Touch 'n Go Teams Up With Alipay. Here's How The Partnership Will Change The Way We Pay

The two companies have joined forces to introduce a new e-wallet payment platform in the near future.

Touch 'n Go has partnered with Alibaba's financial arm Alipay to introduce a new e-wallet payment system in the country

On 24 July, Touch 'n Go, which is a subsidiary of CIMB Group Holdings Bhd, entered the joint venture with Alipay to spearhead the development of a new mobile e-wallet platform for payments in Malaysia.

"Touch 'n Go's leading position combined with Ant Financial's Alipay capabilities will allow all Malaysians to participate and access secure payments and digital financial services for the long term," said CIMB group chief executive officer Tengku Datuk Seri Zafrul Aziz as quoted by The Edge Markets.

What is an e-wallet?

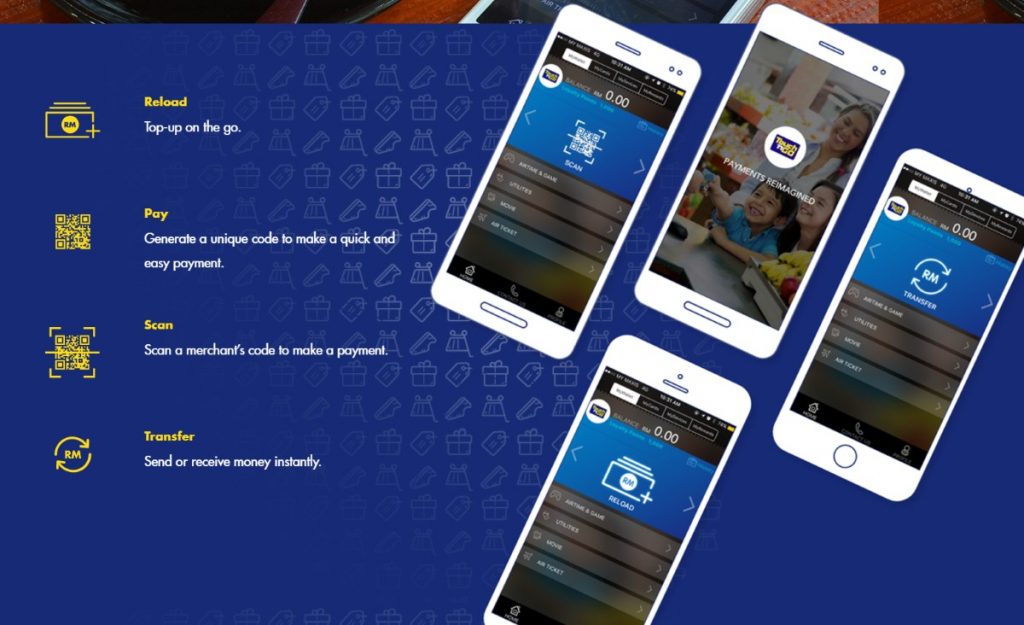

An e-wallet is a cash-free payment platform that is typically made up of an application in your mobile phone. The wallet is tied down to an account which you can top up through banking facilities. To make a transaction, you'd need to scan the app's QR code on the merchant's point of purchase (POS) terminal.

Alipay is one of the most popular e-wallet payment methods in the Asian region. According to The Star Online, it's currently accepted in over 80,000 merchants in 70 countries.

There's a difference between the Touch 'n Go cards that we commonly use and the e-wallet

The platform is not the mobile extension of the usual TnG cards that many of us own. In fact, they are two separate products.

You will not be able to utilise the credit you have in your TnG card through the e-wallet. Lowyat.net noted that the platform can't be used to pay for public transportation fares, toll charges, and parking payments.

So what can the platform be used for?

The platform can be used to top-up prepaid accounts, buy movie tickets, book a hotel, and transfer funds from one user to the other.

Additionally, the service also has its own loyalty programme where users can redeem rewards through points that they accumulate from purchases.

With this partnership, Touch 'n Go is hoping to introduce the convenience of e-wallet to every merchant in Malaysia, including pasar malam vendors

"Our vision is to introduce this cashless payment system deeper at the community level, not just at the city centre or shopping malls, but also at retail outlets close to the community. We will be launching this platform and we will see the reaction from the users by then," Touch 'n Go chief executive officer Syahrunizam Samsudin told Bernama.

Malaysia will be joining the likes of China and India in adopting e-wallets

In China, almost everyone uses Alipay or WeChat to pay for transactions. The New York Times reported that almost everyone in major Chinese cities is using a smartphone to pay for just about everything. At restaurants, waiters will ask if you’d like to pay with WeChat or Alipay - the two smartphone payment options - before bringing up cash as a third, remote possibility.

Currently, about five million merchants in India are using Paytm, an e-wallet previously backed by Alibaba.

The service is currently undergoing several evaluation processes before it’s introduced to the public

A trial project for the platform was launched in Taman Tun Dr Ismail a few months ago in collaboration with the residents association, along with retailers, restaurant operators and market traders. The response had been positive.