A Malaysian's Last-Minute Guide To Filing Your Taxes

The deadline for filing income tax returns is 30 April 2013. That's really soon. Your parents are sending you reminders and the coming elections is robbing you of the urgency. Here's an easy last-minute guide to filing your taxes and getting tax reliefs. Share this if this was useful to you!

How do I know if I'm taxable?

If you no idea how to files you taxes, have no fear, the " Malaysian's Last Minute Guide To Filing Your Taxes" is here!

Image via financetwitter.comYou are, if you earn more than RM29,775.00 per year (about RM2,480 per month) including all benefits, allowances, bonuses, overtime and commissions

If you earn less than RM29,775.00 per year, you don’t have to open a tax file and should not be paying any tax.

What's my deadline for filing taxes? Which form do I fill?

The types and categories of forms, general date of their availability and their due dates for submission by Malaysian Taxation 101.

Image via malaysiantaxation101.com30 April 2013 for individuals without business source. You fill up Borang BE.

30 June 2013 for individuals with business source. You fill up Borang B.

3o June 2013 for partnership. You fill up Borang P.

What do I need to prepare before filing my taxes?

Form EA/EC: from your employer which tells you how much you have earned and how much tax they have paid on your behalf.

freemalaysiatoday.comBorang BE or B? Your source of income will determine which form you have to fill up. You can now also do this online at www.hasil.gov.my.

Receipts: keep records for 7 years from the date of filing so don’t throw away any receipts or evidence of tax reliefs.

freemalaysiatoday.comWhat's the best last-minute way to file for income tax return?

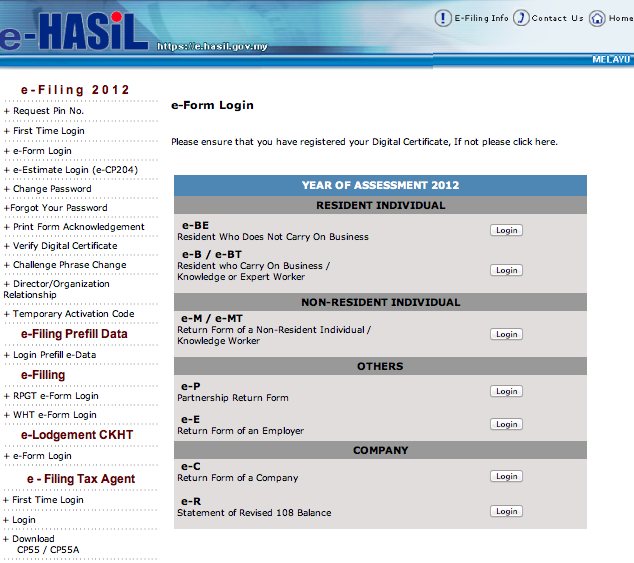

LHDNM e-Filing services allow you to submit your Tax Return Forms electronically via the internet. This service is available for FREE. Initially, this application was introduced to corporate taxpayers in 2003 and later it was expanded to individual taxpayers in 2004.

Image via imgur.comCLICK HERE TO ENTER THE e-FILING WEBSITE.

hasil.gov.myFor first timers, you have to obtain PIN number and register for e-Filing. PIN number can be obtain from Tax Return Form, nearest LHDN branch, mail, fax or e-mail.

You have to provide the following details and documents for PIN number application: (1) Tax Reference Number (2) Latest Address (3) Copy of IC (4) Telephone Number.

For email application, send all 4 required documents to [email protected]. Use your own email address as application for PIN number through third party e-mail will not be entertained.

After first time login, you do not need to register again for subsequent year tax return. Just remember your password and continue to complete the form only.

The quickest way and simplest way to file your taxes is via e-filing (https://e.hasil.gov.my)

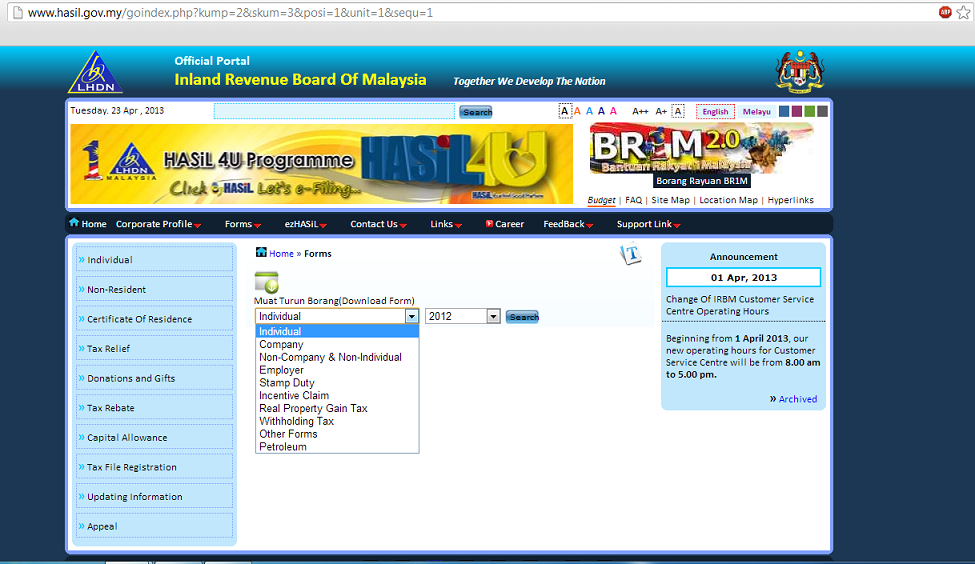

Image via malaysiantaxation101.comWhere can I download the forms if I can't do it online?

CLICK HERE: DOWNLOAD YOUR TAX FORMS AT THE LEMBAGA HASIL DALAM NEGARA (LHDN) WEBSITE HERE.

hasil.gov.myWhat rebates am I entitled to? Here are tax relief items that help reduce your taxes

“What are the easiest legal ways to claim tax relief”? After reading this article, you will be able to identify “7 Easy Ways to Claim Tax Relief when Filing your Income Tax”.

What happens after I've finished filing my taxes?

Check again: Heavy financial (and potentially criminal) penalties are afoot for taxpayers who make misdeclarations on their tax positions, so do be thorough when you file.

freemalaysiatoday.comAny refunds due to you will be refunded automatically. However, if you do not receive your refund you should send an email to [email protected].

Oh no, I missed the deadline! How now?

In the event that a taxpayer is unable to meet the tax filing deadline, the taxpayer may apply for an extension of time for filing of the tax return.

The application must be furnished together with reasonable and strong justification and will be considered based on the merit of each case.

The application must be received by the IRB 15 days before the due date for submission of the form. Otherwise, the application will be rejected.

If a tax return is submitted late, the rate of penalty stipulated by LHDNM can be reduced by 5% if the relevant tax return is submitted via e-Filing.

Where the approval is granted, the tax return must be submitted by e-Filing, failing which, the approval will be withdrawn and a late submission penalty imposed.

Where can I get assistance and more info on filing taxes?

A simple step-by-step guide on how to file for your yearly income tax using the Malaysia Personal Income Tax Guide on SaveMoney.my

To assist taxpayers especially on e-Filing service, IRBM has opened an e-Filing service counter at every branch nationwide.

Please contact the nearest IRBM branch for your e-Filing consultation.

Call LHDN Customer Service Centre at 1-800-88-5436 (LHDN) for assistance.

hasil.gov.myTAXSAYA: A software designed not just by programmers. It is the brainchild of programmers and tax agents who recognize the need for an easy-to-use automated software.

taxsaya.com