Everything You Need To Know About Affordable Housing Schemes (Part 2)

In total, there are eight affordable housing projects available in Malaysia.

In Part 1, we simplified the many different housing initiatives run by different govt agencies.

Here in Part 2, we list down more details of each type of affordable housing available in Malaysia.

List of affordable housing projects:

1. Skim Perumahan Rakyat 1Malaysia (PR1MA)

2. Skim Perumahan Mampu Milik Swasta (MyHome)

3. Perumahan Penjabat Awam 1Malaysia (PPA1M)

4. Program Perumahan Rakyat (PPR)

5. Rumah Mesra Rakyat 1Malaysia (RMR1M)

6. Rumah Mampu Milik Wilayah Persekutuan (RUMAWIP)

7. Rumah Selangorku

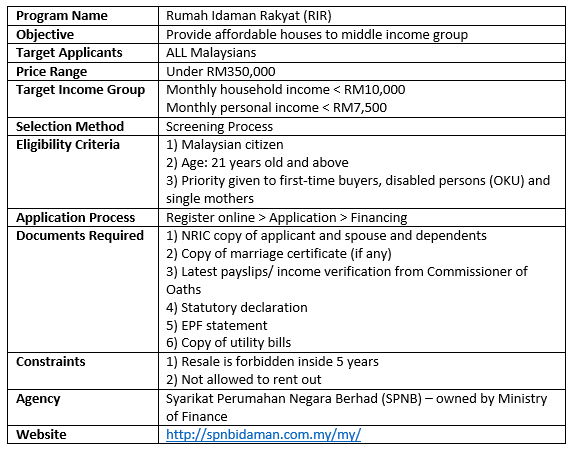

8. Rumah Idaman Rakyat (RIR)

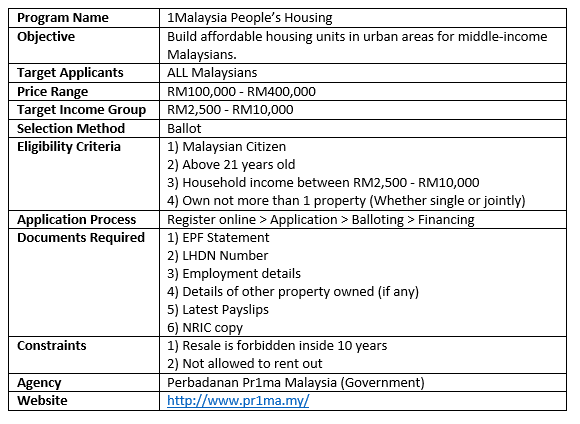

1. Skim Perumahan Rakyat 1Malaysia (PR1MA)

PR1MA is perhaps one of the most popular affordable housing projects that are aimed to benefit middle-income households.

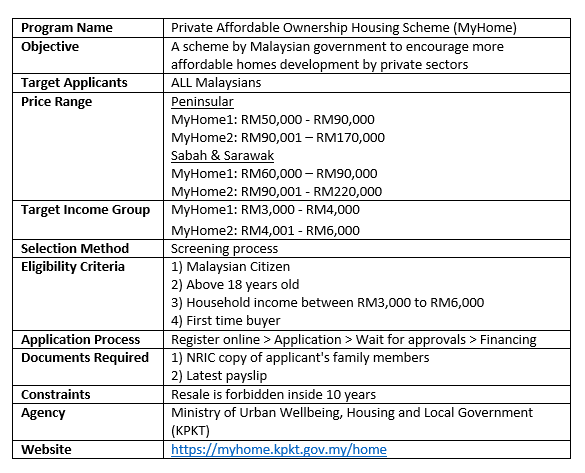

2. Skim Perumahan Mampu Milik Swasta (MyHome)

This scheme is meant to encourage the private sector to build more affordable homes.

Private companies that collaborate with MyHome will offer two categories of houses: MyHome1 and MyHome2.

The main differences between them are the size and price of the houses.

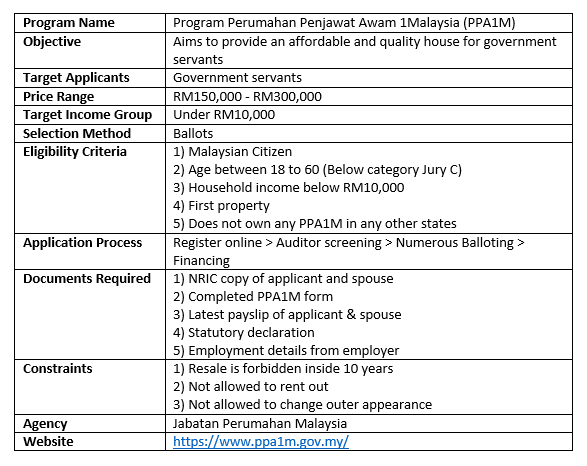

3. Perumahan Penjawat Awam 1Malaysia (PPA1M)

PPA1M is a affordable housing programme that solely benefits civil servants.

