What Happens Now For Malaysia Airlines? Here's What Analysts Say

Analysts fear Malaysia Airlines will not make it beyond 2014. Malaysia Airlines could be privatised or even bankrupt.

Things are looking very bleak for Malaysia's national carrier. Analysts fear for the worst. "The outlook is very dire."

“The outlook is very dire,” says Mohshin Aziz, an aviation analyst at Kuala Lumpur–based Maybank. The airline, he fears, “won’t be able to survive beyond the year in its current form.”

Financially, the airline has been making losses and their finances and profit margins are on a steady decline

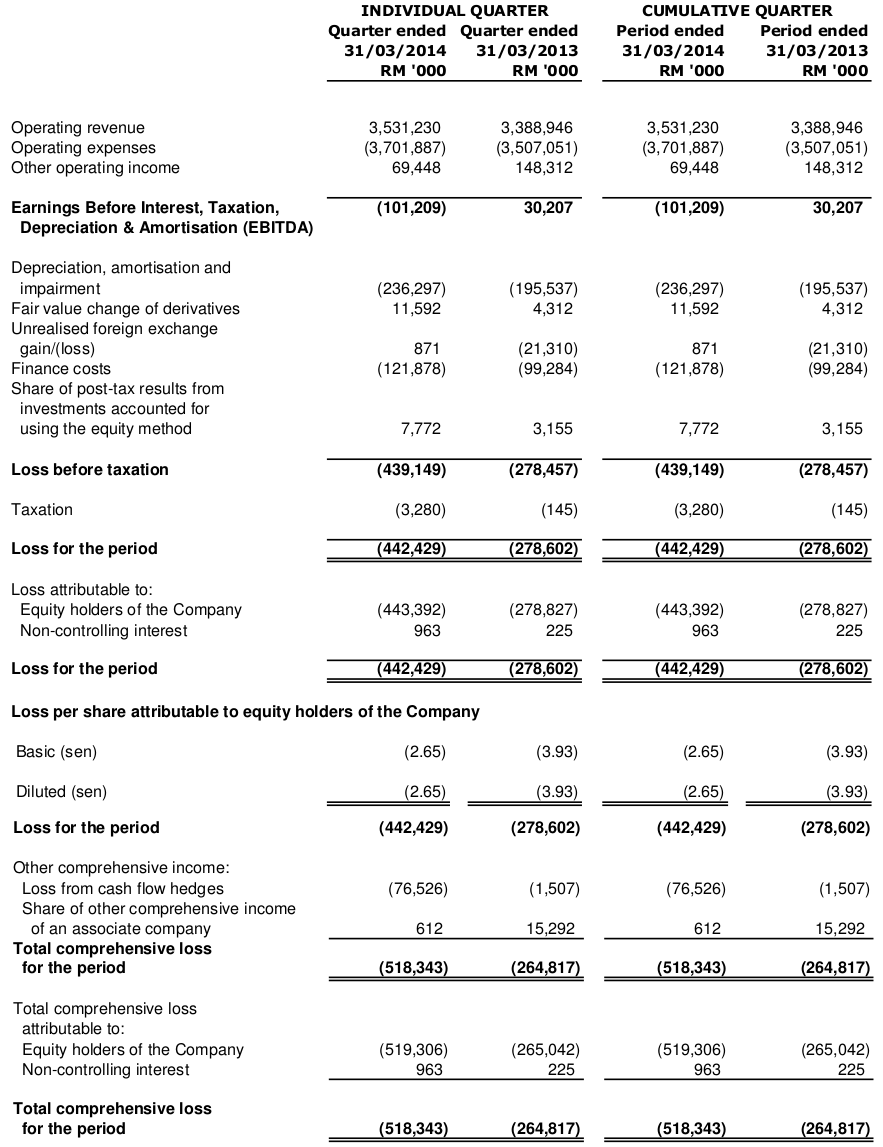

Malaysia Airlines reported a net loss of 443 million ringgit ($138 million) for the first quarter of 2014, a 59% increase compared to a year before. The company has lost more than 40% of its market value this year. The airline attributed the loss to a "tough business environment," and identified the first quarter as a traditionally weak travel period.

“Traditionally, the first half is always weaker compared to the second half following the heavy travel period of the previous year-end holidays," said Ahmad Jauhari Yahya, the Malaysia Airlines Group CEO. "The net loss this first quarter is not unexpected. However, the results were made worse with the impact on air travel in general following the disappearance of MH370. The whole market has reacted by slowing down demand."

The airline’s Kuala Lumpur–listed parent, Malaysian Airline System, has racked up losses of more than $1.4 billion since 2011. Management has tried cutting costs and improving service to turn around the airline’s fortunes, but such efforts were making only minimal progress.

