Najib Assures The Rakyat That EPF Withdrawal Age Limit Will Remain At 55

In response to the rakyat's concerns regarding EPF's proposed initiatives to improve the current pension scheme, PM Najib makes it clear that the withdrawal age limit is to be retained.

Prime Minister Datuk Seri Najib Razak has affirmed that members of the Employees Provident Fund (EPF) will retain their right to withdraw from their retirement savings at the age of 55

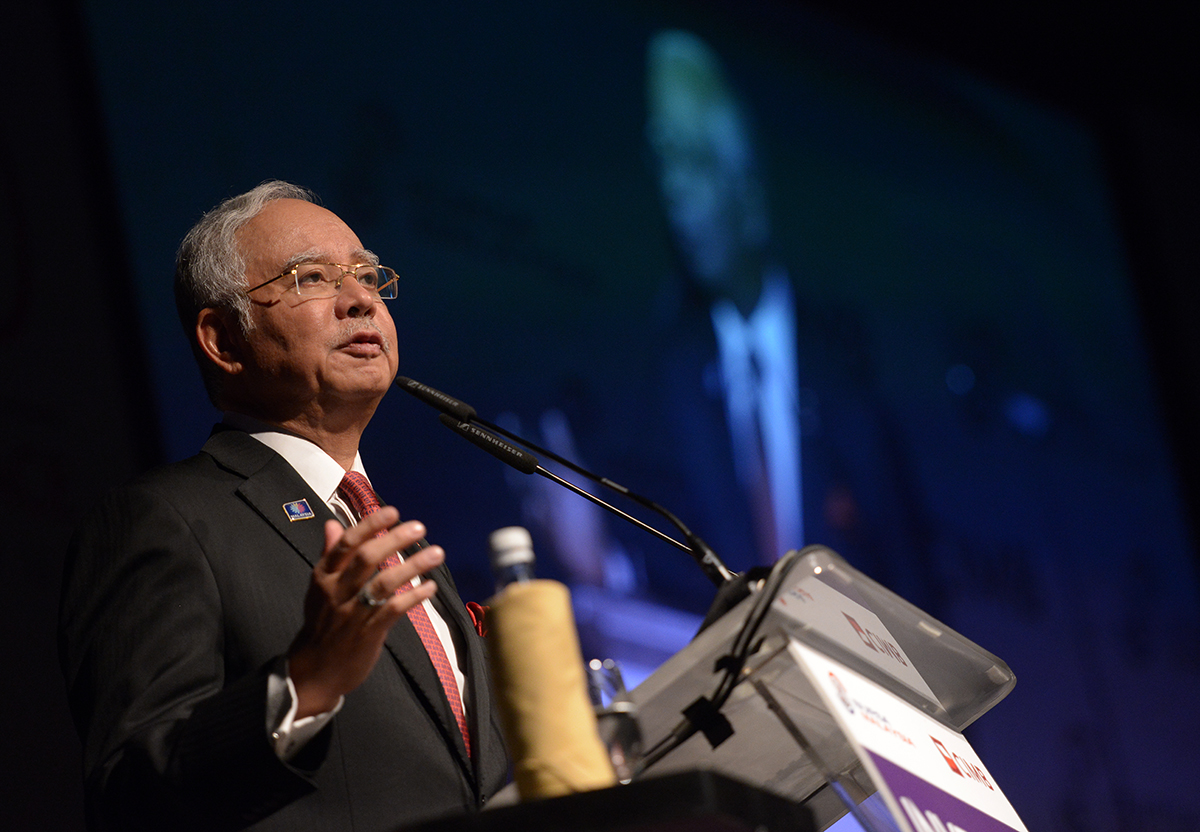

“I want to assure the rakyat that EPF members will retain their right to withdraw at the age of 55," he said during his keynote address at Invest Malaysia 2015 in Kuala Lumpur this morning.

"The EPF will ensure that any new enhancement will only apply to new contributions if members decide to work beyond the age of 55. This strikes a fair balance between the rakyat's expectations to their hard-earned money at the age of 55 while protecting them if they retire at the age of 60."

"This government always listens to the views of the rakyat. And it is clear that the vast majority of EPF members, while understanding the importance of retirement savings at the age of 60, want the right to use their retirement funds at the age of 55," he added.

The Prime Minister's statement was made in response to the people's concerns over EPF's proposal to increase the full withdrawal age limit from 55 to 60 in its 2014 annual report two weeks ago

When EPF first announced its intention following its 2014 annual report announcement two weeks ago, it said it would initiate a public consultation on the move prior to making any decisions.

However, this announcement was met by uproar from the public, particularly via social media, most of whom were and still are, against increasing the full withdrawal age limit.

EPF chief executive officer Datuk Shahril Ridza Ridzuan said the deliberation was based on the fact that on average, people exhausted their retirement savings within 3-5 years after a full withdrawal from EPF.

"Roughly 70% of people who withdraw their retirement savings in full will essentially deplete the money within three to five years’ time. Malaysians now make the withdrawal first (at 55) before actually retiring (at 60), and we are looking at this issue for the right policy response," Shahril told a media briefing on April 10.

Before making a decision, however, EPF said that it would initiate a public consultation exercise to gauge the public's responses. Hence, on 20 April, EPF presented four new initiatives in improving its current scheme:

2. Maintain the current age for full withdrawal at 55.

3. Extend dividend payments for contributors who choose to maintain their money in the fund, from age 75 to 100.

4. Introduce a Syariah-compliant retirement savings plan.

More details on the initiatives are available here.

EPF contributors are then given two weeks - from 21 April to 5 May - to provide their feedback and opinions on the proposed initiatives via an online survey on the EPF website

"EPF encourages members to participate in this discussion to ensure a comprehensive decision among EPF members," said the government agency in a statement.

Information on the EPF scheme enhancements can be obtained through the myEPF website and survey participation is via the i-Akaun.

For those who have yet to register for their i-Akaun, they can obtain the activation code at any one of the 67 EPF branches nationwide, EPF kiosks or contact the EPF Call Centre at 03-8922 6000.

Response to the survey has been encouraging, with more than 50,000 members having recorded their feedback since the public consultation exercise was launched two days ago

"In just two days of the online consultation process that was recently set up, more than 50,000 Malaysians have taken part and given their views.

"It is already the largest ever public consultation carried out," Najib said.

However, the Congress of Unions of Employees in the Public and Civil Services (Cuepacs) are of the opinion that the online survey is irrelevant as it is obvious that many are not in favour of the proposal

Cuepacs resident Azih Muda said an open meeting between EPF and interested parties such as workers and employers would have been more suitable.

“It is obvious many do not agree with the proposal, EPF need not carry out the survey,” he said at a media conference here yesterday.

Azih said Cuepacs was firm on its stand that the proposal would cause retirees greater financial hardship with existing commitments such as house instalments and other expenditure.