How Did I End Up Paying So Much For My Flight?!

The airline isn't the only one taking a bite out of your airfare.

Chances are, that flight ticket was the most expensive part of your overseas holiday. Price wars and flash sales have been great respite, but globally, the price of flying is increasing.

There are many factors that determine the price of a flight ticket, including:

2. Flight Distance

3. Competition

4. Timing of Purchase

5. Timing of Flight

6. Government and airport tax

7. Airline capacity and routes

8. Empty Middle Seats

9. Travel agency fees

Competition has typically been good news for consumers as airlines enter price wars to offer the most competitive prices. In the US and Europe, airlines are consolidating, which means less competition and more pricing power.

A wave of consolidation that started in 2008 has left four U.S. airlines—American Airlines, Delta Air Lines, Southwest Airlines, and United Airlines—controlling more than 80 percent of the domestic air-travel market.

cnbc.comThanks to bankruptcies and mergers, there are now only four major airlines in the US (soon to be three when American merges with US Airways). In Canada, there are two. In Europe, KLM and Air France are now one company, and Lufthansa has its hands in many smaller airlines. As airlines have partnered up, merged, or gone bankrupt, the incentive to create low fares to win your business has mostly disappeared. Less competition means less need for cheaper prices.

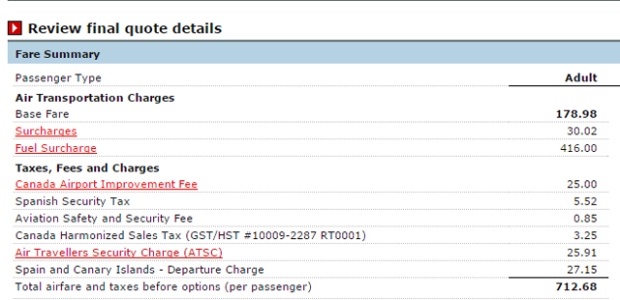

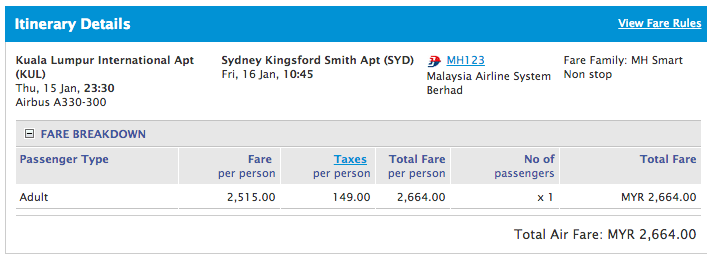

If you drill into the breakdown of an airfare, you would notice a long list of taxes and surcharges that are being transferred to customers. In fact, these extra charges are sometimes even higher than the base fee.

American airlines have a long list of government tax that are imposed:

- September 11th Security Fee of $2.50 (up to a maximum of $10 per round trip)

- Passenger Facility Charge of $4.50 per segment (up to a maximum of $18 per round trip)

- US Federal Domestic Segment Fee of $3.70 per segment

- US Travel Facilities Tax of $8.20 per direction (only applicable to flights to/from Alaska and Hawaii and the 48 contiguous US states or between Alaska and Hawaii)

- US Immigration User Fee of $7

- US Customs User Fee of $5.50

- US APHIS User Fee of $5

- US International Transportation Tax of $16.30 per arrival or departure

- Foreign government security/tourism/airport/international transportation taxes and fees of up to $290 (varies widely by destination and fluctuates with exchange rates)

Governments charge a fee for entering and exiting the country while airports impose security and passenger services fees, all of which drive up the airfare

And then there is the fuel surcharge. Jet fuel is the highest operating expense for the airline industry, and it is transferred to the passengers via an additional surcharge.

Mona Aubin of the International Air Transport Association, the trade association for the world's airlines, told CBC News that "fuel is the largest category of operating expense for the industry, representing around 30-33 per cent of industry operating expenses." Theoretically, such a fee—which can easily add $500 or more to the total cost of an international round trip—is instituted to help airlines cover their added expenses during periods when fuel is extraordinarily expensive.

Whether or not an airline has a fuel surcharge depends on its business philosophy, says David Tyerman, airline industry analyst for the wealth management firm Canaccord Genuity. He says for airlines with a surcharge, "they think they're making it clear that fuel is a big part" of the ticket price, with the implied message, "'we're not just trying to gouge you, we're actually trying to cover a higher cost.'" For airlines without a surcharge, Tyerman says the marketing message is, "I just want to make it as simple as possible for the customer, I'm just going to charge a single ticket price."

