All The Last-Minute Things You Need To Know When Filing Your Taxes This 2014

Time to file for your income tax returns before it's too late.

The deadline to file your income tax return for 2013 is just around the corner

1) Employers (Form E) is 31 March 2014

2) Residents and non-residents with non-business income (Form BE and M) is 30 April 2014

3) Residents and non-residents with business income (Form B and M) is 30 June 2014

4) Partnerships (Form P) is 30 June 2014

For first timers, you’ll need to register for e-filing. Head to LHDN’s website where you will see a myriad of buttons leading you into the wide world of taxes. Click on the e-daftar button to get started; fill the form and you will be instantaneously given a Pin and reference number. With this; you can login for the first time. If you’re already registered and have done this before; you’ll want to skip this section! Once logging in; you’ll be taken straight to the appropriate form: Borang B(e) for salaried workers and B for those with their own businesses.

CLICK HERE to file your income tax online.

hasil.gov.myYou will need to open up a file for tax to be deducted from your income if you earn an annual income of RM36,704 or more

You are taxable if you earned an annual income of RM36,704 (or about RM3,058 per month) or more in 2013.

For most residents of Malaysia, the key figure to take note of is about “RM36,704 per year (about RM3,060 per month)” which is inclusive of all benefits, allowances, bonuses, overtime and commissions. If you’re earning anywhere below that figure, then there’s no need for you to open up a file for tax to be deducted from your income (while the con is that you’re not earning as much as you’d like, the pro is that there’s less hassle from a tax perspective!).

Calculate your tax payable by determining your chargeable income, tax reliefs, tax rebates, and tax exemptions

Taxable income actually refers to the “base upon which an income tax system imposes tax”. In general, the Lembaga Hasil Dalam Negeri (LHDN) organisation includes all kinds of earnings which the Malaysian taxpayers have to pay for, but which is reduced by expenses and other tax deductions

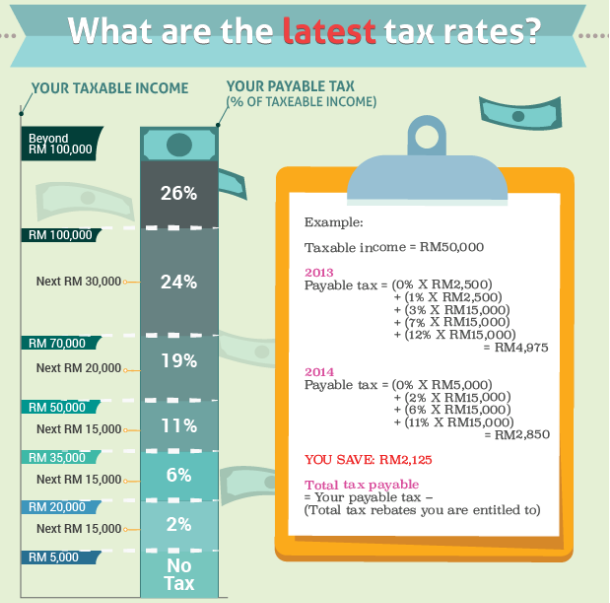

The tax rates above are effected on a person’s Chargeable Income (rather than salary or total income, in fact, the amount of the chargeable income is usually much lower). Now I’m sure many of you first-timers may be wondering what your “Chargeable Income” is. You take the following equation and apply where necessary:

Chargeable Income = Taxable income – Tax exemptions – Tax Reliefs

Chargeable Income = Taxable income income that is taxable and not exempted) – Tax exemptions – Tax Reliefs

*Calculated Tax = Chargeable income x applicable tax rate *

Tax Payable = Calculated tax – rebates (zakat, personal rebate, etc)

