[QUIZ] Take Us Through A Day In Your Life And We'll Guess What's Most Important To You

When your alarm rings, are you a wake up, snooze, or double snooze kinda person? ;P

Have you ever wondered what's really important to you?

For some, it could be family. For others, having meaningful relationships with friends makes them feel alive.

Certain people are driven by career, and don't mind the stress as long as they can achieve their goals. On the flip side, some people prefer a balanced lifestyle that allows them to take care of their own wellness.

While there's no right or wrong answer, knowing what's important to you is crucial, because it will influence the way you live and the choices you make.

So, what really matters to you? Take this quiz below and we'll try to guess the one thing that's most important to you:

Quiz not loading? Just hit 'Refresh' and try again!

Note: This quiz is for entertainment purposes only. Dun so serious, okay? :)

We all have something important to us, be it our health, loved ones, friends, or career. However, things like serious illnesses can shake our world and dramatically change our lifestyle if we are not prepared.

Sometimes, it doesn't even have to be a critical illness like cancer or heart attack. For certain people, going through a surgery, being admitted into the ICU, or even seeing a loved one go through all that can take a toll, physically, mentally, and financially.

That's why it's important to be covered by an insurance plan that provides total care, before and beyond – which means from diagnosis to post-treatment

Fortunately, Prudential has introduced a game-changing plan that not only includes critical illness coverage, but also provides additional benefits which include post-surgery recovery, intensive care support, and mental health coverage.

Known as PRUAll Care, this one-of-a-kind serious illness plan will put you at ease knowing that you won't have to suffer from the domino effect that comes after being diagnosed with serious illnesses. This includes financial worries that happen because of loss of income or treatment costs.

Here's a closer look at what *PRU*All Care covers:

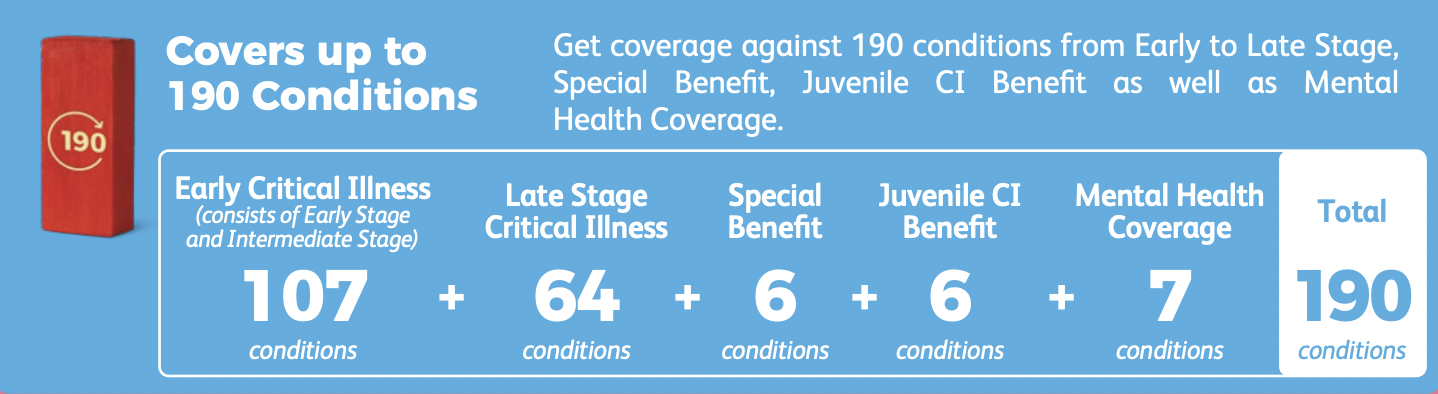

1. It covers up to 190 conditions

PRUAll Care provides you with coverage against 190 conditions, covering from early to late stage illnesses, while also providing special benefits, juvenile critical illness benefit, and mental health coverage.

For most people, what they worry about when they fall sick is finances, and how the costs of treatment may burden their loved ones. With PRUAll Care, it provides a financial safe net, so you can have that peace of mind.

2. Comprehensive critical illness coverage

Upon diagnosis of any of the covered critical illnesses, you will receive a lump sum payment to help you cover expenses beyond medical costs, whether it's income replacement, lifestyle changes, or monthly commitments.

With comprehensive coverage, you can focus on adjusting to major shifts in your day-to-day life, knowing that your loved ones are cared for.

3. Mental health coverage

Tired of going through mental health struggles all alone? Break the cycle of mental breakdowns with mental health coverage, for both adults and children. This coverage includes seven kinds of mental health conditions.

4. Post-surgery recovery benefit and intensive care support benefit

When it comes to serious illnesses, there are many costs that are not covered by insurers. PRUAll Care wants to take your mind off those financial worries and help you focus on getting well. For health issues beyond critical illness, you can get a lump sum payment to cover post-surgery care, intensive care, and more.

5. Compassionate benefit upon death

In the unfortunate event of death, PRUAll Care will give a lump sum payment to your loved ones, which can be beneficial to the family for day-to-day expenses or funeral costs.

6. Continuous protection with waiver riders

To further strengthen your coverage, you can also add extra plans like PRUWaiver Plus, Parent Waiver Plus, and Spouse Waiver Plus. These plans allow you to waive your premiums upon Total and Permanent Disability (TPD), critical illness diagnosis, or passing away.

Ultimately, PRUAll Care wants to help protect you from the domino effect that come with serious illnesses. Find out more about it on their website today!

Sign up today to receive a specially curated Watsons Health Care Box. Plus, you'll get to enjoy one month premium cashback on PRUAll Care with purchase of PRUWith You or PRUWealth Plus.

Terms and conditions apply.