Many have questioned why fuel surcharges remain pricey despite a drop in global oil prices. Besides flight distance, the fuel surcharge is influenced by market conditions, competition, currency strength and even bilateral agreements between countries.

Fitzpatrick says "competitive and market conditions, and in some cases international air bilateral agreements between countries" also influence the amount of the fuel surcharge.

But that is not the main reason why the price of air tickets fluctuates. Airlines are actually strategising ticket pricing to appeal to both big-money businessmen and time-flexible holidaymakers to sell all the seats on a flight.

Prices go up and down for many reasons. No one can really predict when or if a price will change. Only the airline knows that. But there are four things that drive prices: competition, supply, demand, and oil prices. The first and last items are the ones that really affect prices the most.

Together, those four things all affect a lovely thing called load factor. Airlines want to fill their planes and maximize profits, and they do this by calculating a plane’s load factor. Essentially, this is the percentage of seats sold on a flight. They want this number to be as high as possible. Airlines tend to manage their load factor by constantly changing the price of tickets to fill the plane and get maximum revenue. If the load factor is low and demand is low, an airline will increase the availability of cheap fares. If the load factor is high and demand is high, the airline will raise prices.

In the airline industry, there are two types of passengers: business travelers and leisure passengers. Business travelers are flexible on price (the boss is paying) but not on dates. Leisure travelers aren’t flexible on price (the cheaper, the better) but are on dates. Airlines are constantly trying to strike a balance between these two types so they can make a profit. Airlines know that a certain number of people will book far in advance if they can find a decent price. Airlines also know that they need to hold a certain number of seats for business travelers who will book last minute and pay more. Ticket prices jump up and down based on the demand for seats from these two types of passengers.

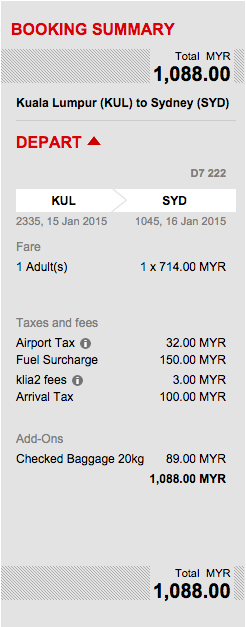

Low-cost carriers cannot avoid transferring third-party fees to the consumers, but they have been able to keep prices low by reducing frills, ensuring high aircraft utilisation, streamlining operations, and using secondary airports

AirAsia can consistently deliver low fares as the business model keeps costs low and efficiency high.

For starters, an airline makes money when the aircraft is flying, not when the aircraft is parked. AirAsia's aircraft is kept flying as much as possible with a 25-minute turnaround time compared to a full-service carrier with a one-hour turnaround time. They focus on getting passengers from point A to point B, eliminating frills such as free food and refreshment to keep the base fare as low as possible. By consistently using a single type of aircraft and standard operating procedures, the cost of retraining pilots, flight attendants, engineers and mechanics is also eliminated.

Besides that, low-cost carriers fly to and from secondary airports, such as klia2 as opposed to KLIA, as operation costs are much lower than major airports. A point-to-point network and lean distribution reduce dependency on travel agents and other airlines for connecting flights, all of which are cost-cutting.

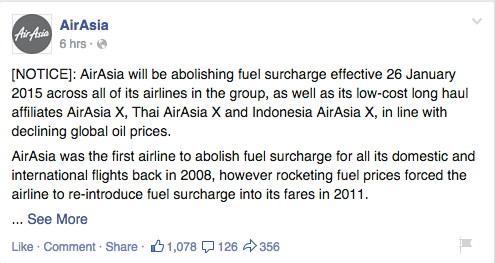

While the price of global airfare might not dip anytime soon, some relief may be in sight. AirAsia will be abolishing the fuel surcharge in line with declining global oil prices.

To introduce this new measure, AirAsia has launched a 'No Fuel Surcharge' campaign to offer ever lower airfares for flights booked from 26 January 2015 to 1 February 2015. The budget airlines is offering consumers a chance to buy lower than usual flight tickets during this period as all fares will consist of only the base fare, administration fee and airport tax.

For more info and to book a flight, see here.