Want To Invest But Not Sure How? Here's An Easy Way To Get Started With Just RM1,000

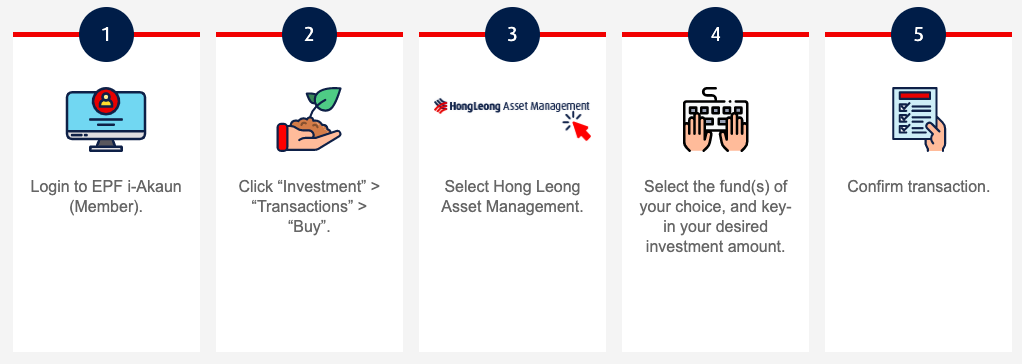

It only takes five simple steps!

We know that investing is important, but it can sometimes get a little overwhelming, especially if you have no idea where to start

What should I invest in? How much do I need to invest? What if I invest in the wrong investment and lose my money?

If these thoughts are running through your head, we feel you!

Stocks, bonds, mutual funds, cryptocurrency, property... There are just so many different types of investments to choose from. For those new to investing, it might be daunting to even take the first step.

While investing may seem complicated to new investors, the easiest way to get started is with unit trusts

How it works: A unit trust pools money from investors into a single fund. This pool of money is managed by a fund manager, who will help you invest your money in a variety of investments.

Is investing in unit trusts suitable for you?

The answer is "yes" if you match at least one of the scenarios below:

- You have savings to invest,

- You have no time or inclination to manage portfolios of direct investments/shares,

- You want easy access to a wide range of investments, which are not normally available.

Here's why you should consider investing in unit trusts:

It's affordable

You don't need a huge sum of money to start investing in unit trusts. It's one of the investments with the lowest barrier of entry. Did you know that in general, some unit trust investments only require a minimum amount of RM100?

It's highly liquid

Liquidity refers to how easy it is to buy and sell. With unit trusts, you can decide to buy or cash in whenever you want to, giving you more flexibility when investing. For instance, when the price goes up, you can decide to cash in right away. Or when it drops, you can cut your losses immediately.

Unit trusts are managed by professional fund managers, so you don't have to worry about doing it on your own.

"Sounds great! How do I get started?"

There are three ways to invest in unit trusts:

1. Lump sum investment

You put in a lump sum of monies into fund(s) of your choice, and let the compounding effect take over. Basically your money continues to grow over time.

2. Regular savings

You make regular (usually monthly) contributions into fund(s) of your choice, and watch the effect of dollar cost average happen.

"Sounds straightforward. But… I don’t have readily accessible money. Can I still invest?"

Absolutely! And that brings us to the third way to invest in unit trusts.

3. EPF savings

You can transfer an amount from your EPF Account 1 to invest in EPF approved unit trust funds.

For as low as RM1,000, you now have the opportunity to invest, diversify, and potentially grow your retirement savings

Definitely a great start towards making sure you are financially secure post-retirement!

There are four key benefits to using EPF i-Invest:

1. Convenient - easily start your investment anytime, anywhere

2. Diversifies your investments - depending on the fund you choose, your money will gain exposure from local and foreign markets

3. No sales charge - from now until 30 April 2021, you can enjoy 0% sales charge when you invest with EPF i-Invest

4. No cash investment - instead, just invest using your existing EPF savings

You can start investing with these five simple steps:

2. Click “Investment” > “Transactions” > “Buy”

3. Select Hong Leong Asset Management

4. Select the fund(s) of your choice, and key-in your desired investment amount

5. Confirm your transaction

Note: Knowing the risks involved in any investment is crucial for an investor. It is important to understand your risk tolerance in selecting the right investment. Risk tolerance is how much risk or volatility you can accept in exchange for potential returns in your investment portfolio. It is recommended that you consult with professional advisers before making any investment decisions.