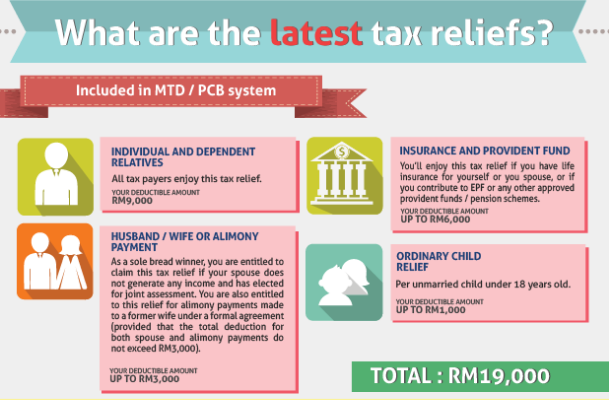

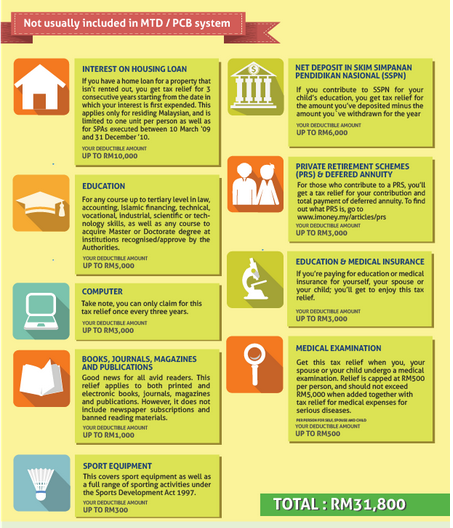

Latest tax reliefs include:

What about a tax relief? It is defined as “an amount that can be deducted from a person’s annual income to reduce the amount on which tax is paid”. To describe it in a more clear and concise manner, it is actually a way for you to lessen your chargeable income.

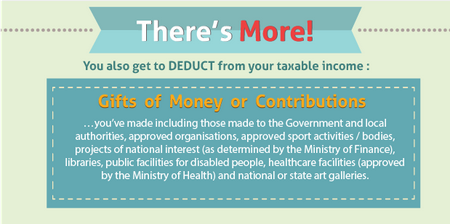

You can get up to 7% tax deduction if you have made a donation to government-approved charities and institutions

LHDN classifies Tax Deductions as a reduction in your Chargeable Income as a result of Gifts or Donations. As a rule of thumb, you can deduct up to 7% of your Taxable Income for gifts to charities and institutions which are approved by the government (not all charities are approved, so be sure to find out before you donate away!), unless you are giving to a few selected government-related bodies, where there is less restrictions on the amount deductible from your income.

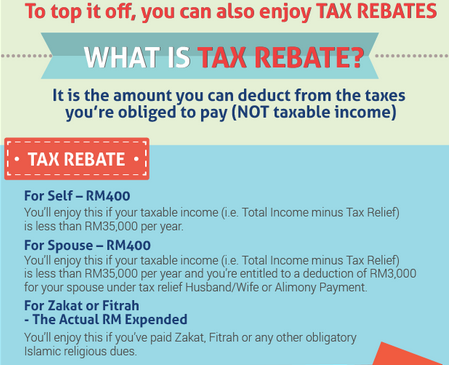

You can also get a tax rebate for yourself and your spouse if your taxable income is below RM35,000, and if you have paid Zakat or Fitrah

A tax rebate is a reduction in your tax expense after you have calculated your tax for the year. Tax rebates (or also known as “tax refunds”) can be defined as “a refund on taxes when the tax liability is less than the taxes paid”.

Your employer might have overpaid your taxes on your behalf via the Monthly Tax Deduction (MTD) or Potong Cukai Bulanan (PCB). This is what you should know:

How this works is that your employer will automatically deduct a certain amount from your salary every month to pay for tax on your behalf, going towards paying your tax for the year. This type of deduction is different from the basic Employees Provident Fund (EPF) and Social Security Organization (SOCSO) monthly deductions.

Therefore, one can sum up that the MTD is calculated from one’s gross salary minus the EPF deductions of up to RM6,000 per year. If you were to take a closer look at the sum of the total MTD for the year, you will realise that the figure will be very close to your actual tax expense for the year, but given that your company has no idea of your additional reliefs other than being married or having children (such as Books, Sporting equipment etc.), they are very likely to have been overpaying for you.

Employers rely on an employee’s personal data submitted to their Human Resource (HR) department to compute monthly MTDs. Therefore, these monthly deductions are net of personal relief, relief for spouse with no income, child relief and zakat payments.

imoney.my

imoney.my

Further, employees may request for other reliefs to be deducted so that the total MTD payments equal the total final tax payable. To do so however, employees need to submit Form TP1. It is in this form that employees should state other tax reliefs that they are entitled to, to facilitate the computation of MTD. Employers are then responsible to remit the amount deducted to Inland Revenue Board (IRB) every month in accordance with Income Tax (Deduction and Remuneration) Rules 1994.

imoney.my

imoney.my

This coming tax submission deadline of April 30, 2014, taxpayers will still have to submit their tax returns. The new ruling of using MTD as final tax will only be applicable from year of assessment 2014, with the deadline on April 30, 2015.

imoney.my

imoney.my

Keep all your receipts used to claim tax reliefs for at least 7 years from the date of filling in case Inland Revenue Board asks you for evidence

Finally, do take note that you must keep records for 7 years from the date of filing so don’t throw away any receipts or evidence of tax reliefs, keep them in a file sorted by tax year.