Settling PTPTN Debts And 6 Other Things You Can Do With Your EPF Money

This is how you can make pre-retirement withdrawals as an EPF member.

If you are a salaried employee in Malaysia, you're most likely also a member of the EPF.

This means that a chunk of your monthly salary would be contributed to the EPF, whether you like it or not.

The Employee's Provident Fund (EPF), also known as KWSP in its Malay abbreviation, is a mandatory retirement benefits scheme that has been enforced to ensure that employees make a monthly contribution to build their retirement income.

Each member would have two accounts namely: Account I and Account II.

Although the savings are only available to us when we retire, the EPF makes certain exceptions to allow withdrawals if a member wishes to take out the money for certain valid purposes approved by the EPF Board.

1. Fund your education - local or overseas

Members can withdraw the money in their EPF account to fund their own (or their children/stepchildren/legally adopted children's) education at higher learning institutions either locally or abroad. The money can also be used if the student is undertaking certain online courses.

The loan can be used for these education levels: Diploma, Advanced Diploma, Bachelors Degree, Masters Degree, Doctor of Philosophy, or any other equivalent level.

Under the EPF guidelines, the withdrawal will only be approved if the student is enrolled in an institution and/or programme approved by the EPF Board.

Be sure to find out more information about the list courses and the overseas institutes approved by the EPF Board.

2. Pay off your PTPTN debts

The EPF Board allows members to reduce or fully pay off their study loan taken from any financial institutions, such as the National Higher Education Fund (PTPTN), that are recognised by the Board.

Other financial institution include Bank Rakyat, Public Service Department (JPA), State Foundation (Yayasan Negeri), State Education Foundation (Yayasan Pendidikan Negeri), MIED (Maju Institute Of Educational Development), Tenaga Nasional Foundation, Telekom Malaysia Foundation, Petronas, and Tun Sambathan Scholarship Foundation (Yayasan Biasiswa Tun Sambathan).

Starting 1 April 2016, the EPF made it more convenient for members to pay off study loans as they can request for withdrawals online via the EPF's e-Pengeluaran system.

Take note that EPF funds can only be withdrawn to settle education loans after the implementation of the withdrawal schemes. Members will not be allowed to withdraw from their account to settle any education loans taken before these dates:

• 1 April 2000 - Bachelor's degree and above or equivalent (for members' children)

• 2 January 2001 - Diploma level and above or equivalent (for members)

• 17 January 2006 - Diploma level (for members' children).

However, this term will be void from 21 July 2017 as members may settle outstanding study loans irrespective of the effective date of their education loan agreement.

Refer to the EPF website for more information on the Education withdrawal.

3. Make more money through investments

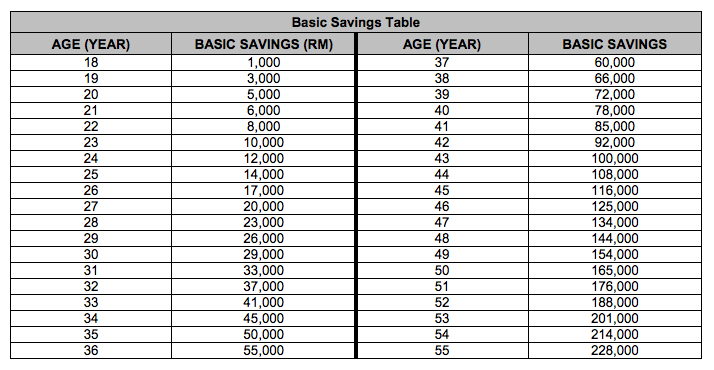

EPF implements strict guidelines to ensure that members could accumulate a minimum savings of RM228,000 by the time they are 55 years old. To achieve this, EPF restricts savings withdrawal from Account I until a member reaches the age of 55.

It is almost unlikely for anyone to make a pre-retirement withdrawal from this account — except for making investments through the appointed Fund Management Institutions for the purpose of investment and the member must have already accumulated more money than the Basic Savings Schedule set by the EPF Board.

The Basic Saving Schedule basically details the minimum targetted savings that a member should have based on their age. Members can only withdraw a maximum of 30% of their total amount in excess of their Basic Savings in Account I.

Members will not be able to use any of the money gained from investments now as all the returns of investment (including profits) will be deposited into Account I upon the liquidation of the investments.

Learn more about the EPF Members Investment Scheme on the EPF website.

4. Buy a house or settle a housing loan

If you're thinking of moving on from being a tenant to a house owner, you could utilise your EPF money to fund the cost incurred to get a new home.

Members may choose to use their EPF money to buy or build a residential house (such as terrace or condominium) or a shop lot with residential unit.

However, EPF will reject withdrawals intended for renovation, repair works or any additional works to the existing house or for personal purposes.

A member may also choose to withdraw EPF funds to pay the housing loan's monthly instalments, refinance a property, or settle an existing home loan home loan from a financial institution approved by the EPF Board.

5. Treat a medical condition

EPF members who need money for healthcare treatment or to buy medical aid equipment, whether it is for their own use or a family member's use, may withdraw their funds from Account II.

Funds can be withdrawn to treat illnesses specified by the EPF Board including cancer, depression, major burns, heart attack, and severe asthma (for children under 16 years old).

The full list of critical illnesses and medical aid equipment approved by the EPF Board are available on the EPF website.

Do note that EPF states that a member cannot use the funds to seek alternative treatments such as acupuncture or traditional medication.

6. Hajj

Hajj is one of the pillars of Islam, where Muslims are obligated to perform a pilgrimage (Hajj) to Mecca.

Muslim EPF members may choose to withdraw their money to supplement the basic expenses incurred when they are performing Hajj.

It is noted that the funds will be made directly to members' account in Lembaga Tabung Haji (LTH), a government-linked financial organisation that manages pilgrimage activities.

You can read more about the Hajj Withdrawal on the EPF website.

7. Leave the country

Members who wish to withdraw all their money from their EPF account to emigrate to another country can do so, but they must first renounce and relinquish their Malaysian citizenship.

Other members who are not Malaysians can also withdraw their EPF money by revoking their Permanent Resident (PR) status or canceling their Residence Pass.

To learn more about how you can apply for this withdrawal, visit the EPF website here.

These are just some of the ways members can utilise their EPF funds for

You may refer to the EPF website for the full list of pre-retirement withdrawals that are available.

Take note of all the terms and conditions that apply to the withdrawal applications as EPF exercises stringent regulations to ensure that withdrawals are not made carelessly. It is, after all, their responsibility to help members prepare for their post-retirement days.