely on making sure you have a budget that works for you

The tool will analyze your finances and spit out a budget planner that's packed with suggestions for where you can save money, trim your spending, and increase your savings, all with the goal that you don't have to live paycheck to paycheck anymore.

lifehacker.com

lifehacker.com

BudgetSimple aims to make the process as easy and approachable as possible, and promises that an hour with the tool will give you a better understanding of where your money is going. You can enter your expenses manually if you want, or connect it with your bank to auto-link accounts.

Once you have your budget and you're all set up, it's a matter of keeping your finances in check, and the tool helps you with that as well. BudgetSimple is a webapp and completely free, but if you want mobile apps or the option to fully link your bank accounts, you'll need a $5/mo premium account.

lifehacker.com

lifehacker.com

Users have praised its simplicity and its focus on creating a no-nonsense, sustainable, and sensible budget that they can live by. It's noted for it's a straightforward tool, and it does a lot of things that some of the other apps charge money for—and the graphs and statistics do a great job of explaining where your money is going.

businessinsider.in

businessinsider.in

BONUS: If you're more of an old-school hands-on approach type person, consider using a custom-designed Excel spreadsheet

Not only it will force you to actively manage your personal finances, it will also give you more control than using a web-based site like Mint. True, a spreadsheet is not as sexy as automated money-tracking web-based applications, but it's one of the most common and at the same time tried-and-true method experienced by many since years.

Here are some quick tips: If you’re just starting out, it’s important to make sure you set aside about an hour or so at least once per month for reviewing your checkbook, receipts, and/or credit card statements and recording your expenses in your spreadsheet. By frequently updating your financial spreadsheet, you’ll not only be able to quickly catch any potential errors on your billing statements, but you’ll also keep from falling hopelessly behind on your record keeping duties.

lenpenzo.comIf you’re not an expert in Excel, there’s no need for despair; Microsoft has scores of budgeting worksheet templates for your to download and modify to suit your needs. In fact, their personal budget worksheet template has been downloaded over 3.6 million times.

If you’ve never used a spreadsheet, don’t be intimidated — they’re not hard to use! Yes, spreadsheets are extremely powerful tools for those who know how to take advantage of all they have to offer. But for most folks, the basics needed to properly track expenses can be learned in less than 30 minutes.

lenpenzo.comIn the end, it doesn't really matter what tool you use as long as it works for you. What's important is your commitment to actively manage your finances.