This Medical Plan Is Tailored For Those With Learning, Hearing, And Visual Disabilities

FWD SpecialMed 2 is Malaysia's first online family takaful medical plan for Persons with Disabilities (PWD).

FWD Takaful Berhad (FWD Takaful) is taking a significant step forward in inclusivity with its medical plan tailored to prioritise the needs of people with disabilities — FWD SpecialMed 2

FWD SpecialMed 2 is Malaysia's pioneering online family takaful medical plan tailored for Persons with Disabilities (PWD). This innovative protection plan not only addresses the unique needs of PWDs, but also reflects FWD Takaful's commitment to providing accessible and comprehensive protection plans for all.

Through partnerships with the likes of The National Autism Society of Malaysia (NASOM), Inclusive Outdoor Classroom (IOC), Alumni Kiwanis Down Syndrome Foundation (KDSF), Uzair Cycle Club, and Genius Kurnia, FWD Takaful is actively involved in supporting the development of infrastructure – such as sensory gardens – for non-governmental organisations (NGOs) and providing product consultations to members of the community.

FWD Takaful and IOC collaborated during the launch of the IOC On Wheel initiative. (Image owned by FWD Takaful)

Image via FWD Takaful"FWD Takaful has significantly contributed to supporting IOC and NASOM by providing essential funds and resources. This support has been pivotal in multiple ways such as building organisational capacity and raising visibility awareness of our community," said Anne Sivanathan, as she shared on NASOM's and IOC's collaboration with FWD Takaful.

Anne, who is the founder of IOC and the former secretary of NASOM, further said, "IOC and NASOM have been able to explore new projects and activities such as sports programmes for individuals with disabilities, online talent shows during the COVID-19 lockdown period and comprehensive training programmes for volunteers, ensuring that they are well-equipped to support and interact effectively with individuals with disabilities."

This demonstrates FWD Takaful's dedication to making a tangible difference in the lives of PWDs and their caregivers by ensuring they have access to the resources and support they need to thrive.

A comprehensive online medical card, FWD SpecialMed 2 offers three levels of support

The Inpatient Benefit is a key component, covering hospital room and board, ICU, surgical and anaesthetic fees, and even unexpected ambulance fees. This ensures individuals receive financial assistance during urgent medical situations, easing the burden of hospital bills.

Secondly, the Outpatient Benefit covers pre- and post-hospitalisation services such as consultation fees, emergency accidental outpatient or dental treatment, and more.

Lastly, the plan also covers companion bed expenses for one person, providing support for up to 60 days a year, emphasising the protection plan's commitment towards caregivers as well.

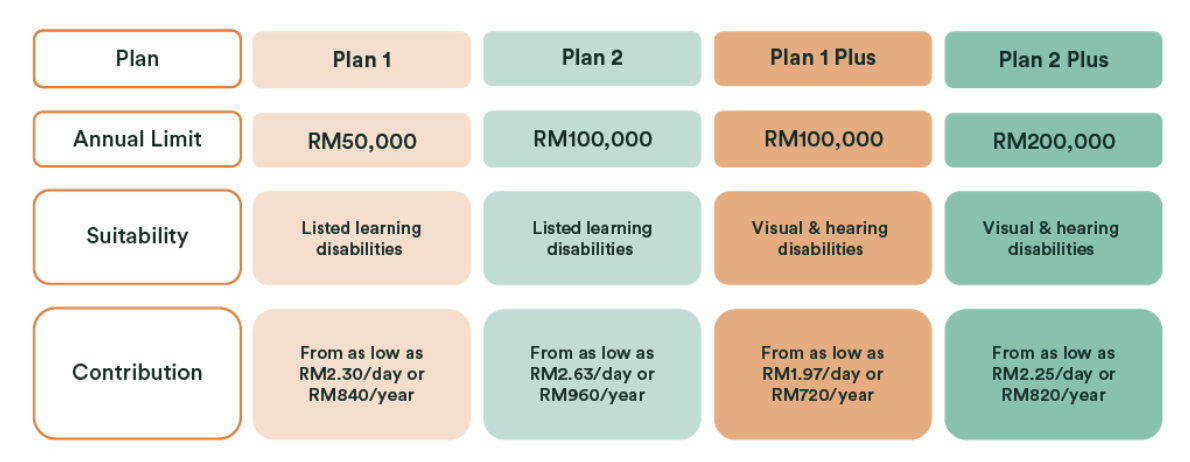

Here's a closer look at FWD SpecialMed 2:

FWD SpecialMed 2 is available to people with visual disability, hearing disability, as well as learning disabilities such as Autism Spectrum Disorder, Tourette Syndrome, Attention Deficit Hyperactivity Disorder (ADHD), Global Developmental Delay (GDD), Intellectual Disability (ID), Specific Learning Disability (Dyslexia/Dyscalculia/ Dysgraphia), and Down Syndrome.

There are also four plans to choose from, with annual limits ranging from RM50,000 to RM200,000.

In addition to its core benefits, FWD SpecialMed 2 boasts several standout features that are thoughtfully designed for PWDs

One standout feature? There's no lifetime limit! Yep, you heard it right. This means you're covered for the long haul, with an annual claim limit to keep things financially manageable.

There's more! FWD Takaful has made paying for medical bills a breeze with its cashless takaful system. FWD Takaful pays for your eligible expenses directly to the hospital as long as the total bill amount falls within the sum covered limit and the hospital is a network hospital.

Coverage for unexpected ambulance fees and emergency accidental outpatient or dental treatment are just some of the benefits thoughtfully designed for PWDs.

You even get to choose between full coverage or deductible options, giving you the power to tailor your plan to fit your budget and your needs.

Know someone with disabilities in your life? Get them covered today with FWD SpecialMed 2!

Head over to the FWD Takaful's website to find out more.

The benefit(s) payable under eligible product is(are) protected by PIDM up to limits. Please refer to PIDM’s TIPS Brochure or contact FWD Takaful or PIDM.