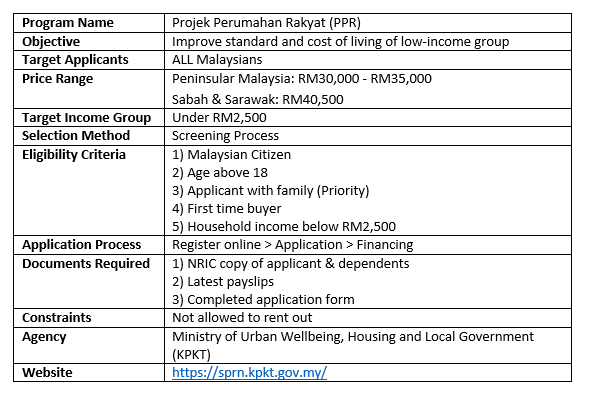

4. Program Perumahan Rakyat (PPR)

PPR is a low cost housing project targeted to low-income household.

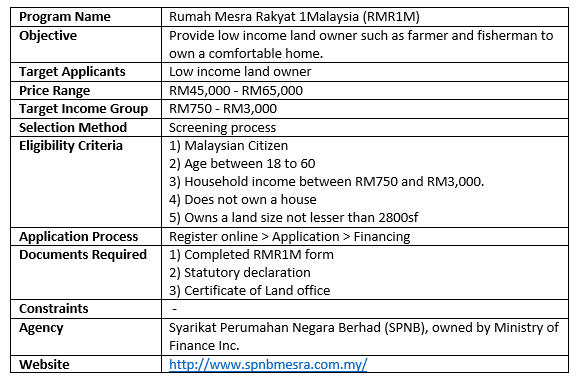

5. Rumah Mesra Rakyat 1Malaysia (RMR1M)

RMR1M is targeted to low-income household.

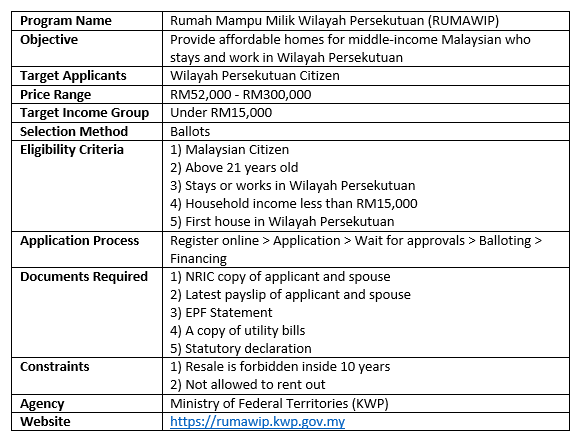

6. Rumah Mampu Milik Wilayah Persekutuan (RUMAWIP)

RUMAWIP is targeted to both low- and middle-income group in Federal Territories (Kuala Lumpur, Putrajaya and Labuan).

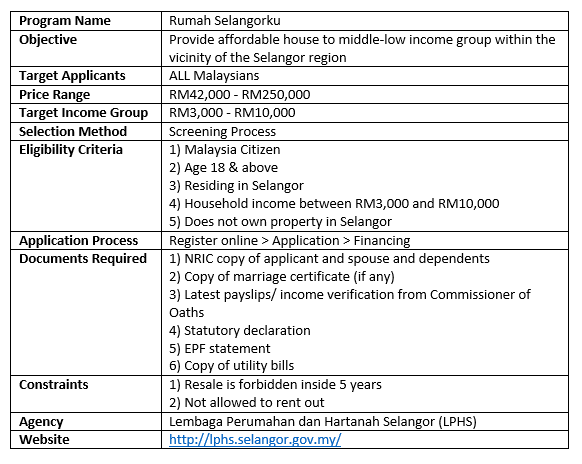

7. Rumah Selangorku

Rumah Selangorku is targeted to both low- and middle-income groups in Selangor.

Conclusion

Having implemented so many affordable housing programs, our government has shown an incredible effort to tackle affordability problem in Malaysia.

But did you know that the onus is still on you to secure a housing loan from banks even if you successfully balloted for one of these programs?

Worry not! You can always make use of Loanstreet’s loan eligibility checking service to find out your chances of successfully getting a loan for free!