With over 25 years of experience, Hong Leong Asset Management is ¹ranked no. 6 amongst all the unit trust management companies in Malaysia

In 2020, Hong Leong Asset Management received ²12 prestigious Lipper Fund Awards. What's cool is that five of these award-winning funds are available for EPF members to invest in!

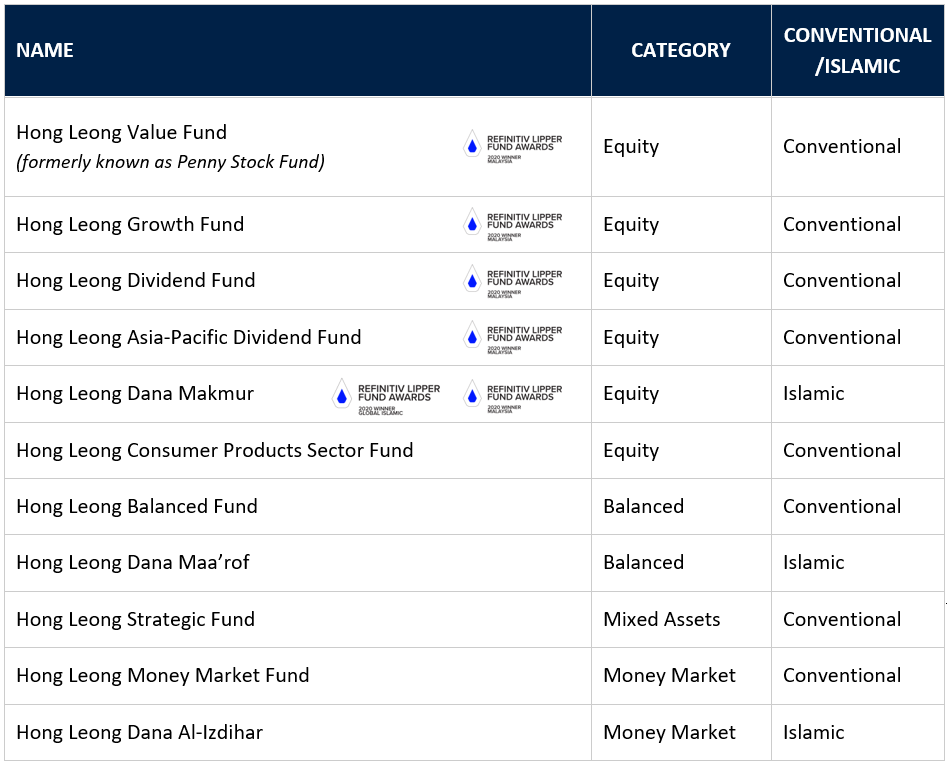

Hong Leong Asset Management has a total of 11 EPF approved funds; comprising both conventional and Islamic funds.

Below are the 11 EPF approved funds from Hong Leong Asset Management:

Ready to invest? Visit the Hong Leong Asset Management website to get started or call their Customer Experience at 03-2081 8600 for more information.

Notes:

1. Ranked No.6 according to source: Lipper, as at 30 June 2020 based on unit trust and wholesale funds registered in Lipper.

²2020 Refinitiv Lipper Fund Awards – Malaysia:

- HONG LEONG ASSET MANAGEMENT BHD (Best Equity Award – Malaysia Provident)

- Hong Leong Dividend Fund (Equity Malaysia Income – Malaysia Provident, 3 Years & 5 Years)

- Hong Leong Growth Fund (Equity Malaysia Diversified – Malaysia Provident, 3 Years & 5 Years)

- Hong Leong Penny Stock Fund (Equity Malaysia – Malaysia Provident, 5 Years & 10 Years)

- Hong Leong Asia-Pacific Dividend Fund (Equity Asia Pacific ex Japan – Malaysia, 3 Years)

- Hong Leong Dana Makmur (Equity Malaysia – Malaysia Islamic, 3 Years & 5 Years)

2020 Refinitiv Lipper Fund Awards – Global Islamic:

- Hong Leong Dana Makmur (Equity Malaysia – Global Islamic, 3 Years &5 Years)

Disclaimer:

- Before investing, investors are advised to read and understand the contents of the following: Hong Leong Master Prospectus dated 23 August 2019, its First and Second Supplementary Master Prospectus dated 18 November 2019 and 27 March 2020 respectively, and the Product Highlights Sheets.

- This advertisement has not been reviewed by the Securities Commission Malaysia.

- Refinitiv Lipper Fund Awards, ©2020 Refinitiv. All rights reserved. Used under license.