The tragedy of MH370 and downing of MH17, both major unprecedented losses in the span of just four months, add fire to the turbulence

Only four months after Malaysia Airlines Flight 370 vanished somewhere in the Indian Ocean with 239 passengers on board, Flight 17 was shot down over Ukraine, causing the loss of another 298 souls — an unprecedented blow to a major international airline.

"Malaysia’s flag carrier is in no financial shape to absorb these catastrophes."

Even a robust operator would have trouble overcoming twin disasters like that. But the fact is that Malaysia’s flag carrier is in no financial shape to absorb these catastrophes. In fact, analysts wonder if it will ever be able to recover.

So what does this mean for Malaysia's national carrier? Will MAS be able to recover?

According to Bloomberg, Malaysia Airlines is likely to be delisted from Bursa Malaysia following the two tragedies

Malaysia Airlines (MAS) faces the prospects of being delisted following the second tragedy to hit the national carrier in less than five months, reports Bloomberg today.

The two disasters were likely to end the flag carrier’s days as a publicly traded company, Bloomberg said.

The downing of MH17 may hinder insurance payouts, and there is a possibility that Malaysia Airlines (and the Malaysian government) would have to bear all cost, which could run into billions

Malaysia Airlines might have to bear responsibility and pay out the insurance which runs into billions.

Image via thenation.comThe precise circumstances of the crash on Thursday will determine whether Malaysia Airlines receives compensation from its insurance carriers for the loss of the $500-million Boeing 777 and liability for the passengers.

But for insurance brokers, airline executives and government officials, it's a pertinent — if tricky — question that hinges on the interpretation of "wartime exclusions" and hotly contested facts on the ground in the border region between Ukraine and Russia.

The key issue is whether the shoot-down of a civilian airliner over an area where there is a conflict but no official declaration of war will trigger aviation insurance policies' "wartime exclusion" clauses. Such clauses are written into almost every insurance policy of a costly, high-tech airliner such as the 777-200, and they mandate that the insurance companies underwriting the aircraft won't be liable if an act of war or terrorism destroys the plane.

Bill Coffin, group editorial director for the insurance industry publication National Underwriter, says the wartime clause would probably apply to Flight 17, and this would mean the airline itself, and therefore the Malaysian government, would be liable both for the loss of the plane itself and for any liability claims from passengers' families. This could add up to $1 billion or more.

Malaysia Airlines will be presenting a plan to its biggest stakeholder, Khazanah Nasional this week

Bloomberg on Monday cited people familiar with the matter as saying those would be among the turnaround options presented by the airline’s board to its majority shareholder, Khazanah Nasional, this week.

MAS plans to present a revival plan to its biggest stakeholder Khazanah Nasional Bhd this week, sources told the financial portal yesterday.

Options for MAS: shrink their business (including halting most international routes), file for bankruptcy or privatise the company - whatever it is, they don't have the luxury of time

There are options, but all are equally unsavory. Mohshin believes that Malaysia Airlines will have to greatly shrink its business, perhaps eradicating most of the international routes it flies, to focus on the more profitable parts of the operations. “It will never get back to the large size it was before,” he says. “The sooner they accept that fact, the better off they will be.”

The options range from privatising the company to bankruptcy, both of which involve a delisting from Bursa Malaysia. “They don’t have the luxury of time,” Mohshin Aziz, an analyst at Maybank, was quoted as saying.

Tsang says that bankruptcy proceeding would be a “pretty good option” for Malaysia Airlines. That process would make it easier to strip out more of the legacy costs and make the airline more competitive.

Analysts had speculated that the airline could be forced to file for bankruptcy because of mounting pressure following MH370. Now the focus of two international aviation disasters, the airline's tough situation just became tougher.

When all is said and done, the future of MAS lies in the hands of the Malaysian government as a majority of shares are owned by a state-controlled fund. It's a political issue.

A strong union makes it difficult for the carrier to make a decision.

Image via themalaysianinsider.comWhat happens next ultimately depends on the Malaysian government. A state-controlled investment fund owns a majority of the shares in the carrier’s parent company, and that makes the future of Malaysia Airlines a political issue.

The airline’s powerful union has been able to fight off previous efforts at radically overhauling the carrier and analysts say that rescuing Malaysia Airlines this time will require a high degree of political commitment.

As of 2014, Malaysia Airlines has won over 100 local and international awards including best airline in Asia last year. Will it rise again?

Still, if Malaysia Airlines manages to streamline its operations, it may live to fly another day. “The restructuring will be painful for a lot of people,” Tsang says. “But a phoenix can rise from ashes.”