The Government Will Pay The Deposit For Your First Home Under This Scheme

Applications for MyDeposit 2018 will be open until 15 February.

Malaysians who have been planning to own their first home should take full advantage of the MyDeposit scheme now that applications are open

The applications for First House Deposit Financing Scheme or MyDeposit 2018 has been open since 15 December 2017.

The financing scheme was first announced by Prime Minister Datuk Seri Najib Tun Razak during Budget 2016. It is aimed at making home ownership possible for first-time homebuyers.

Through MyDeposit, new first home owners are able to get a one-off contribution of 10% on the sale price or a maximum of RM30,000 (whichever is lower). This amount does not need to be paid back as it is a contribution from the government.

Urban Wellbeing, Housing and Local Government Deputy Minister Datuk Halimah Mohamed Sadique revealed last month that a total of 1,469 applications had been approved with a payment of more than RM39 million under the scheme.

To be eligible for this assistance, you'd have to fulfil the following criteria:

2. Aged 21 and above

3. The applicant is buying a property for the first time

4. Able to secure financing for the property from financial institutions

5. Your gross monthly household income lies between RM3,000 and RM15,000

6. The property must be priced below RM500,000

Do note that the property must be from licensed new housing projects from a licensed housing developer. Housing projects by the federal and state governments such as PPA1M, PR1MA, RUMAWIP, PPR, and MyHome will not be eligible.

It has been stipulated that the properties bought via the MyDeposit scheme cannot be sold for 10 years, effective from Sale & Purchase Agreement date.

Those who are interested to apply for MyDeposit may submit their applications online

HOW TO APPLY:

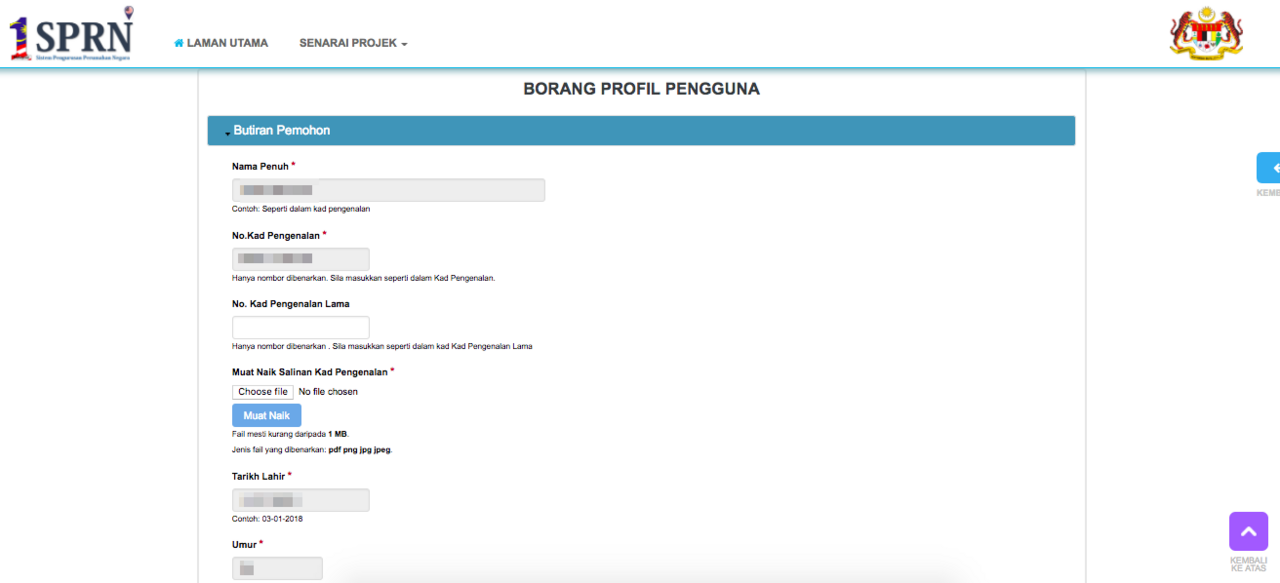

First, sign up for an account on the Sistem Pengurusan Perumahan Negara (SPRN) website and fill up all details required.

The applicant will have to provide the following supporting documents:

FOR INDIVIDUALS WHO ARE MARRIED:

• Copy of applicant and applicant's spouse identity card

• Copy of applicant's dependent's identity card/birth certificate

• Copy of marriage certificate

• Copy of applicant and spouse's latest payslip

• Copy of applicant and spouse's EPF statement

• Copy of statutory declaration indicating that the applicant is a self-employed/unemployed applicant, which must be signed by Commissioner for Oaths

• Copy of employment verification letter for applicant and spouse

• Copy of Center Credit Reference Information System (CCRIS) report of applicant and spouse

• Copy of Letter of Offer/confirmation of purchase of property from licensed housing developer

• Letter of support and confirmation by local leader

• Copy of utility bill (electricity/water) of applicant's residential address

FOR INDIVIDUAL PURCHASE:

• Copy of applicant's identity card

• Copy of applicant's dependent's identity card/birth certificate

• Copy of statutory declaration indicating that the applicant is of a single status

• Copy of death certificate/divorce certificate (if applicable)

• Copy of applicant's latest payslip

• Copy of applicant's EPF statement

• Copy of employment verification letter for applicant

• Copy of statutory declaration indicating that the applicant is a self-employed/unemployed applicant, which must be signed by Commissioner for Oaths

• Copy of Center Credit Reference Information System (CCRIS) report of applicant

• Copy of Letter of Offer/confirmation of purchase of property from licensed housing developer

• Letter of support and confirmation by local leader

• Copy of utility bill (electricity/water) of applicant's residential address

• Copy of OKU card / OKU confirmation letter (if applicable)

The application process will be completed within two months after the closing date. For more information on the MyDeposit scheme, visit The Ministry of Urban Wellbeing, Housing and Local Government website.

Applications will be open until 15 February 2018. Don't forget to submit your application soon, and share this story to let your friends know too!